Denial is the new religion. It now has the power to supersede basic math and 3rd grade logic. The wall of denial is complete. It's massive. And it's a beautiful thing, for those who worship that sort of artifice...

Today's pundits believe they are doing people a favour by telling them to keep calm and ride it out on maximum risk. They are the good guys, and the perma-bears are the bad guys. As if to warn people of risk is the real problem. And they do a great job at it. Telling people fairy tales to attend Disney Markets is now a full time job on Wall Street.

Unfortunately, the real world doesn't work that way. Just ask Cathie Wood. Last May she was saying she welcomed Tech stock meltdown. No surprise, she got both her capital and her investment strategy from Bill Hwang the famous hedge fund exploder. However, this week down -50%, she was out complaining that the same markets that bid her unprofitable stocks to record over-valuations have now become "irrational".

They lost that bet because the Fed sat on the sidelines too long and made the policy error of allowing asset inflation to get out of control just long enough to suck in a cohort of people who believed the cycle would never end. Now the Fed is making the opposite policy error of tightening far too fast.

Double policy error.

This week we learned that investors piled into bank stocks at the fastest rate since the election. There's only one problem, the yield curve is now signaling recession.

"I don't think a lot of Fed officials, economists and investors appreciate the fact the economy keeps buckling at lower and lower interest rates"

No, they don't appreciate that fact, because too many people such as Jeff Gundlach were telling everyone that inflation is out of control and would remain so indefinitely.

The Fed's policy panic has now raised MARKET rates in three months the equivalent of what took five years post-2008.

Now you say, who could have seen all of this coming? Anyone. Anyone who has been watching this same movie over and over again during the past decade.

The term "transitory" of course is definitional. However, most people who say inflation is no longer transitory have been fooled into believing that inflation is at a "40 year high". Here we see via commodities that nominal prices are at 1973 levels, which means real prices are much lower. However, the rate of change is at a multi-decade high. It's a huge difference that today's pundits are not capable of understanding. Relative versus absolute inflation. Even the Fed doesn't make the distinction.

What was interesting during Powell's Senate confirmation hearing today was when Sen. Richard Shelby (R-Ala.) said the Fed had lost credibility. He also said that the Fed was facing a Volcker Moment i.e. when Paul Volcker raised the Fed rate to 19%.

Put down the crack pipe and take off the boogie shoes Senator.

So put it all together:

A global pandemic comes along and central banks flood the system with excess liquidity. The supply chain is disrupted and inventories are cleared out. Small business and travel services are shut down so consumers plough all of their excess cash into durable goods, most of which are imported. The port system is gridlocked for months due to backlogs and double ordering. So what happens, "inflation" of almost entirely imported goods.

Then, over three million Boomers leave the labor force for early "retirement", due to mass layoffs caused by the pandemic, and due to the asset bubble:

"Many older workers faced layoffs, and others left the workforce to protect themselves from the risk of infection. It's much harder for workers in their 50s and 60s — or older — to re-enter the workforce after a period of unemployment, due to persistent ageism in corporate America. So it's likely that many of those who left jobs got discouraged and chose to retire instead"

Every HR department specializing in mass layoffs of older employees now says they can't find good young people anymore.

Too fucking bad.

Meanwhile, Tech unicorns flush with 0% funding, "blitzscale" totally unprofitable internet-based ecommerce ventures that all happen to draw upon the same pool of gig workers. Sixty million Americans now have gig side jobs that are in no way accounted for in the monthly jobs report. All of which caused the first wage increase in Jamie Dimon's entire lifetime, and set off rampant inflation hysteria at the first sign of wage inflation in decades:

So the Fed, who promised to keep rates low long enough to boost wages for the working class is now panic reversing that decision at a RECORD pace. And yet the same pundits who say the Fed has lost credibility i.e. the ones who no longer believe in the cycle, NOW believe the Fed is making the right decision the other way. They will now engineer a soft landing.

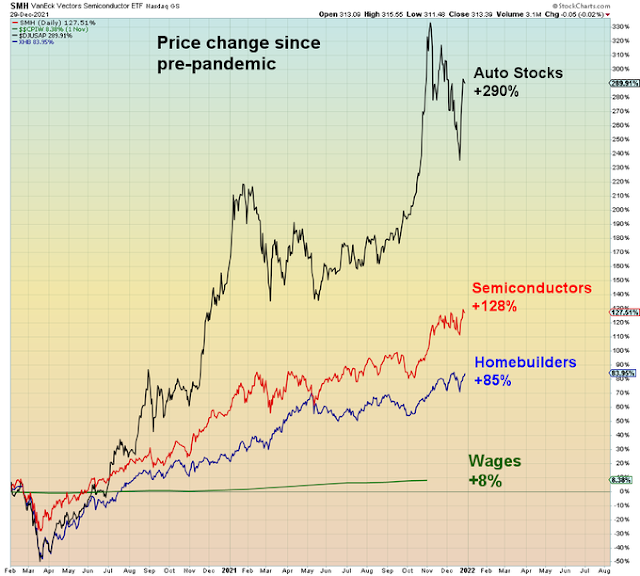

This shows what happens to investors who are in cycle denial:

In summary what is my definition of "transitory?".

My definition of "transitory" is inflation that lasts just long enough to convince a cohort of denialists that the cycle will last forever. And then it explodes unexpectedly.

All over again.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion" - Ludwig Von Mises