Thursday, July 14, 2022

FOMC: FEAR OF MISSING CRASH

Wednesday, July 13, 2022

THE BIG LONG

July 13th, 2022:

This post was written concurrent with the latest CPI reading which is yet another hotter reading than last time. So far there is no sign of Fed reversal on the horizon. Markets are at a critical juncture. Unfortunately, today's investors have forgotten the NUMBER ONE rule on Wall Street. Don't fight the Fed...

There has been far too much fixation on the job market as the source of inflation. Wages as a share of the economy have been trending down for forty years straight and only ticked higher during the pandemic. However, corporate profits and total wealth have sky-rocketed relative to GDP.

What's interesting is that no pundits were worried about asset inflation when Elon Musk's wealth increased 600% in one year. It wasn't until the CPI started creeping up last Fall that the business media became hysterical over inflation. They blamed the tight job market.

Of course the job market IS tight. Twenty million people were laid off in March 2020 which is a DECADE worth of jobs. Three million Baby Boomers retired early and untold undocumented immigrants went home and never came back.

Nevertheless, to believe that job CREATION is causing inflation is purely asinine. Most of these new jobs are low paying McJobs in the service sector. The number of jobs alone is in no way driving inflation. Coming out of the pandemic, many pundits predicted that the pandemic unemployment programs would lead to inflation. The problem with that hypothesis is that those programs ended almost one year ago. There is only ONE WAY to account for all of this lingering inflation - which is the central bank wealth effect.

Step back and recall that the "genius" behind Quantitative Easing was that it wasn't supposed to create inflation. The money is injected into the bond market where it ripples out from that market into various risk assets until next thing you know one totally worthless Bitcoin costs $60,000. However, the middle class sees NONE of this money. You see QE didn't create DIRECT inflation, it created indirect inflation via the fake wealth effect. Contrary to ubiquitous belief, this is NOT middle class inflation. This is "Ponzi inflation".

Fortunately, there is a cure for that problem and it's not interest rate hikes, it's balance sheet reduction which is now on AUTO-PILOT for the foreseeable future.

So far, so bad:

Crypto bubble toast

Growth stocks/IPOs toast

Emerging Markets Imploded

Global Bonds collapsed

Commodities collapsing

Which leaves the housing bubble AND the passive indexing bubble.

My last blog post was called "No One Saw It Coming" because the majority of today's pundits are far too obsessed with rate hikes and the job market to realize the magnitude of financial collapse that is now INEVITABLE.

Ironically, the one pundit who has CONSISTENTLY warned about these two final mega bubbles (housing/stock indexing) is Michael Burry. The exact same guy who warned about the bubble in 2007. This prescient warning was from one year ago, but there have been many more since that time:

June 2021:

"Michael Burry, the famed investor who predicted the collapse of the housing market bubble in the US in 2008 and had a movie made about his legendary short position, is now ringing the church bells for another disaster"

“People always ask me what is going on in the markets. It is simple. Greatest speculative bubble of all time in all things. By two orders of magnitude”

That is where the happy comparisons to 2008 largely end. Because instead of banks falling like dominoes, this time it will be sovereign nations falling like dominoes.

July 7th, 2022

"A quarter-trillion dollar pile of distressed debt is threatening to drag the developing world into a historic cascade of defaults."

“With the low-income countries, debt risks and debt crises are not hypothetical,” Reinhart said on Bloomberg Television. “We’re pretty much already there.”

And is the solution to this problem RECORD monetary divergence between the U.S. and China?

No.

"The net outflows from EM fixed income funds are the most severe in at least 17 years, far worse than were recorded during a bout of acute concern about China’s economy in 2015"

“The probability of a soft landing—is only about 10 percent. Conversely, the chances of a hard landing—are about 80 percent”

Correction. The chance of a soft landing is actually ZERO percent. Position accordingly.

Saturday, July 9, 2022

"NO ONE SAW IT COMING"

Wednesday, July 6, 2022

Global Synchronized Meltdown

The nature of meltdowns is that you only get out BEFORE the meltdown or AFTER. Never during...

Picture this scenario: Rabid Fed rate hikes implode Emerging Markets, setting off a domino collapse of global risk assets. Everything from commodities, to housing, to cryptos, and of course stocks simultaneously implodes. Liquidity is non-existent, so gamblers are trapped in bad trades. Getting margined out between limit down and circuit breaker halts. Finally, the Fed reverses and takes their puny Fed rate down 1.5%. What happens next? Nothing.

Then the REAL panic sets in.

When the smoke clears and global markets have cratered, who gets bailed out this time? No one.

The Fed is pushing the entire world to a global depression and the chance it doesn't happen just became the LEAST likely and most widely expected scenario.

Any questions?

"Federal Reserve officials in June emphasized the need to fight inflation even if it meant slowing an economy that already appears on the brink of a recession"

Wow.

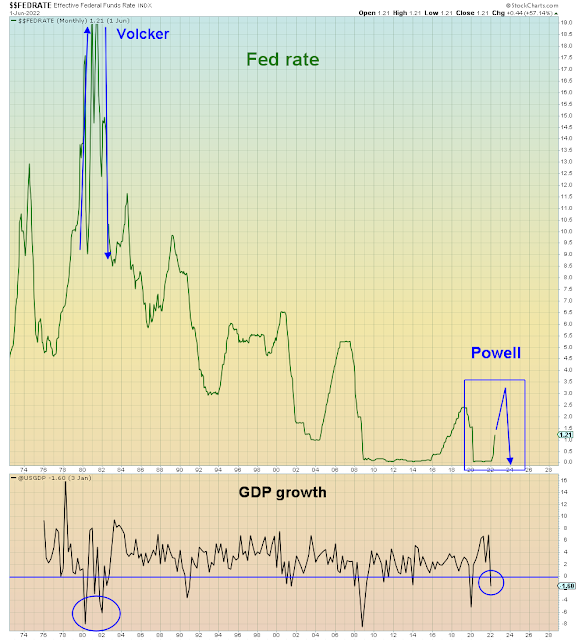

Let me get this straight, the Fed is slowing an economy they acknowledge is on the brink of recession, knowing full well that monetary policy has a six month lag. So by the time they've figured out it's a policy error, it's WAY too late.

No surprise, they have recent experience making this exact same mistake. Recall that the BIG mistake the Fed made last year was using lagged CPI data to set policy while ignoring the bond market which was warning of inflation. So now this year, they are making the SAME mistake but in the opposite direction. Using lagged CPI data to confirm that inflation is coming down while ignoring the bond market.

Because everyone knows that two wrongs make a right.

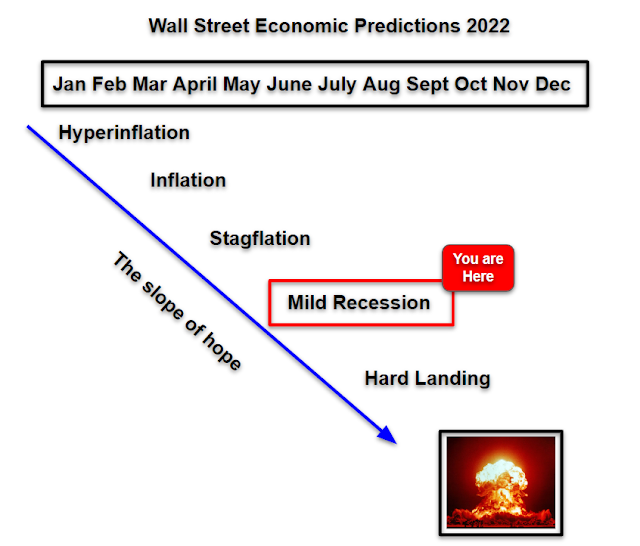

"While the market has become fearful, many Wall Street economists do not expect a recession this year"

Economists ALWAYS think they are smarter than the bond market, whereas history confirms their conceit is unrequited.

For now, most of the dislocation from Fed policy has been in non-U.S. markets. The dollar has been sky-rocketing which has been sucking capital out of the rest of the world, which is now collapsing like a cheap tent. We learned today that Emerging Markets have seen four straight months of outflows - the most since 2015. We know the Fed is totally ignoring global markets because EM stocks and EM currencies are now at levels that initiated Fed reversals in 2015, 2018 and 2020:

Meanwhile, as I warned recently, Tech stocks are starting to outperform Cyclicals again on a relative basis, because investors are abandoning the reflation trade. The commodity complex is going bidless at the fastest rate since 2020 and before that 2008.

It was just another Ponzi trade - slowly sucking in capital on the way up and then collapsing on the way down.

Four months of gains gone in four weeks:

Another reason Tech stocks are outperforming is because they've been heavily shorted and hedge funds are now taking their entire exposure DOWN on the long side and short side.

The Nasdaq is clinging to the LAST line of support. The line at which the Fed bailed out investors every time since 2008 during economic expansion. Only to be abandoned by the Fed during recession.

Investors have had AMPLE warning, but they have continued to stick to their hypothesis that the Fed can bail them out of EVERY situation, even a global depression at the zero bound.

2022 has been the year of the Black Swan event:

Largest Crypto crash EVER

Largest Tech crash in two decades

Largest commodity spike since 2008

Fastest interest rates increases in three decades

Fastest Quantitative Tightening ever attempted, has started now in July

Largest dollar rally in two decades

Largest global bond collapse on record

And officially the largest two year housing price increase in history:

Still, when their bailout fails, gamblers will say no one saw it coming. Not the crash, just the failed bailout.

We are witnessing the end of the Efficient Bailout Hypothesis and the requisite belief that printed money is the secret to effortless wealth.

Tuesday, July 5, 2022

THE NOOSE IS TIGHT

Everything taking place right now makes perfect sense in the context of a collapsing Global empire, called Globalization...

The consistent theme of 2022 is that as the collapse accelerates, the sugar coated media fall further behind the curve on explaining where this is all heading.

Every step of the way, bagholders have been tempted into the casino as the noose gets tighter and tighter.

More fake inflation, more rate hikes, more recession, more lies.

The one common theme taking place across all media and political platforms right now is denial of reality. Why? Because both sides are making a land grab for how many fools will believe their own one-sided version of the truth. In the process they are accelerating the overall collapse of mental health. Is there anyone at higher levels of power who will tell the unvarnished truth anymore? No. There's no audience for it. Sugar coated pablum is the order of the day.

The one consistent theme of 2022 is that bad news gets worse AND the media continually fall further behind the reality curve. We've reached a point now where Wall Street has stopped updating their price and profit forecasts. Out of laziness or deception who knows?

"Commendable courage or a refusal to face reality, a receding stock market tide has left Wall Street analysts sitting with price predictions that will take more than a little luck to come true"

The brutal six-month repricing in markets has been met with a significantly less hurried reappraisal of analyst forecasts"

[The inertia around] estimates today is a carbon copy of situations in past bear markets...adjustments have been slow, not just on price targets but also on forecasts on corporate earnings. At $249 a share, their expected 2023 profits for S&P 500 firms have increased by roughly $7 this year, an improvement that’s at odds with growing recession warnings"

The next major gauntlet that today's investors will face is earnings season. The fact that companies and analysts have NOT been warning ahead of time means a lot more land mines are waiting for the market in July.

Back in May the Fed started DOUBLE tightening interest rates and they also announced they would be double tightening their balance sheet by the end of the summer. At that point ALL of Wall Street's predictions for 2022 were TOTALLY null and void. Analysts started this year with a narrative of a strong consumer and a moderate Fed. Halfway through the year and we've seen a collapsing consumer and RECORD rate hikes ALREADY. With more to come. The largest policy error in history is only getting started.

But who will tell the sheeple? No one.

The evolution of rate hike predictions by Goldman Sachs:

The Fed is attempting to repeat what Fed Chair Paul Volcker did back in 1980 - to rapidly raise interest rates, crash the economy, exorcise inflation, and then begin easing to prevent depression. However, this Fed is attempting the same aerial acrobatics at ground level, at the zero bound. In other words, what they are attempting is not improbable, it's impossible. They will be highly successful right up until they crash the economy. After that, they will be dick in hand amid mass panic at 0%.

Still, so many of today's pundits are bought into the 1980 paradigm that there isn't anyone to warn the Fed that this is Volcker madness.

Worse yet, all of this "inflation" is hiding weakness in the underlying economy. In the absence of a strong consumer, price increases are offsetting quantity declines. Meaning demand IS falling across both durable and non-durable goods.

The Fed's obsession with % price increases has put them on the path for total disaster:

On a nominal basis, commodities as a whole are lower than 2008. Adjusted for wage inflation, there is not even ONE commodity that is higher than 2008. During the pandemic, commodity prices collapsed and now the recovery has been conflated as "inflation". The Fed is therefore mistaking a one time price recovery for secular inflation.

One must ask the obvious question in an election year - how much of this inflation hysteria is purely political? Because if it is, I suggest that those who are propagating this hysteria and otherwise claiming the Fed is behind the curve, are complicit in the largest policy disaster in modern history.

If this all sounds like a lot of infantile idiocy, it's because it is. Denial of reality has become a societal addiction. It's clear that people would rather sacrifice their mental health on the altar of consumption addiction than to accept the inconvenient truth.

I call that consumer choice.

Saturday, July 2, 2022

THE EVERYTHING DEFLATION

Investors have been conditioned to believe that prices of everything are going higher. They will soon learn the hard way that while liabilities are "sticky", asset prices can collapse...

Pundits are just starting to realize that recession is inevitable. Most believe that it will happen in 2023. The technical definition of a recession is two quarters of negative growth. This week, final Q1 GDP came in at -1.6% and Q2 real-time GDP crashed down to -2.1%. Which means that technically we've already met the definition of a recession. Theoretically, Q2 could pull out of the nosedive, however Q2 just ended, therefore only backward data revision can save the quarter. In other words, recession will very likely be backdated to the beginning of 2022 and yet most pundits see it happening in early 2023. They are a FULL YEAR off from reality. With forecasting like that, who needs enemies? Somehow, the Fed is even more clueless because they are still holding out hope that recession won't happen at all.

Then there are the pundits who are saying, Ok recession is inevitable but it will be a "soft landing". They never quite explain what that means. The difference between a soft landing and hard landing is whether or not there is deleveraging of households and corporations. Because mass deleveraging implies major job cuts. Most stock forecasters remain sanguine on further market downside, because they assume a "soft landing", despite the fact that the Fed has the least amount of dry interest rate powder in history. This key assumption makes it easy for them to data mine the past 50 years and find the LEAST painful recessions and bear markets for comparison to the current market. Which has become a very common practice lately.

We are to believe that the LARGEST asset bubble in human history will require the LEAST amount of Fed rate buffer and will be a soft landing.

You have to be brain dead to believe that, hence it goes largely unquestioned.

Unfortunately for investors they were led to believe that inflation is NOT transitory. However, inflation ALWAYS collapses in a recession. There have been no examples in the past 100 years where it didn't. Which means that inflation IS now once again transitory, only the pundits and the Fed don't admit it.

Basically they've all been conned by their own cycle denial.

Worst of all, inflation is a RISK ON paradigm. It means crowding into commodities, carry trades, and cyclical stocks. This year, investors have been dumping Treasury bonds en masse and buying stocks. In particular they've been buying Cyclicals which are now imploding.

Much has been written about the imploding Tech bubble, and most pundits are in agreement that it will continue collapsing.

However, what they deny is the fact that Cyclicals are now imploding FASTER than Tech stocks. And now THOSE stocks have the MOST downside.

Here we see Q2 relative performance for key sectors. The S&P 500 declined the least because recession stocks kept it from imploding. Tech stocks performed the next best. Followed by Cyclicals and Consumer Discretionary. We've been told all this time that the consumer is strong, but we just learned it was a widely believed fabrication.

June 29th, 2022:

"Consumer spending was weaker in early 2022 than previously believed, a sign that cracks may be forming in a crucial pillar of the U.S. economy."

Amazon, Walmart, Target, Nike and every other retailer ALREADY warned that consumer spending is slowing, but economists like to wait until everything implodes for confirmation. Imagine, as an investor if you had waited for EconoDunces to confirm that consumer spending had slowed more than predicted? You would get obliterated.

Why did so many economists happily ignore the COLLAPSE in consumer confidence that has been taking place throughout 2022? It's because they believe they are far smarter than the average consumer, whereas the opposite is true, they are as dumb as a brick.

Another lie we've been told is that there are shortages of everything, especially semiconductors.

This week we learned that there is now a massive glut of semiconductors.

No surprise, semiconductors were the WORST performing sector of Q2 since they are at the intersection of Tech AND Cyclicals.

Commodities of course are a huge part of "inflation". June saw the fastest collapse in copper since 2011, and before that 2008.

Copper is a key bellwether of the global economy:

Which gets us to the imploding housing bubble.

This news came out two weeks ago:

The Fed's own housing data shows new home prices collapsing at the fastest pace since 2008:

In summary, there are no shortages of ANYTHING. Soon there will be oversupply of EVERYTHING. The shortage lies were told so that companies could jack up prices and create a buying frenzy to pull forward demand.

It worked great. What's coming is an everything deflation, that will be out of central bank control. And it will give lie to all of the sugar coated bullshit that investors have been SOLD in 2022.

This past week, the $USD hit the highest level in 20 years. So far, Emerging markets and the rest of the world are bearing the brunt of outflows to the U.S.

However, June saw the largest overnight S&P futures selloffs since March 2020. Ex-2020, the largest since the Asian Financial crisis:

You don't have to be a genius to figure out what's coming, but you do have to be able to fog a mirror. Which appears to be a bridge too far for most people.