Investors are trapped, but they are complacent because they are told constantly, don't worry, be fat, dumb, and happy...

Allow me to recap events to date:

The pandemic initiated the largest combined fiscal and monetary bailout in history. Record stimulus flowed from central banks and Federal governments into local bank deposits. Banks parked that money into long-term Treasuries creating a duration mismatch with their deposit base.

Central banks were slow to withdraw stimulus believing that the inflation was caused entirely by the Federal unemployment programs. However, inflation accelerated AFTER the pandemic unemployment programs ended in September 2021. Subsequently, the Fed has panic raised interest rates at the fastest relative rate in history now at 4.75%. Fed rate hikes .5% greater than the rate increases from 2003-2006. Short-term rates have increased 200% over where they were pre-pandemic (1.5%). Mortgage rates have doubled from where they were pre-pandemic. However, the balance sheet which is the true source of (asset) inflation came down only 7% year over year. The Fed balance sheet remains DOUBLE where it was pre-pandemic, which has kept asset markets and the CPI artificially inflated. The CPI is currently at 6%, or three times higher than it was pre-pandemic.

In the event, growth stocks were annihilated. Pending home sales are now at the lowest on record. Consumer sentiment hit the lowest on record in October 2022. Meanwhile, we now learn that the record increase in interest rates was a ticking time bomb on regional bank balance sheets which have racked up ~$600 billion of unrealized bond losses pushing many banks into technical default. However, the Dodd-Frank regulatory rollback of 2018 exempted many mid and smaller banks from mark to market rules so regulators ignored the impending disaster. Ironically, the FDIC pointed out this massive risk the exact same week that Silicon Valley Bank failed. Coincidence?

March 6th, 2023:

"The total of these unrealized losses, including securities that are available for sale or held to maturity, was about $620 billion at yearend 2022. Unrealized losses on securities have meaningfully reduced the reported equity capital of the banking industry."

"Unrealized losses weaken a bank’s future ability to meet unexpected liquidity needs. That is because the securities will generate less cash when sold than was originally anticipated, and because the sale often causes a reduction of regulatory capital"

One day later, Silicon Valley Bank initiates a capital raise and the bank was shut down within 24 hours.

In addition, to the above risks, due to the unprecedented rise in interest rates, 2022 saw the largest and only net annual deposit outflow in U.S. history. Deposits have now declined $565 billion year over year.

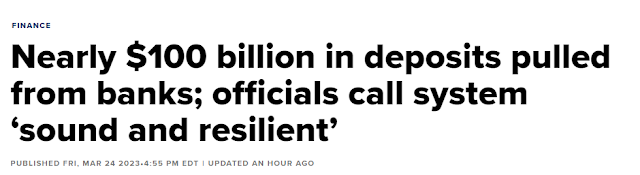

We learned late on Friday that $100 billion of that came in the last week ALONE:

Monthly deposits, $ change:

This combination of unrealized losses AND deposit outflow is a ticking time bomb as Silicon Valley Bank found out the hard way. The new Fed "BTFP" facility put in place over the past two weeks allows banks to trade their underwater assets for Fed loans so they can avoid mark to market realized losses. However, most of their balance sheet assets are NOT eligible to be used as Fed collateral. Which means that eventually they will run out of liquidity to cover the accelerating bank run.

In the meantime, as I've pointed out many times, policy-makers have declined to provide blanket FDIC insurance because it's a political issue. Which is something NO ONE wants to admit.

So instead, the FDIC is implementing full depositor bailouts on a case by case basis which is rapidly depleting their reserves. Meanwhile, this ad hoc approach is doing nothing to stem the deposit exodus because no one knows what will happen once the FDIC fund is depleted.

Once the fund is depleted this whole mess will come down to a congressional vote. Consider that the unrealized bond losses are six times larger than the FDIC insurance fund $600 billion v.s. $100 billion.

What pretty much all of today's pundits forget is that the FIRST TARP vote in October 2008 FAILED. It was voted down. I am sure Mike Shedlock remembers that vote well since he led the effort to ensure it was voted down. However, after it failed, markets tanked so lawmakers panicked and a WEEK later the second vote passed.

HOWEVER, by that time the damage was done. Because when the second vote passed, the market REALLY collapsed.

It IS different. It's far worse.