Four years ago, Trump was holding massive rallies in crowded stadiums, now he has been laid low by a virus that most of his acolytes still consider a hoax. His campaign is effectively over. Joe Biden has opened up a 14 point lead on Trump, he just needs to stay alive for four more weeks. No guarantees...

Historians often say that history rhymes it doesn't repeat. In reality, it usually repeats quite closely. Why? Because the emotional fragilities of our species are always predominant. It will NEVER be different. The human race is not a thinking species, it's an emotional species. Far worse yet, the leaders of this species tend to be the most extroverted and least inclined to deep thinking. The populace at large, having the IQ of a dead fly demands facile answers to all questions. Charismatic leaders and their gullible populaces are as lethal now as at any time in our history. Those introverts who are the deepest thinkers are not skilled speakers. They think in terms of facts and data which are not easily distilled into soundbites.

This is an historic moment. A teaching moment. The fragilities of our species are laid bare as we hang between the delusions of the past, and a seemingly non-existent future.

A true leader would be laying out a path right now to a more green and equal future. One in which workers participate in the prosperity of the economy. An economy built around sustainable energy. But instead, we are confronted with short-term solutions and existential fear. Is Nancy Pelosi's job really to dream up bigger and bigger stimulus packages? When will these continuous fire drills ever morph into anything longer term than the next two year election cycle?

Stepping back we can readily view our species from the perspective of a truly intelligent species from another planet, or the Creator herself would see us: Weak, corrupt, venal, lost and leaderless. Ignoring centuries of knowledge, the average human today is far less intelligent now than Socrates was thousands of years ago. This society has packed a human history full of knowledge into a handheld smartphone, bringing unprecedented access to facts and information at the push of a button. So what have we done - outsourced all thinking to the device, freeing up time to play Candy Crush. What else?

How many societies have to rise and fall, before this species takes a good long look in the mirror? Our competitive nature prevents us from seeing ourselves in the truest light, shorn of delusion and fantasy. When I read the missives of a Pat Buchanan or any other hubristic old timer recycling the past, I just shake my head. Blindly arrogant to the very end of their time. Never admitting that their own failed ideas are what have led us to this parlous juncture. This society does not age gracefully. They desire instead to remain cleaved of reality right to the very end. Choosing an ignominious epitaph over one day of contrition. Making it impossible to remember a time when they were anything more than cynical denialists. No thanks. I want to be idealistic to the end. Let young people have their time, as we demanded for ourselves. If they can't handle it, it's not their fault, they had bad parenting. The purpose of parenting is to prepare the next generation to be self-sufficient. Not to be drinking buddies with their kids. A society should not be ordered around the fantastical delusions of people in their last inning of life. Worse yet, people who have proven themselves to be abject failures at leadership. Japan has been down this failed path for decades. Pray we don't waste that much time wandering in the desert of dumbfuck ideas.

While I'm here, I wanted to give my thoughts on what we have learned of Disney markets over the past decade.

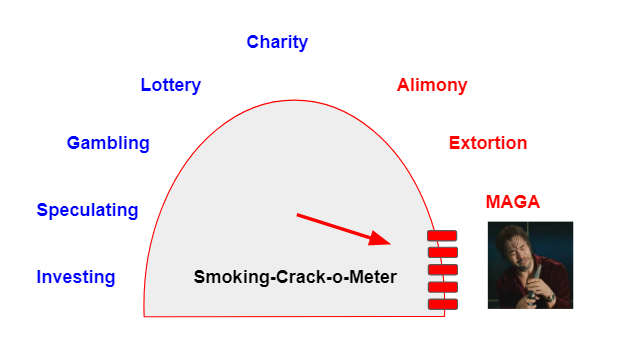

First and foremost they have become more and more fragile. I expect this impending crash to test the faith of the most dedicated gamblers. This past week, the Japanese Nikkei was offline for an entire day for no known reason. As Japan has been for decades, I expect U.S. stocks to be in a volatile sideways range until we get real leadership. Which as we know, will take a while. At some point, I will take some rentals from the long side. Whenever possible, I will use mutual funds instead of ETFs. Mutual funds are always in synch with their underlying net asset value, whereas ETFs can diverge massively at times.

Overall what we have learned, is that you can rent delusion but you can't own it.

"The only thing that looks good right now is the stock market"