Back in 2008 the Fed made the exact same mistake they are making right now - believing that inflation is a higher risk than incipient global meltdown. In that event, the bailout worked. This time will be the hardest landing...

Over on Zerohedge, they have successfully "pivoted" from hyper-inflation last Fall, to stagflation last week, to recession now. Ironically, these are the same people who were mocking the Fed last Fall for saying inflation is transitory. And now the Fed is more hawkish than they are. It's this cabal of Peter Schiff acolytes who have assured this gong show will end as painfully as possible. The ubiquitous delusion is that the Fed can easily pivot back to cutting rates again.

There's only one problem with that fantasy: the Fed funds rate is at .25%, whereas in 2008 it was at 5.25%. There is nowhere to go on the downside. Therein lies the difference between this blog and all others - I don't assume there will be another happy ending when this end of cycle con job explodes. For that assumption you can go anywhere else where the sole objective is expanding the subscriber base and/or assets under management.

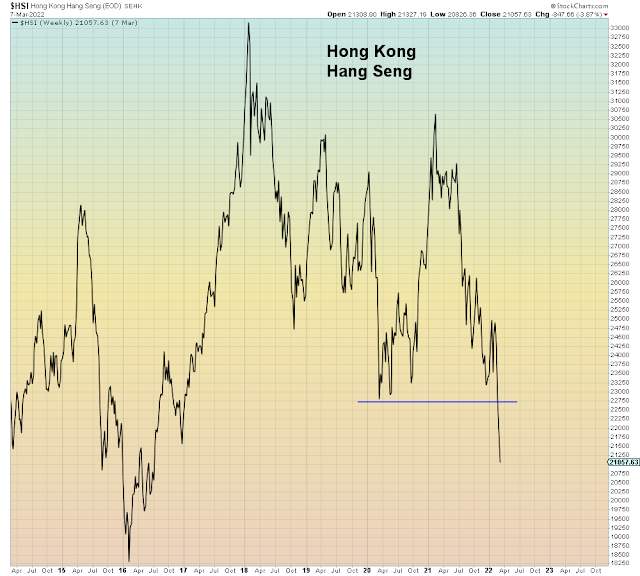

In 2008, in addition to a U.S. 5.25% interest rate reduction (i.e. 21 serial rate cuts), China's economy was still booming. It was China that dragged the world out of recession. This time they are leading the world into recession.

What you notice about this chart is that commodities follow China GDP, not the other way around. There is a staggering difference between China GDP in 2008 versus now. That was their highest growth rate in modern history.

All of which means that QE alone will not be enough to revive the global economy. What will be required is a combined fiscal + monetary super stimulus similar to what took place during the pandemic. Which will be challenging with a gridlocked Congress in a mid-term election year. When all else fails, I assume they will get it done, however, it won't be nearly as easy as during the pandemic.

And then there will be the protests and rioting. Why? Because a generation of Millennials is about to get financially wiped off the map. When that happens, one can assume that a TARP style bank bailout will be off the table. Which means that financials will be bidless. All of which means that the "just in time" bailout hypothesis which is propagated by all of Wall Street and most financial pundits, is lethal bullshit.

Go figure that Wall Street would not predict the wholesale collapse of their own industry.

Those who are not positioned ahead of time for what is coming will suffer TERMINAL losses. Why? Because there will be systemic meltdown of financial markets. Featuring extreme volatility. record volumes, and total lack of liquidity. Culminating in mass panic.

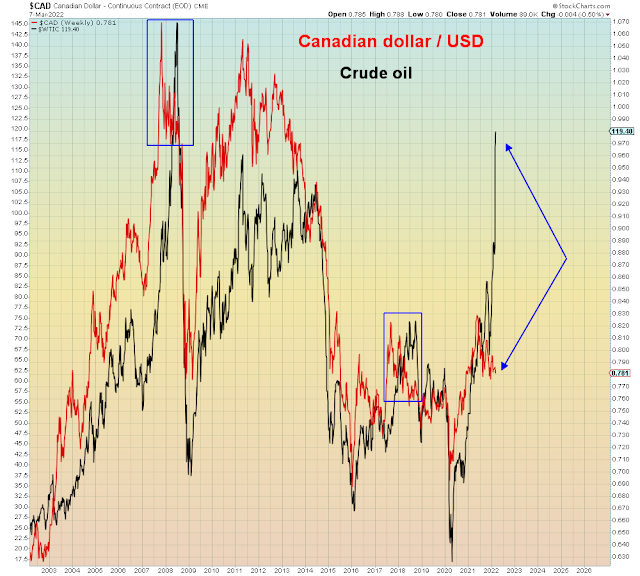

Unfortunately, the ubiquitous "hyper-inflation" hysteria has caused most investors to be very badly positioned for this impending event. Instead of respecting cash balances, they've been told that "cash is trash". What happened to hedge funds in commodities this past week is a warning for what's coming to the rest of the market. Going into last week, hedge funds were record LONG commodities. Then came the melt-up in crude oil last week followed by a straight line -30% crash into bear market. RECORD volatility, exceeding 2020. In addition, the nickel market has been shut down for over a week due to volatility.

These commodity trades are MASSIVELY crowded death traps at this phase of the cycle. Anyone can easily see that the commodity cycle peaked in 2008 along with China GDP above, and is now three wave corrective to a lower high. The pandemic commodity rally was an echo bubble.

But really who knew that a global pandemic and two year lockdown wouldn't lead to stronger global growth?

Not this Idiocracy.

Which gets us to the casino.

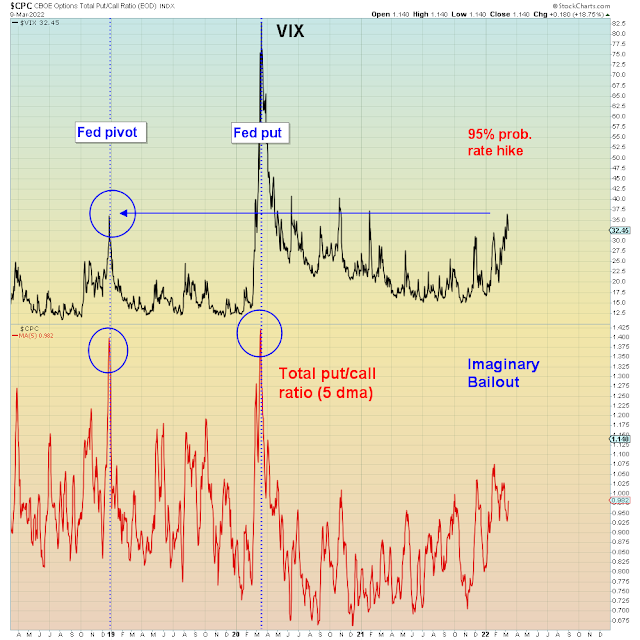

Bulls have mistaken post-FOMC volatility unwind for a positive response to Powell's rate hike. When these weekly puts expire or move further out of the money, options market makers buy back stock to unwind their option hedge. For the true direction we must wait until post-OPEX next week.

This market is now eerily similar to the last Fed policy error back in December 2018. Coming off the all time high, the market imploded -12% and then bounced up into the 50 dma. Then it re-tested and bounced up into a death cross. Which is where we are now. As we see, the % bullish is identical: This is the % of stocks that are deemed to be in a technical bull market. When the wheels came off the bus in late 2018 however, it was Trump who commanded Powell to pivot on rate hikes. Whereas this time, there is no chance Biden will interfere in monetary policy on behalf of stock gamblers. And Powell has already shown via the Nasdaq that he doesn't care if stocks implode. The Nasdaq is ALREADY down as much as it was when he pivoted in 2018 (not shown).

Here we see the extreme moral hazard that is now baked into this "market". In each of the past major market events, gamblers were reaching for hedges. However, in this event with global markets ALREADY in meltdown, there is no reach to hedge. In addition, this is the least likely time to get bailed out due to the Fed's hawkish stance.

This is beyond any level of risky risk-seeking we've ever seen:

In summary, I just nuked a bunch of trolls over on my Twitter feed. Bulls have command over the entire internet and yet they still feel the need to camp out on my site. My number of followers has increased dramatically recently, but I only care about quality not quantity. Today's bulls believe they have strength in numbers. Sadly, in an Idiocracy there is no such thing. Which is why the public is in no way prepared for this inevitable meltdown.