For those who were not around during Y2K, I will now explain what happened during that era and how this current fiasco is very similar...

I have several relatives in-law who are former hedge fund managers, which is how I know a few inside secrets of Wall Street. For example that hedge funds - aided and abetted by prime brokers - made a lot of money crushing the Gamestop bubble on the short side when it hit $400+. However, the most recent crop of Wall Street analysts were all in preschool during the Dotcom bubble so it's not hard to understand why they have not even the slightest clue what's going on. As far as anyone over the age of 40 who are now claiming "No one knows what's going to happen", their only "good" excuse is dementia. This is all deja vu.

The 1990s stock rally at the time was the longest rally in U.S. history. Born out of the 1990 recession, it began to accelerate in 1995 with the nascent Dotcom boom. Fed Chief Alan Greenspan famously declared that stocks were caught up in "irrational exuberance". He had no idea that was nothing compared to what was coming. The bubble accelerated from that point forward, but hit a hiccup in 1997/1998 with the Asian financial crisis which was a currency crisis caused by the strong dollar. Sound familiar? The contagion spread worldwide, leading to Russian debt default and the LTCM hedge fund collapse in October 1998. The Fed which had been on a tightening path, then eased to assuage markets. That easing set off the Dotcom blow off top. The Fed stayed too loose for too long because they were concerned about the Y2K millennial date change event.

The Y2K date change event forced companies to invest large amounts of money on Technology equipment in order to replace older software and hardware with newer systems. This set-off an IPO "Dotcom" bubble of companies seeking to cash in on the bonanza. The surfeit of new startups further fueled demand for new Tech equipment. It all frothed higher until early 2000 when the Fed slammed on the brakes post Y2K date change. We knew early on New Year's Day that planes were not falling out of the sky in Australia.

After New Year's 2000 the Fed did an abrupt u-turn on monetary policy and the Nasdaq collapsed by March 2000. Still, most of Wall Street predicted the Tech boom was NOT over. It was John Chambers of Cisco in December 2000 who officially said that demand had fallen off a cliff, something the stock market had already figured out. The Nasdaq bear market lasted two years longer. Down -80%.

Good times.

Fast forward two decades. Pre-pandemic, this was already the new longest stock market rally in U.S. history: Lasting from March 2009 to February 2020. Aided and abetted by continuous monetary bailout at the zero bound. When the pandemic struck, global central banks eased on a level never before seen in human history. The pandemic lockdown forced companies to invest large amounts of money in Technology equipment in order to create the "Virtual Economy" for their work from home workforce. This setoff an IPO bubble of companies seeking to cash in on the bonanza. Over 1,000 new IPOs debuted in 2021, the most by far for any year in history. The surfeit of new startups further fueled demand for Tech equipment. Sounds familiar.

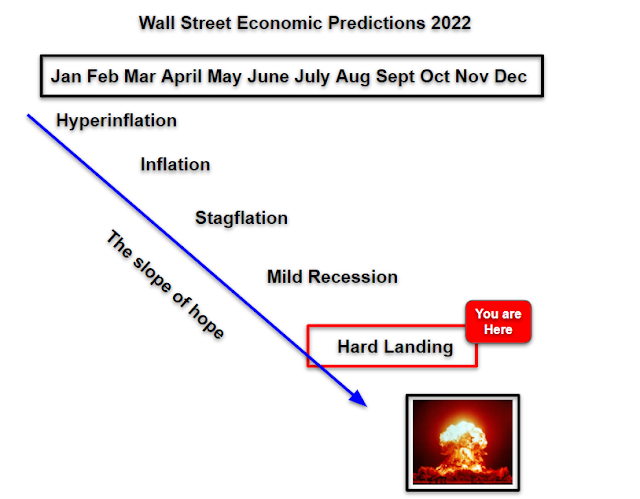

The wheels started coming off the bus in early 2021 when the meme stock pump and dump frenzy came to a head with Gamestop. Record newbies flooded into markets where they were quickly bilked of all their capital in meme stocks and crypto Ponzi schemes. The majority of Tech stocks peaked and collapsed. However, mega cap Tech remained bid due to the passive indexing super bubble. All the way up until a year ago, October 2021, when the Fed slammed on the brakes on "lower for longer" and abruptly U-turned to a policy of "higher for longer" going into 2022. Still, most of Wall Street has yet to acknowledge that Tech demand is now falling off a cliff.

Good times.

Big Cap Tech is now trading like a brick. For Amazon, Facebook, and Google, they face an outright decline in earnings. In the case of Microsoft and Apple, those companies are seeing an abrupt down shift in growth. They are ALL massively overvalued relative to the rest of the market.

In summary, we don't know what is going to happen, we only know what is happening all over again.

Which is only something "different" in an Idiocracy.