During the 1930s there were 10 cyclical "bull markets", meaning rallies >= 20%. Each one imploded. The first bear market rally took place from the October 1929 low through May 1930. When that ended, the market collapsed to the 1932 nadir -90%. The goal now is to not repeat the mistake of buying that first bear market rally on the belief that the worst is over, when the worst hasn't even started yet.

The Dow's biggest gain in history was in 1933 when it gained over 100% intra-year. However, the market was still down -80% from the all time high. What most investors don't realize is that massive losses require far larger gains, because the losses are calculated from the top and the gains are calculated from the bottom.

It would require a 1000% gain to offset a -90% decline.

The high wire act that all of today's bullish pundits follow is to ignore all of the obvious risks that have coalesced at the end of the cycle and instead fall back on long term average stock market returns. Because they all believe that investors are owed a recurring rate of return. For example:

"Whenever there’s a period of extreme market volatility, new investors might wonder if it’s really worth keeping their money in the stock market at all"

Investors who keep their money at work in the S&P 500 have been able to enjoy an annualized stock market return of around 10% over the long haul"

When valuations are extreme as they are now, historical averages have no meaning. Whether in stocks or real estate, or any other market. During the pandemic, home prices rose 40% in two years. There is no historical precedent for that magnitude of gain. John Hussman has consistently explained that current stock market valuations portend a -2% average return for the next decade. However, long-term averages do not provide an accurate depiction either. As we see above, what's more likely to happen is that the major decline is front-loaded, followed by positive returns from that point forward.

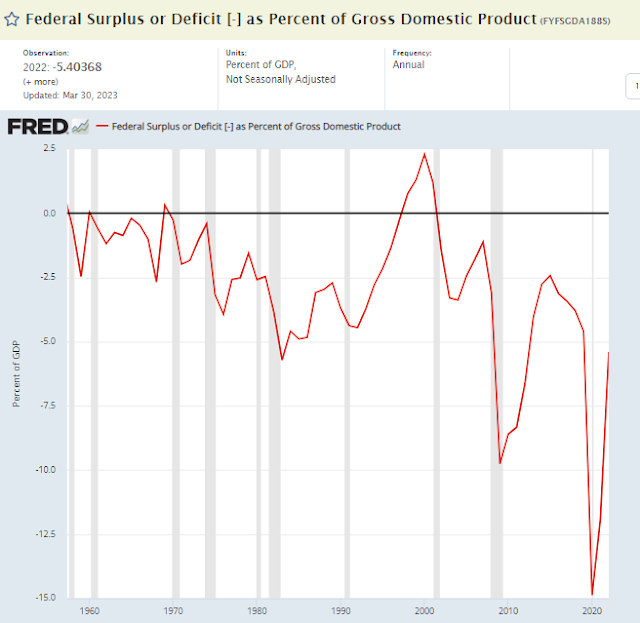

Another risk bulls are ignoring is incipient recession. The current Federal deficit is -6% of GDP and the growth rate is at best 1%. As we see below, that is the largest non-recession deficit since WWII. If every other generation had been this profligate, there would have been NO recessions, but the U.S. would have been bankrupt a long time ago.

The next question is how will a massive -6% deficit during "expansion" ever provide adequate stimulus during a major recession? Clearly the "Keynesian" multiplier is essentially zero. Meaning additional fiscal stimulus is having no effect on the economy. Corporate profit growth is entirely dependent upon expanding fiscal stimulus which only barely passed this latest debt ceiling vote. So how will fiscal stimulus offset imploding demand in a recession? Corporate profits are set to fall off a cliff amid sky-rocketing corporate defaults. You don't have to be a genius to figure this out. The Federal deficit is already worse than 6 out of 8 recessions, and it's getting worse with each recession.

Corporations are massively levered to the cycle both operationally and financially.

Another risk factor bulls are ignoring is the collapse in breadth.

They did the same thing at the all time time high, they assumed breadth doesn't matter:

December 2021:

In the meantime, breadth has become far worse.

In this chart we see that the ratio of equal cap to market cap has collapsed at the fastest rate since March 2020 and October 2008. The key difference is that during those prior times, breadth collapsed during a market crash. This is the first time that breadth has collapsed in a "rally".

In summary, this is a cyclical "bull market" within a secular bear market. And now it's running on glue fumes.

Unfortunately, most bulls can no longer afford reality.