"It is surprising. You can see it to some degree from the markets reaction. I think some people figured if the Fed was going to kill it, they would give it more than 12 days.”

Saturday, March 20, 2021

Margin Call On Bullshit

"It is surprising. You can see it to some degree from the markets reaction. I think some people figured if the Fed was going to kill it, they would give it more than 12 days.”

Friday, March 19, 2021

Financial Weapon Of Millennial Destruction (WMD)

Thursday, March 18, 2021

Hyper Asset Inflation Hyper Asset Crash

Wednesday, March 17, 2021

PEAK SUGAR HIGH

Tuesday, March 16, 2021

Another Wall Street "Recovery"

"Automation, in tandem with the Covid-19 recession, is creating a 'double disruption' scenario for workers," said the report published Wednesday in Switzerland by the World Economic Forum, which warns that inequality is likely to increase unless displaced workers can be retrained to enter new professions."

Monday, March 15, 2021

Stimulated Prosperity

One year later and central banks have succeeded in creating human history's biggest pump and dump scheme. They couldn't have done it without Reddit, Robinhood, and comatose regulators. The over-stimulated losses will be astronomically unaffordable in the worst economy since 1930. All of today's economic predictions are now riding on the biggest bubble in human history...

One year since the steepest depths of the March 2020 crash and what has changed? Gamblers are throwing their third stimulus check into the casino this week in order to bid up their stimulated prosperity:

"During the “hope” period, between March and November, healthcare and technology stocks soared at the expense of financials, airlines and others hit by contracting economies and travel bans. The two sectors now comprise 42% of global equity market capitalisation compared with one-third before the pandemic hit."

On the chart below we see that at the February highs last month, the one year Nasdaq % gain equaled the melt-up in Y2K. As we see, the uptrend line was never broken. The "bear" market of last year doesn't even register on the weekly rate of change (lower pane), that's how fast the rotation from cyclicals to Tech stocks took place.

Now, deja vu of Y2K, markets are reversing out of Tech back into cyclicals. Gamblers are under the firm belief that cyclicals can take over from the Tech/healthcare sectors that now dominate market cap. Unfortunately, the Dow's outperformance into this top is the greatest in history, going back 100 years. Only today's copious fools would believe this will continue, which is why it goes unquestioned.

This is a far deadlier set-up than what occurred in Y2K.

"It is a common saying that smart money is out of market in such formation and market is out of control. In its formation, most of the selling is completed in the early stage by big players and the participation is from general public in the later stage."

"Retail investors are continuing to jump into the market in droves even after the dust has settled from the GameStop trading saga."

How to explain to the grandchildren that a massive pump and dump scheme was the reason traders flocked to the markets at the end of the cycle?

Of the three major rallies in the past five years - two of which already failed, this one is by far the fakest, and least questioned.

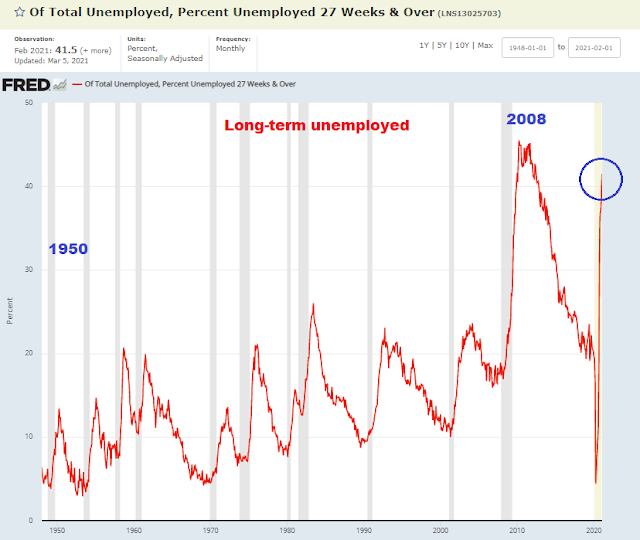

The global Dow has been decade overbought for four months now. Looking at this chart one would have no clue that this is the weakest global economy since the Great Depression. Job losses are four times worse than the 2008 Great Recession.

What all of today's "experts" have forgotten is that monetary policy no longer stimulates the economy, it only stimulates markets. On the fiscal side, the U.S. economic multiplier has collapsed to the point at which a 20% of GDP deficit is only producing 4% GDP growth in 2021. As the third stimulus gets distributed this week, risk markets are once again running on glue fumes. Policy-makers have succeeded in creating the biggest divergence between fantasy and reality in history.

Large even by today's dumbfuck standards.

The top performing sector making new all time highs this week happens to be micro cap stocks - the junkiest stocks in the entire market.

In summary, when the largest financial WMD in human history explodes at the new permanent plateau of delusion, "without warning", the financial dislocation will be epic.

And the sheeple will no longer trust stimulated prosperity and the "experts" telling them to believe in it.

All it took to achieve record complacency was a global pandemic depression, and record printed money, the secret to effortless wealth.