Retail investor bagholders have a long tradition of going ALL IN at the top. Why stop now?

Today's pundits are largely of the groupthink mind that the Fed can thread the needle between normalizing monetary policy and recession.

Every oil shock in the past 50 years has preceded recession. Every inflation shock for the past 50 years has preceded recession. Every housing bubble in 75 years has preceded recession. 8 out of 10 rate hiking cycles has preceded recession, and the DotCom bubble in Y2K preceded recession.

This time we have ALL of those risk factors and a negative GDP print in Q1, but pundits are STILL not certain there will be a recession.

Here we see the University of Michigan index of current economic conditions is the lowest in 50 years, yet this time the housing bubble is STILL growing. What are we to believe will happen when it collapses?

Retail sales came in today near expectations, which has led pundits to believe "the consumer is strong". However, headline retail sales are NOT adjusted for inflation. On a quantity basis, we can see that retail sales are imploding:

Real consumption expenditures, QUANTITY:

Walmart warned today that they are no longer able to pass along all costs to the consumer hence profit margins are imploding:

Walmart stock peaked only three weeks ago, which is several months AFTER the overall market. The same pattern that took place in 2008.

What today's retail gamblers don't understand that institutions DO understand is that the Fed bailout cycle is OVER. The Fed is now intent on normalizing monetary policy as quickly as possible, because they know recession is coming. Which means they need as much dry powder as possible. So ironically, they are now in the process of accelerating recession in order to get rates to a level that will allow them to cut in the future. Investors are now trapped by this policy conundrum.

The rational strategy is to rebalance portfolios from stocks back to T-bonds and to raise CASH aka. t-bills, money markets. However, RETAIL investors have been led to believe that inflation is NOT transitory and therefore they must OWN the riskiest end of cycle assets. By this I mean commodities and commodity stocks. While holding minimal cash.

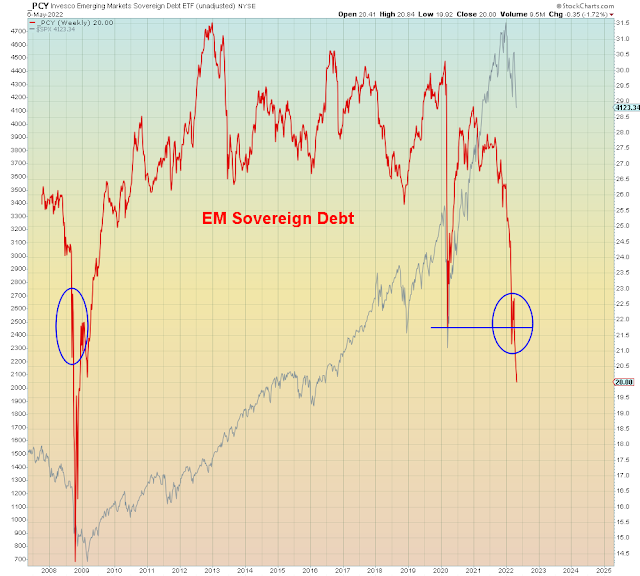

What is not priced into these markets is DEFAULT risk. The Fed's proprietary financial stress indicator has fallen since the stock market crash began. Why? Too much complacency in the stock market AND in the high yield bond market.

There is no cycle risk priced into these markets:

We got news this week that China is already in a recession.

Their market has collapsed back down to where it was in late 2015 right before the wheels came off the global bus. In addition, the Yuan is collapsing at the fastest rate in history (not shown).

The markets have ALREADY done the Fed's job for them. Consider that the Fed rate is currently at .75% but the 30 year mortgage is at the highest level since 2008. HIGHER than it was in 2018 when the Fed rate was at 2.5%!

That's insanity.

Homebuilder sentiment is collapsing. AND home buyer sentiment is collapsing as well.

Which means that the Nasdaq is imploding AND the Fed is tightening both at record pace.

BTFD: Buy The Fucking Depression...

In summary, this same market pattern played out in 1929. At first, individual investors bought the dip. But then the selloff accelerated and they ultimately panicked and the market crashed.

This chart shows the 1929 Dow inset against my predicted path for the U.S. market. Until the Fed panics, this market WILL NOT see a tradable bottom. Which means the initial crash will not be enough to stop stocks from going lower. I predict a neutral Fed will lead to a dead cat bounce followed by another leg lower. Which is what happened in 1929. The percentages are ESTIMATES. There is nothing magical about these price levels. If anything, they could be lower.