Bulls can only be "right" so long as there is more dumb money to suck into the vortex of the casino. In this bear market rally, Bernie Madoff would be proud...

If you haven't watched the Fukushima documentary on Netflix "The Days", I highly recommend it. It completes the trilogy of nuclear reactor clusterfucks - "Chernobyl" (HBO) and "Three Mile Island" (Netflix). All are very similar tales - bad assumptions, greed, and hubris go into meltdown mode due to some unexpected "Black Swan event". It's clear that the manufacturers of nuclear reactors - similar to the dunces on Wall Street - STILL have no real plan for when nature pulls back the curtain on their PhD assumptions, revealing the fabricators to be nothing more than abject idiots. Who are for some unknown reason STILL entrusted with the capability of causing global meltdown.

Which gets us back to these Disney markets and this latest iteration of impending unforeseen meltdown:

I think we have to always remember that the "smart" money self-destructed on subprime junk mortgages in 2008 and then had to get bailed out by the so-called dumb money. It's important to understand that won't be happening again. If you believe it will, then it means you don't understand history and politics, much alone finance. New York is a tale of two cities. One which has the most billionaires in the entire world living in sky high penthouses. And the real city at street level which smells like a Third World garbage dump and is inhabited by homeless denizens sleeping on cardboard.

Which is why today's "smart" money managers - most of whom were completing middle school in 2008 - are all piling into a late stage Ponzi rally. Citigroup asserts that this is the "Most Extended S&P positioning in history".

I don't know if that is actually true, because I don't know what indicators they are using to arrive at that conclusion. All I know is that based upon momentum, volume, and positioning, this market is multi-year overbought across every dimension. Add in the fact that only a handful of stocks are making new highs which only increases the risk factor. Fittingly, BofA (Hartnett) capitulated last week as one of the last bears on Wall Street. Which leaves only Mike Wilson of Morgan Stanley, who never capitulated at the all time high in December 2021. Who is also the highest rated analyst on Wall Street and therefore the only one who has the sack to still remain bearish. After all, the pressure from his own organization to capitulate must be overwhelming given that Wall Street's hedge fund clients are adding exposure en masse. Why? Because it's not their money. And if you think that every hedge fund manager manages their own money the way they manage client money, then you don't know any hedge fund managers.

Chalk it all up to conflict of interest. These Wall Street brokers can only get investors into risk, they can't get them out. Which is why I call these bear market rallies, Ponzi rallies. You only make money if you are FIFO - first in, first out. If you wait until Cramer says it's time to sell then you are part of a stampede out of the market.

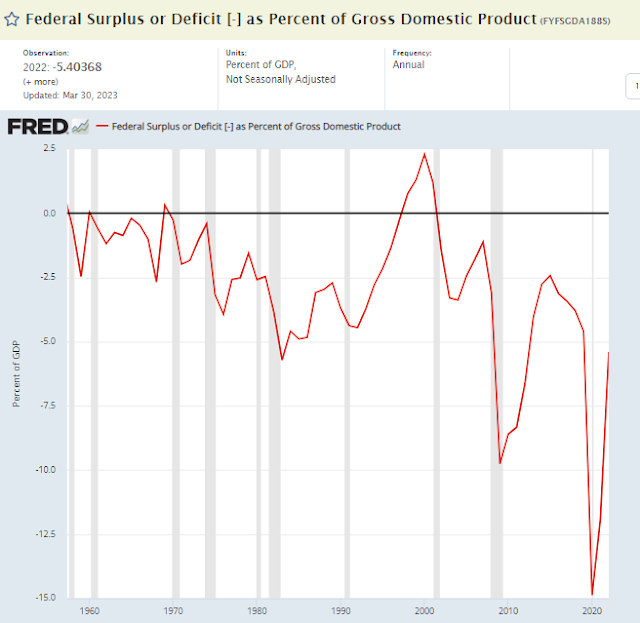

Getting back to the theme of this new bull shit market, it's all about monetary and fiscal expansion. Meaning it's entirely fictional. The Fed "pause" last week has led to a 77% probability of rate hike in July. On the fiscal side, things are even more dire as the Treasury is issuing massive amounts of new debt which will only implode liquidity further going into the low liquidity summer months.

In other words, liquidity is set to collapse, just as this stock market glue sniffing rally is set to implode. Deja vu of last summer, only brought forward by a couple of months.

Note RSI in the top pane. Every rally for the past year has become more overbought than the last one. And yet, the breadth divergence in the lower pane has grown larger.

What could go wrong?

On the economic side, student loan debt payment relief is set to end in October, providing a massive drag on the economy.

For more than three years, federal student loan borrowers have not had to make monthly payments. But that pandemic-era pause is coming to an end this fall, setting up a financial shock for millions of Americans – and the big-name stores where they shop"

Note that among the stocks that will be most impacted is the one that usually LEADS new bull markets:

IBD: Target Leads New Bull Markets

In summary, investors have now bought a fictional bailout with both hands. Why that's good is not for me to say.

It's what you would expect to happen at the end of wave '2'.

And, contrary to popular belief, breadth matters.

Because everything explodes for a reason.