This week the Fed pulled the trigger on the first .5% rate hike in twenty-two years. In the process they very likely initiated global financial meltdown. The general consensus is that it was not enough. You can't make this shit up...

The Financial Instability Hypothesis

https://www.levyinstitute.org/pubs/wp74.pdf

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. If an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. This is likely to lead to a collapse of asset values"

This week Larry Kudlow deemed the .5% rate hike as "dovish":

"The basic inflation rate is running around 8%. That would require a 9% or 10% Fed funds rate, or even higher in the days of Volcker shock and awe. Volcker also reined in money supply growth and here, Powell completely struck out"

The 30 year mortgage is currently at 5.25%, can you imagine a 30 year mortgage at 18% which was the 1980 level?

We are constantly reminded this is the highest level of "inflation" in 40 years (despite nominal oil prices still below 2008 levels). However, the rate of change in interest rates is the highest level EVER in the biggest housing bubble in HISTORY.

"It's going in the right direction ... hopefully we'll be able to get away from this behind-the-curve characterization soon," Bullard said.

Indeed. Much sooner than anyone can possibly imagine.

All of the above means that the Fed's mandate is to cool the economy and bring down inflation. NOT to save asset markets from collapse.

This change in policy taking place after FOURTEEN straight years of bailing out markets, is NOT priced in to any asset market right now. Investors are still under the delusion that the Fed can slam on the brakes as hard as possible for price inflation AND yet keep asset markets inflated. It's the delusion of the CENTURY, and it has been assiduously cultivated by Wall Street and their media acolytes.

Not everyone took the bait:

"Wall Street titan Jeremy Grantham has been warning of a “superbubble” in the U.S. since last year, arguing the S&P 500 is set to be cut in half as an era marked by exceedingly risky investor behavior begins to fade."

Now, with interest rates for a 30-year fixed-rate mortgage rising to 5.27% this week, their highest levels since 2009, he sees that point coming ever closer"

Of course, not everyone is convinced that the housing market is set for a dramatic drop"

Got that? We can't even agree on what is a "bubble" anymore. In my neighborhood prices went up 30% in the past year. Apparently that's NOT a bubble, but eggs going up 30 cents, that's existential inflation.

What a bunch of fucking morons.

Clearly these people can't spot an asset bubble over and over again in their lifetimes, so how do they know what is inflation? In other words, what if all of these asset prices are temporary? That would mean they could all come crashing back down and leave the Fed "dick in hand", just like last time. Then you will see rampant morons rioting in mass protest. Wondering how they are going to pay for cheap eggs when they don't even have a job. Buried by another housing bubble.

What economists never noticed is that consumer sentiment NEVER recovered after the pandemic. Corporate profits sky-rocketed and consumer sentiment went in the other direction.

We've never seen this much disconnect between consumer sentiment and corporate profits. One is inflated, and one is deflated.

The Tech bubble is DOOMED. It's collapsing for the same reason it collapsed in Y2K - slowing growth AND a Fed eager to make up for lost time. Back in 2000, the Fed purposely held off on rate hikes until after the millennium date change, because they were worried computer systems would fail. When that didn't happen, the melt-up accelerated into March 2000. By May 2000 the Fed was doing everything possible to contain inflation. Sound familiar?

The Tech sector just got rejected at the 200 dma for the first time since 2008:

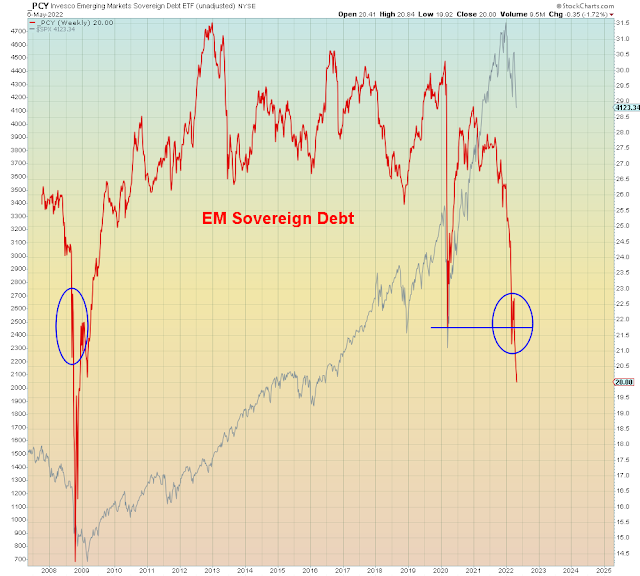

In summary, the Fed and its inflation acolytes have triggered global Minsky Meltdown. Which in today's Idiocracy means they didn't do ENOUGH.

Why? Because SO FAR, most of the pain has been in non-U.S. markets.

2008 sans bailout aka.

MONETARY POLICY FAILURE.