In the perfect world for stocks, the Fed implodes the middle class, inflation comes down, and the Fed rescues markets before they collapse. This is what Wall Street now universally expects from the Fed, because it's been standard policy for the past 40 years. This time, they are flirting with disaster at the zero bound. Anyone who is now betting policy-makers can pull this off, deserves their certain fate...

The CPI print did indeed come in hot. As expected, the hotter than expected reading INCREASED bets on massive rate hikes.

"Stubbornly hot U.S. inflation is fueling bets that the Federal Reserve will get more aggressive about trying to cool price pressures and even potentially ditch its own forward guidance by delivering a jumbo-sized interest rate hike in coming months.

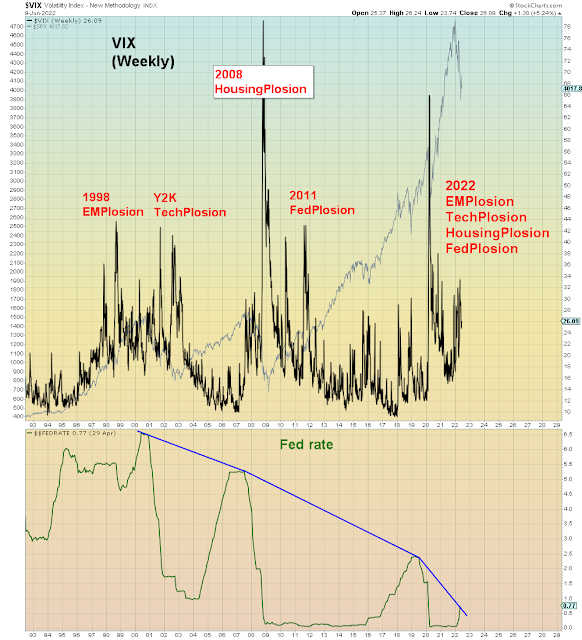

Commodities just round tripped back to the 2008 high and the two year just hit the same retracement level it reached in 2008 when markets went into meltdown. In other words it took 14 years for investors to forget the exact same policy error that took place in 2008. Only this time on a far greater scale:

The belief that the Fed is behind the curve on rate hikes is now extant on Wall Street. The fact that these higher interest rates are already imploding the middle class are of NO concern. Now the Fed is under pressure to go big on rate hikes. Which means they are falling ever further behind the curve on bailing out the collapsing middle class.

Nevertheless, we are to believe that these rate hikes are to help the middle class by bringing down inflation. In other words, the Fed will implode the middle class in order to save them. A 2008 meltdown on steroids. And yet no pundits question this idiotic narrative.

So be it. This money printing gambit was always doomed to end at the zero bound with an Idiocracy certain of the invincibility of central banks. So here we are.

We have now reached the point at which monetary policy can no longer save the middle class from imploding. But investors are betting THEY will be the ones who are bailed out.

It's not going to work out that way.

We got news late on Friday that consumer sentiment just hit an all time low. Lower than 2008 and 1980 which were the two worst recessions since WWII. And at the same time we see that corporate profits are at an all time high. It's no wonder investors are delusional.

Consumer sentiment is at a record low and yet the Fed stress index is ALSO at a new record low, clearly indicating the Fed considers middle class implosion to be a sign of low risk.

Meanwhile, corporate profits are at record high.

So it is that Wall Street sees new highs on the horizon:

Putting it all together, the middle class will continue imploding and Wall Street will continue making new highs. And if you believe that then there is nothing you won't believe. Except the truth. Which means you are wasting your time here.

What happens next is dictated by basic logic:

A global RISK OFF event leading to financial bailout failure aka. "The Gong Show". It's now logically impossible for this next stock market bailout to work as well as the last one. Considering the fact that the Fed was in FULL bailout mode back in 2020 and they are in FULL tightening mode now.

Financial bailout failure will be followed by a Fed slow to realize the magnitude of their policy error. At that point stocks enter Death Valley. The point of no return wherein future returns are deeply negative for long term bag holders. In addition, political acrimony will rise in a mid-term election year. Politicians will be slow to enact a fiscal bailout. The combination of inadequate monetary and fiscal economic fire power combined with an asset collapse will ensure that the recession is much deeper than anyone currently expects.

Consider consumer sentiment has already hit a record low with home prices at a record high. Back in 2007 consumer sentiment collapsed AFTER home prices collapsed.