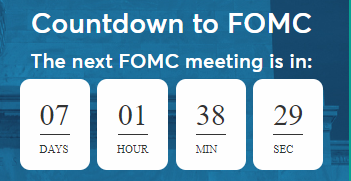

Today's bulls have FOMC: Fear of Missing Crash...

For the purposes of this discussion I will be referring to the chart below. Best case scenario, bulls stage a short-covering rally each time they implode closer to full bailout. Worst case scenario, they panic and implode straight down to the bottom.

Either way, until they panic, there will be no Fed bailout.

What bulls call the impending bailout, I call the impending clusterfuck.

What we got this week was not a pivot on rates, it was an impending taper on rates. The current Fed funds rate is 3.75% and it's expected to increase .5% in December and another .5% by March which is when the Fed would pivot to neutral. Which means that bulls are front-running the Fed by a full four months on the pivot, which makes this rally a taper rally.

This week, Wharton Professor Jeremy Siegel was saying that if the Fed pivots in December then this rally is for real.

Siegel:

Inflation Is Over. It's Rally Time

"There's still a chance we can avoid a hard landing if the Fed pivots in December"

Today (Sunday), the Fed came out and said they are not planning to pivot in December. Why? Because every time risk assets rally, they are forced to move back their pivot in terms of timing and magnitude of rate hikes:

"The U.S. Federal Reserve may consider slowing the pace of rate increases at its next meeting but that should not be seen as a "softening" in its commitment to lower inflation, Federal Reserve Gov. Christopher Waller said on Sunday"

Markets should now pay attention to the "endpoint" of rate increases, not the pace of each move, and that endpoint is likely still "a ways off"

What no bullish pundit is considering right now is what will happen when in fact the Fed does pivot from hiking to neutral which will only come amid MASSIVE market turmoil. They are all using the 2018 playbook of massive face ripping rally. However, what they ignore is that the inflation trade has been the dominant theme of 2022. These are the most successful trades of the year. I am of course referring to value stocks, commodity trades, dollar carry trades, and long stock short bond trades. Picture what will happen when all of those trades implode. There will be no leadership in the market. UNLESS one believes that Tech will exit its bear market and lead the market higher once again.

What today's pundits don't seem to know is that overvalued Tech stocks are now dead money, and will be dead money for years to come. There hasn't been a single bubble in history that popped and then immediately resumed its ascent. After Y2K, it took 17 years for the Nasdaq to make a new high.

Still, investors are in no way giving up on the Tech trade, as recent unprecedented VXN flash crashes have proven:

In addition, when U.S. bond yields fall then the carry trades will unwind and the vaunted "TINA" trade will implode. A process that has already started as we see below, the $USDJPY having it's biggest collapse since the START of the pandemic. This means that the hot money that flooded the U.S. due to hawkish Fed policy, is already leaving the U.S. ahead of the pivot. Meanwhile, bullish gamblers are piling into the casino ahead of the pivot.

Next, we talk about the value trades which are led by the Energy sector. This sector already imploded back in June and has enjoyed a three wave rally. Including Exxon and Chevron, the XLE is at new all time highs. However, on an equal weight basis the Energy sector is three wave corrective. What this chart shows us is that the 'b' wave retraced all of the 'a' wave gains, which means it's a weak rally. Confirmed by the fact that NYSE lows spiked each time Energy came down to the origin of the rally.

To confirm this theory, we look at Warren Buffett's Berkshire Hathaway conglomerate which is considered the best deep value fund in the market. It's heavily weighted with bank stocks and other cyclicals, and of course a heavy allocation to Apple.

Look up to the chart above, and look below. They are the same wave pattern on the same timeline only Berkshire is an even weaker version of the Energy trade, the stock has gone nowhere for six months.

All of which means that social mood peaked earlier in the year and is now making a new lower high in speculative appetite.

In summary, for fourteen years straight, central banks bailed out stock market bulls. Now they are saying you are on your own. Which leaves bulls praying for a crash and a recession, so they get their long awaited pivot. However, the ongoing delay in capitulation means that by the time it arrives it will be far too late for "soft landing". And what will the Wharton Professor say?

Oh well, I was wrong. It wasn't the beginning of a new bull market, it was the end of the cycle, and at the end of the cycle, low rates come with a caveat: careful what you wish for.