Wednesday, April 19, 2023

RALLY INTO RECESSION

Sunday, April 16, 2023

BTFP

Wednesday, April 12, 2023

A BUBBLE IN COMPLACENCY

What we are witnessing in real-time is monetary policy failure. The full cost of which will be revealed during the deflationary phase...

There has never been a rate hiking cycle without a recession and there has never been a recession without a significant rise in unemployment. Therefore, today's bullish pundits are of the mind that for the first time history, we will have both - no recession and no significant unemployment.

Unemployment rate (red)

Fed funds rate (green)

The two most recent cycle downturns were the Tech bubble in Y2K and the housing bubble in 2008. This pandemic hangover bubble features both six sigma Tech overvaluation and RECORD housing overvaluation yet pundits don't predict a meaningful correction in either market. What we are witnessing is 15 years of central bank moral hazard unwinding the hard way. Amid abject denial.

Here we see homebuilder stocks inversely correlated to homes sold, for the first time in history. Which is why the ratio of homebuilder stocks to homes sold is at a record high (bottom pane).

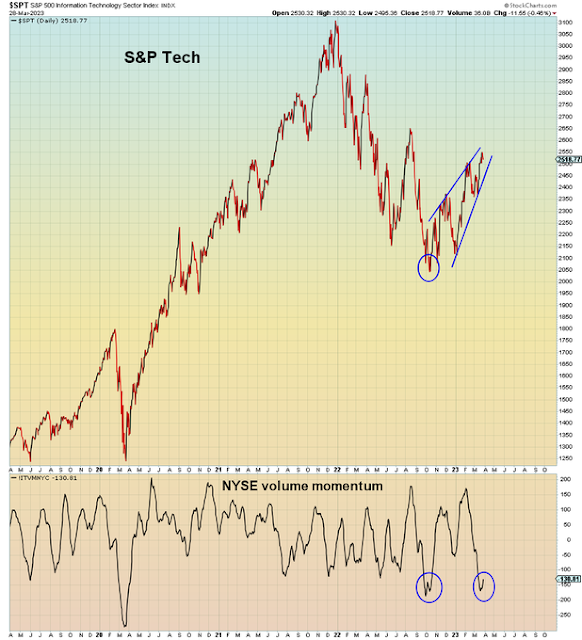

In Tech-land, delusion is likewise rampant. The best performing sector so far in 2023 is about to see the largest earnings decline of any sector:

"This year’s rally in the shares of the biggest technology companies is the best thing going for bulls. It’s about to run into an earnings season that’s expected to deliver the biggest profit drop for the tech sector in more than a decade."

The (15%) projected drop for tech earnings in the first quarter would be the biggest since 2009. The consensus has been consistently weakening: Six months ago, analysts in aggregate were expecting that tech-sector earnings would edge up by 1%"

Q4 2022 saw the biggest decline in Tech spending in U.S. history:

At the beginning of a Tech bubble, the stocks hiring the fastest perform the best. When the bubble collapses, the stocks laying off the fastest perform the best.

"Tech already has cut 5% more than for all of 2022, according to the report, and is on pace to eclipse 2001, the worst year ever amid the dot-com bust"

We saw all this before of course in Y2K. Back then it took 17 years for the Tech sector to overcome the bubble high. This time, gamblers are expecting new highs any day now.

We just got "better than expected" CPI, but the core CPI re-accelerated. There has never been a time when the Fed paused rate hikes with the core CPI above the Fed rate. So another rate hike is a lock for May.

The Fed has raised rates 4.75% but the core CPI has only come down 1%. Which means we are witnessing monetary policy failure for the first time in history:

Warren Buffett says more bank failures are inevitable, but ALL deposits are safe. Which is totally delusional.

"Investing legend Warren Buffett believes there could be more bank failures down the road, but depositors should not ever be worried"

"Buffett said the government would likely step in to backstop all depositors in all U.S. banks if that was ever necessary, though he did note that would require Congressional approval"

Buffett, 92, said he so confident that U.S. depositors are safe that he would put a million dollars of his own money in a bank"

A multi-billionaire doesn't even have $1 million of his own money in a bank, but he says it's 100% safe.

Because if it's not, HE is not getting bailed out this time.

Wednesday, April 5, 2023

SYSTEMIC RISK EXPLOSION

Markets are priced for 100% bailout. Anything less than that and they will spontaneously explode...

Allow me to recap the past month:

Four weeks ago, Powell announced that the Fed was re-accelerating their rate hikes. By the end of that same week, the U.S. had suffered the second (Silicon Valley Bank) and third (Signature Bank) largest bank failures in U.S. history.

Subsequently, the Fed implemented their "BTFP" asset repurchase program whereby banks temporarily trade their unrealized loss encumbered assets in exchange for fresh Fed loans at 4.75%. Unfortunately, the average long bond exchanged in these programs is bearing 1.75% so the BTFP program allows banks to go out of business slowly, instead of instantaneously if they marked to market.

Meanwhile, Congress held a hearing into the collapse of these banks and thoroughly castigated the FDIC for bailing out wealthy depositors using the "Systemic Risk Exception" (SRE). Which is moronic because the entire catalyst for the bank run was wealthy depositors assuming that they can't rely upon the SRE for future bailout. Congress has now conveniently confirmed that assumption.

Therefore, imagine if you will that next some smaller banks implode and the FDIC decides NOT to implement the SRE and instead allows wealthy depositors to get wiped out. When that happens, we will witness mass bank failure as ~$8 trillion of uninsured deposits flees small banks and heads for money market and t-bill funds.

It's the same set of events that led up to Lehman. There had been multiple failures and multiple bailouts followed by a bailout-weary Fed finally deciding that Lehman was NOT too big to fail. So markets exploded. Because they were priced for 100% bailout.

All of which explains why after four weeks of BFTP, the small banks are at new lows. We are one non-bailout away from wholesale meltdown. So what to do?

Load up on risk.

"March recorded the worst U.S. bank failures since the 2008 crisis, but that did not stop some investors from snapping up battered financial stocks"

The other development over the past four weeks since Silicon Valley Bank exploded, is that the economy has fallen off a cliff.

Why? Because banks have tightened lending standards due to the new tighter regulatory and funding environment. Which means that the IPO equity market AND the bank lending market are both shutdown at the end of the cycle.

All of which means that the end of cycle stock to bond rotation has now begun. The exact same pundits who didn't predict the bank run, also did not predict the resulting slowdown in the economy. Which is why t-bond shorts are now getting duly monkey hammered.

Recession is a lock for 2023. And now even the majority of pundits who've been saying it wouldn't happen are finally realizing they were wrong. All because they thought that Fed tightening at the fastest rate in 40 years wouldn't lead to a tightening of credit:

“We have argued for some time that the economy would avoid recession this year," said Ian Shepherdson, chief economist and Kiernan Clancy, senior U.S. economist at Pantheon Macroeconomics. "But that view now looks untenable, given our expectation of a sharp tightening of credit"

The last market narrative that is now imploding is that Tech stocks are safe havens from deflation. During regular slow-growth part of the cycle that is certainly true. However, during the end of the cycle deep recession phase, that is false.

Below, fittingly we see that semiconductors are imploding on the right shoulder amid the highest volume since March 2021 aka. the left shoulder. Consider that volume is already the highest in two years and it's only Wednesday in a holiday shortened week.

In summary, the systemic risk explosion has been slowly coalescing for two years. However, this society has an extreme case of survivor bias and is highly adept at ignoring those who are already under the bus.

Saturday, April 1, 2023

APRIL'S FOOLS

"What a fool believes he sees, no wise man has the power to reason away. What seems to be, is always better than nothing"

In my last blog post I discussed the epic divergence that has opened up between mega cap Tech stocks and the rest of the market. In the meantime, that divergence has only grown larger.

As we close out the first quarter we learn that a mere eight mega cap Tech stocks account for all of the S&P's year-to-date gains:

What's even crazier is that the equal weight Nasdaq 100 peaked back in February. Of the eight stocks listed above (AAPL, MSFT, GOOGL, META, AMZN, NFLX, TSLA, NVDA), only three have exceeded their February highs: Apple, Microsoft, and Nvidia.

Here we see the equal weight Nasdaq 100 has yet to exceed the February high. In addition, new Nasdaq highs peaked two years ago and had a major divergence at the all time high in November 2021. Now we are seeing another major divergence on this right shoulder:

Zooming out to the weekly view. We see that this is merely a VERY weak correction in a bear market. Compare the rally off the low in March 2020 to this one. That was a straight shot higher. This has been a sideways to down choppy rally to nowhere.

Do you remember the high last August ('a')? We were told that the Nasdaq is in a new bull market. That was the end of the rally.

Now, we hear the exact same thing all over again, at a lower high:

The Nasdaq Just Entered A Bull Market

That's the good news.

Unlike Tech stocks, banks have been unable to manage any sort of meaningful rally. Compare 2008's short-covering rally to this one. In addition, we see via the VIX there is no sign of fear in this market.

Belief in "just-in-time" bailout is total. Bulls now believe that the Fed can implode markets and rescue markets before they implode. This is the belief of the day.

As I have said many times, bulls are the reason the Fed must keep tightening. On this rally, once again the high yield spread has declined signaling an EASING of financial conditions in financial markets. The real economy is a whole other story.

History informs us that the Fed will reverse when the S&P is -20% lower from this level. And by that time, it will be far too late for just-in-time bailout.

This week, the most famous bear in modern history, Mr. Big Short Michael Burry inexplicably capitulated. He claims that he was wrong to say "Sell" back in February at the market's rebound high.

Bulls were ebullient.

But, it's pretty clear that he too has been suckered by this latest bear market rally.

Mark this date.

In summary, fittingly in a denialistic Idiocracy, the bullish hypothesis and the bearish hypothesis are the exact same now. Financial dislocation will force the Fed to reduce rates sooner than expected. However, what bulls seem to forget is that back in 2008, when the Fed cut rates, markets collapsed.

All of which makes this, the Big Long:

Any questions?

Wednesday, March 29, 2023

BEWARE: ARTIFICIAL INTELLIGENCE BUBBLE

To buy a global bank run or not. This is the artificially intelligent question of the day...

Since the bank run started, NYSE stocks have become extremely oversold, especially financials. Banks are a crowded short. Conversely, Tech stocks are a very crowded long. Which is leading to a chasmic divergence.

The question on the table is, does it resolve with NYSE rally or Nasdaq crash?

Banks are trying to rally, but they can't get off the mat.

Meanwhile, there is zero fear in this market of a continuing bank run. It appears that bears went ALL IN back in December and now they've decided the market is going higher.

We saw this level of divergence between large caps and the rest of the market back in 2008:

Nvidia is at the apex of the Artificial Intelligence bubble.

"Nvidia trades at an eye-watering 56 times projected earnings, nearly three times more expensive than the Philadelphia Stock Exchange Semiconductor Index’s 21 times and a near 150% premium to the Nasdaq 100, according to data compiled by Bloomberg. Nvidia’s average multiple over the past decade is 30 times"

With 42 buy-equivalent ratings, Nvidia has by far the most bullish recommendations of any chipmaker"

Based on this chart, you would never know that Nvidia earnings just fell -50% year over year:

"Net income in the quarter ended Jan. 29 was more than halved from the prior year, falling to $1.41 billion, or 57 cents a share, from $3 billion, or $1.18 a share, a year earlier"

The A.I. bubble is just another empty load of bull shit.

Micron just reported their largest loss on record, but the stock is up today because analysts are praying that the worst is over for the semiconductor sector. It's a big bet to make going into near-certain recession. Why would semiconductor demand bottom BEFORE the beginning of the recession? You would have to be brain dead to believe that, hence it's Wall Street consensus.

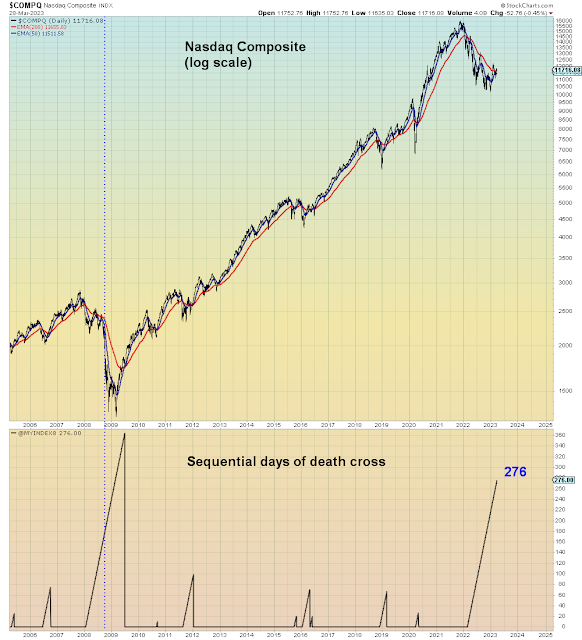

The Nasdaq has been in a death cross for the longest period of time since 2008. Which means that the 50 day moving average is below the 200 day moving average. Given that bulls STILL haven't capitulated, it's extremely likely this death cross will last far longer than the last one.

The bond market and the stock market are sending opposite signals. Which does not end well for stocks:

“Our 21 Lehman systemic risk indicators are pointing at the highest probability of a crash or a sharp drawdown in the next 60 days—the highest probability since COVID,”

McDonald believes investors are ignoring the risk of a “rolling credit crisis and focusing too much on the rise of new technologies like artificial intelligence"

In summary, this fake rally is driven by artificial intelligence.

But, who to believe?

Saturday, March 25, 2023

WORST OF ALL CASE SCENARIOS

Investors are trapped, but they are complacent because they are told constantly, don't worry, be fat, dumb, and happy...

Allow me to recap events to date:

The pandemic initiated the largest combined fiscal and monetary bailout in history. Record stimulus flowed from central banks and Federal governments into local bank deposits. Banks parked that money into long-term Treasuries creating a duration mismatch with their deposit base.

Central banks were slow to withdraw stimulus believing that the inflation was caused entirely by the Federal unemployment programs. However, inflation accelerated AFTER the pandemic unemployment programs ended in September 2021. Subsequently, the Fed has panic raised interest rates at the fastest relative rate in history now at 4.75%. Fed rate hikes .5% greater than the rate increases from 2003-2006. Short-term rates have increased 200% over where they were pre-pandemic (1.5%). Mortgage rates have doubled from where they were pre-pandemic. However, the balance sheet which is the true source of (asset) inflation came down only 7% year over year. The Fed balance sheet remains DOUBLE where it was pre-pandemic, which has kept asset markets and the CPI artificially inflated. The CPI is currently at 6%, or three times higher than it was pre-pandemic.

In the event, growth stocks were annihilated. Pending home sales are now at the lowest on record. Consumer sentiment hit the lowest on record in October 2022. Meanwhile, we now learn that the record increase in interest rates was a ticking time bomb on regional bank balance sheets which have racked up ~$600 billion of unrealized bond losses pushing many banks into technical default. However, the Dodd-Frank regulatory rollback of 2018 exempted many mid and smaller banks from mark to market rules so regulators ignored the impending disaster. Ironically, the FDIC pointed out this massive risk the exact same week that Silicon Valley Bank failed. Coincidence?

March 6th, 2023:

"The total of these unrealized losses, including securities that are available for sale or held to maturity, was about $620 billion at yearend 2022. Unrealized losses on securities have meaningfully reduced the reported equity capital of the banking industry."

"Unrealized losses weaken a bank’s future ability to meet unexpected liquidity needs. That is because the securities will generate less cash when sold than was originally anticipated, and because the sale often causes a reduction of regulatory capital"

One day later, Silicon Valley Bank initiates a capital raise and the bank was shut down within 24 hours.

In addition, to the above risks, due to the unprecedented rise in interest rates, 2022 saw the largest and only net annual deposit outflow in U.S. history. Deposits have now declined $565 billion year over year.

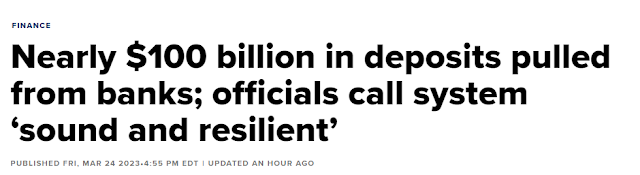

We learned late on Friday that $100 billion of that came in the last week ALONE:

Monthly deposits, $ change:

This combination of unrealized losses AND deposit outflow is a ticking time bomb as Silicon Valley Bank found out the hard way. The new Fed "BTFP" facility put in place over the past two weeks allows banks to trade their underwater assets for Fed loans so they can avoid mark to market realized losses. However, most of their balance sheet assets are NOT eligible to be used as Fed collateral. Which means that eventually they will run out of liquidity to cover the accelerating bank run.

In the meantime, as I've pointed out many times, policy-makers have declined to provide blanket FDIC insurance because it's a political issue. Which is something NO ONE wants to admit.

So instead, the FDIC is implementing full depositor bailouts on a case by case basis which is rapidly depleting their reserves. Meanwhile, this ad hoc approach is doing nothing to stem the deposit exodus because no one knows what will happen once the FDIC fund is depleted.

Once the fund is depleted this whole mess will come down to a congressional vote. Consider that the unrealized bond losses are six times larger than the FDIC insurance fund $600 billion v.s. $100 billion.

What pretty much all of today's pundits forget is that the FIRST TARP vote in October 2008 FAILED. It was voted down. I am sure Mike Shedlock remembers that vote well since he led the effort to ensure it was voted down. However, after it failed, markets tanked so lawmakers panicked and a WEEK later the second vote passed.

HOWEVER, by that time the damage was done. Because when the second vote passed, the market REALLY collapsed.

It IS different. It's far worse.