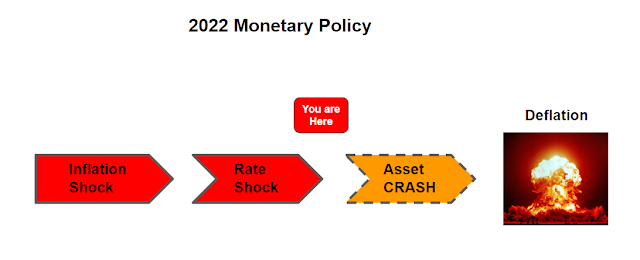

Central banks are hyper tightening into an incipient global depression. Bulls STILL can't figure out what could go wrong...

The central bank meetings this week were ALL dollar positive. First the Fed announced on Wednesday an even more hawkish stance on interest rates. They want the Fed rate at 4.4% by the end of 2022 which is almost double where it was going into this week.

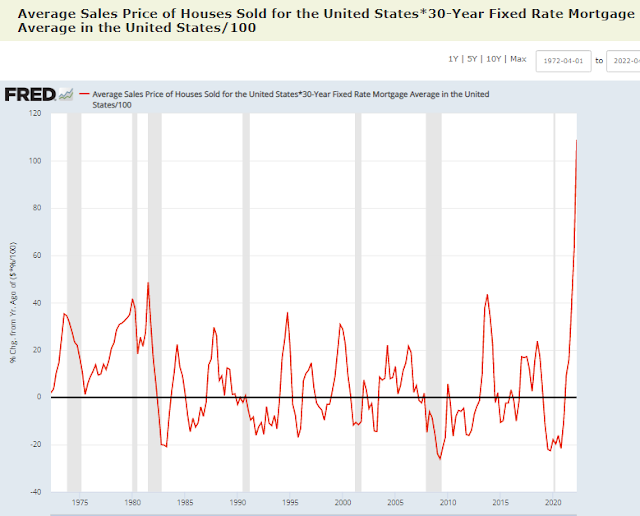

The Fed is now primarily concerned about "inflation" in the housing market. Which is ironic, because they continue to be the sole source of housing inflation. During the pandemic, their QE programs caused housing prices to soar, now during the tightening phase, their interest rate hikes are causing carrying costs to soar. This is what Powell said at the FOMC debrief:

“I think that shelter inflation is going to remain high for some time. We’re looking for it to come down, but it’s not exactly clear when that will happen. It may take some time. Hope for the best, plan for the worst”

In other words, the Fed is using their own rate hikes as a justification for further rate hikes. Which means the only thing that will bring "inflation" down is a collapse in housing prices. Which is coming, but not coming fast enough to prevent disaster.

Falling home sales are a precursor to falling home prices.

Next, the BOJ met and kept interest rates unchanged which means there is now a ludicrous 3.7% spread between U.S. short-term rates and Japanese long-term rates. Shortly after the meeting, the Japanese Treasury intervened in the $USDJPY market, but as FX traders predicted, without monetary change, intervention alone had little effect. Which means that the Yen carry trade will continue to hang over this market until such time as there is a final global RISK OFF event.

Similar to March 2020.

And then the Bank of England met and raised rates .5% while declaring that the economy is likely ALREADY in recession.

In other words, what we are witnessing is central bank hyper tightening into a global depression.

Now, "someone" must blink and capitulate and it won't be the Fed. The dollar wrecking ball is out of control, as the Fed is the tightest central bank on the planet.

The AAII bears sentiment survey is the highest since 2008, but there is no follow through in markets. The VIX is somnolent because everyone believes that everyone else is capitulating.

They are trapped in moronic deadlock.

The Global Dow is well through the June low and beneath the 200 week moving average for the first time since March 2020.

Bulls who were expecting a Fed pivot in September are now trapped.

The market won't bottom UNTIL the VIX spikes due to capitulation.

And when it finally arrives, capitulation will explode markets and expose rampant fraud like a Pinata spilling out candy.

Believe it. Or not.