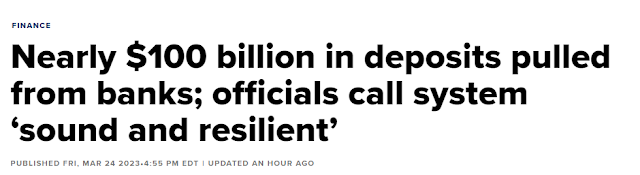

To buy a global bank run or not. This is the artificially intelligent question of the day...

Since the bank run started, NYSE stocks have become extremely oversold, especially financials. Banks are a crowded short. Conversely, Tech stocks are a very crowded long. Which is leading to a chasmic divergence.

The question on the table is, does it resolve with NYSE rally or Nasdaq crash?

Banks are trying to rally, but they can't get off the mat.

Meanwhile, there is zero fear in this market of a continuing bank run. It appears that bears went ALL IN back in December and now they've decided the market is going higher.

We saw this level of divergence between large caps and the rest of the market back in 2008:

Nvidia is at the apex of the Artificial Intelligence bubble.

"Nvidia trades at an eye-watering 56 times projected earnings, nearly three times more expensive than the Philadelphia Stock Exchange Semiconductor Index’s 21 times and a near 150% premium to the Nasdaq 100, according to data compiled by Bloomberg. Nvidia’s average multiple over the past decade is 30 times"

With 42 buy-equivalent ratings, Nvidia has by far the most bullish recommendations of any chipmaker"

Based on this chart, you would never know that Nvidia earnings just fell -50% year over year:

"Net income in the quarter ended Jan. 29 was more than halved from the prior year, falling to $1.41 billion, or 57 cents a share, from $3 billion, or $1.18 a share, a year earlier"

The A.I. bubble is just another empty load of bull shit.

Micron just reported their largest loss on record, but the stock is up today because analysts are praying that the worst is over for the semiconductor sector. It's a big bet to make going into near-certain recession. Why would semiconductor demand bottom BEFORE the beginning of the recession? You would have to be brain dead to believe that, hence it's Wall Street consensus.

The Nasdaq has been in a death cross for the longest period of time since 2008. Which means that the 50 day moving average is below the 200 day moving average. Given that bulls STILL haven't capitulated, it's extremely likely this death cross will last far longer than the last one.

The bond market and the stock market are sending opposite signals. Which does not end well for stocks:

“Our 21 Lehman systemic risk indicators are pointing at the highest probability of a crash or a sharp drawdown in the next 60 days—the highest probability since COVID,”

McDonald believes investors are ignoring the risk of a “rolling credit crisis and focusing too much on the rise of new technologies like artificial intelligence"

In summary, this fake rally is driven by artificial intelligence.

But, who to believe?