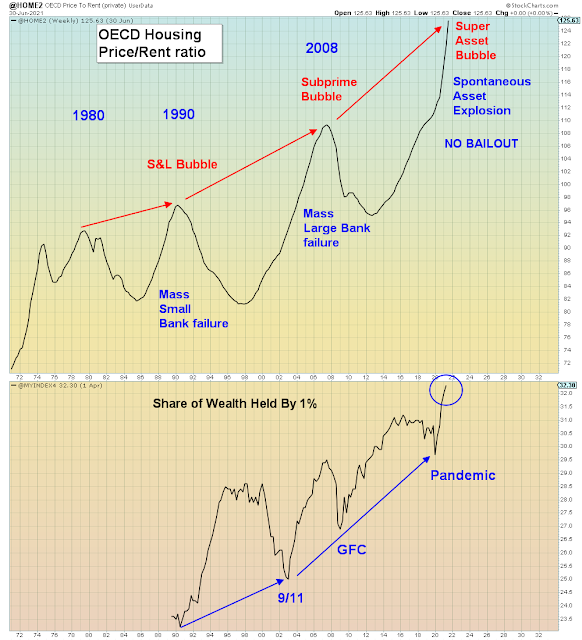

For a society that specializes in finding the easy way out, this is NOT it. One could not imagine a more lethal set-up than this one. Still, to the masses this will be a "Black Swan" event. Why? Because they've been well trained to ignore all risk...

This week, Omnibomb hysteria is imploding the reflation trades while inflation hysteria is simultaneously imploding the Tech/deflation trades. Neither risk poses any real threat to society at large. Each side of the political spectrum can take credit for ramping hysteria to lethal levels - the left on the pandemic and the right on inflation. Both sides politically motivated to stir up their base and serve their own agenda. What they have in common is that they have not even the slightest clue as to the financial consequences of their mass hysteria. Quite the opposite - central banks have given them the illusion that their pandemonium has been extremely lucrative.

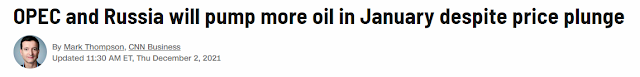

Negative real yields as generated by commodity speculation will be their death trap. Today's policy-makers continue to ignore the relationship between commodity speculation and inflation. As commodities rise they feed back into CPI, driving real yields lower. This in turn accelerates the asset flows to commodities. This asset-driven inflation spiral continues until such time as prices are fully disconnected from fundamentals. Then the bubble bursts and the spiral goes in reverse. OPEC is the latest party to succumb to inflation hysteria, promising to proceed with an output increase in January despite the risk of Omnibomb and the FOMC. Fooled by speculation and the negative yield feedback loop. Oil demand is nowhere near where it was pre-pandemic and oil volatility has exploded as the speculative premium unwinds.

Now, compliments of artificially collapsed real yields, the financial industry has convinced their clients to avoid cash. Yield seeking has reached the same excesses that attended the 2007 top. According to Ray Dalio, cash is "dangerous". Dalio has an unbeaten track record for trashing cash at key market turns. I suggest this will be his last and greatest opportunity. Going into the (second) most deflationary event in history after COVID, this crash will prove that nothing is further from the truth. Central banks can pivot and macro tour guide pundits with no skin in the game can pivot, but masses of investors cannot “pivot”. A hyper-hawkish Fed is not something that is "priced in".

Jan. 23rd 2018: Holding Cash Will Feel Stupid

2018 was the market's first down year since 2009.

Jan. 21, 2020: Cash Is Trash

He said that at Davos when the pandemic was already well underway globally

And this week...

Cash Is Not A Safe Place Right Now

Why is it not safe? Inflation of course...

"You can reduce your risk without reducing your returns"

But that's not all, get 6 free ginsu knives if you call now...

Dalio's hedge fund strategy is based upon "Risk Parity" which is essentially a 60/40 stock bond allocation. What he is saying is basically being repeated by every financial advisor right now - the safest thing to do is to ignore risk and stay fully invested in highly correlated trades.

History will say that the true policy error was ignoring fatal levels of asset inflation and then freaking out at the first sign of price inflation. QE should have been ramped down a long time ago when Market cap / GDP first reached record levels. If it had been, then it's unlikely that tsunamis of retirement capital would STILL be rushing to accelerate history's largest bubble on the belief that it's increasing their likelihood of early retirement. For some reason people don't mind paying massively inflated values for overvalued stocks, but they freak out when the price of eggs goes up 50 cents. Apparently, they're not understanding the impact the former will have on their dining choices for YEARS into the future. If they were, then they wouldn’t be panic buying lost decades worth of return, while being mesmerized by unrealized gains.

Meanwhile we learned this week that insiders are rushing for the exits at a record rate.

The list of widely ignored risks at this juncture are quite extraordinary by any standard. Taking any one on its own would not be so much a problem as taking down all of them at the same time:

Inflation mania/Fed policy error

Debt ceiling/Fiscal Cliff

China/EM Plosion

Asset super bubble/Y2K 2.0

Omnibomb

Consumer sentiment collapse

OPEC output increase

Record margin, inflows, valuations, issuance

Which gets us to the casino...

What's interesting about this week, is that despite the news of the COVID variant AND the news of Powell's new double taper, Emerging Markets outperformed the rest of the world on the week. Why? Because last Black Friday, EMs had a washout bottom having led the world down for several months. Subsequently, they have bounced this week in a three wave correction back-testing the key support line.

Bullish? Not necessarily. Here we see that worldwide Google searches for "BTFD" are the highest since 2018:

Another interesting piece of news this week is that after having been told there is a worldwide chip shortage, it turns out that Apple is seeing weakening demand for the iPhone.

This article asserts that Apple has a problem with supply AND demand. Really? They just told their suppliers to dial back production, so I suggest the market is moving into equilibrium.

"CEO Tim Cook said the company’s last quarterly earnings took an estimated $6 billion hit due to the semiconductor supply shortageIf Bloomberg’s report is accurate, though, it suggests that the iPhone 13 demand might not meet Apple’s initial expectations even without the supply crunch"

The supply problem has been solved.

Tech gamblers will be happy to know that after the morning gap open crash, Apple rallied back all day yesterday and is now three wave corrective from the prior melt-up. All while Nasdaq new lows expanded to the highest level on an up day since March 2020 (I showed that chart on Twitter).

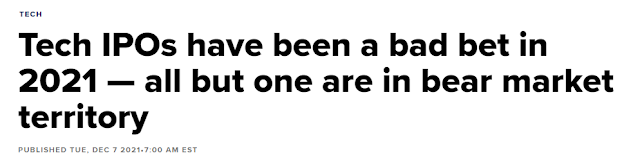

The Nasdaq is heavily oversold and due for a bounce at any time. Nevertheless, the fact that it hasn't been able to rally for any sustained length of time is extremely bearish. The market has been extremely volatile this week, with alternating rallies and crashes. However, the crashes keep growing larger as the market stair steps lower. What it points to is the fact that the alchemy of index manipulation is no longer having an effect on the broader market as breadth disintegrates. Throughout this momentum rally, the various means of manipulation - central bank liquidity, momentum algos, and options manipulation have given investors a false sense of security. Now investors are fat and happy in a casino that is increasingly getting out of control as global risks coalesce to asinine levels in the background.

All of which points to the fact that the only true shortage in this world is in IQ. And that supply shortage is going to be exorbitant.

No sound required. I am not endorsing financial products.