As it turns out, the less you know anything, the more you can pretend to know everything. Until it all blows up in your face, totally unexpectedly.

Fortunately as I've said, this gong show is now in the hands of a higher power who only accepts carbon payment. 2020 is the official year of carbon reduction. We can't ask for a lower carbon footprint than the one currently mandated by COVID pandemonium, or we will all be living in caves. Running down the litany of industries that will be permanently affected, airline industry experts are saying that air travel will never return to pre-COVID levels. Same for cruise ships, hotels, theme parks and rental cars. Then there is the entire office real estate market which will be permanently impacted by the new "work from home" mania. This is the first generation that thanks to broadband internet could even contemplate never returning to a full time office. Add in shopping malls, local strip malls, local retail and restaurants and you see why gamblers are crowded into a small handful of mega cap "winners" in this new virtual economy. Virtual being the key word.

"U.S. airlines hammered by the catastrophic loss of passengers during the pandemic are confronting a once-unthinkable scenario: that this crisis will obliterate much of the corporate flying they’ve relied on for decades to prop up profits."

Business travel makes up 60% to 70% of industry sales"

Here is where it gets interesting for Disney markets:

What the Fed already knows and gamblers haven't figured out, is that the FOMC can control asset reflation, but they can't control economic reflation. Which is why they keep pushing for more fiscal stimulus, which they will happily monetize with more bond buying. However, it's a bad time for an existential election which is creating this political impasse:

"Federal Reserve officials don’t like to wade into political debates, which is why it can be a distress signal when they do.

“Trouble is brewing with the expiration of these relief policies,” Chicago Fed President Charles Evans told reporters in early August after temporary federal unemployment benefits lapsed.

A month later, after little congressional progress on a new financial assistance package, Mr. Evans cited partisan politics as a threat to the economy. “A lack of action or an inadequate one presents a very significant downside risk to the economy today,”

Getting back to Trump Casino ahead of the FOMC (Tues., Wed.):

This bounce is a weak three wave contrivance off of the 50 day moving average:

Semiconductors are deja vu of Feb/March, the last time the BTFD team got fooled by a dead cat bounce

Tesla is another very good indicator of social mood, as it was in February:

I've become an expert on Disney markets. Add that to my resume.

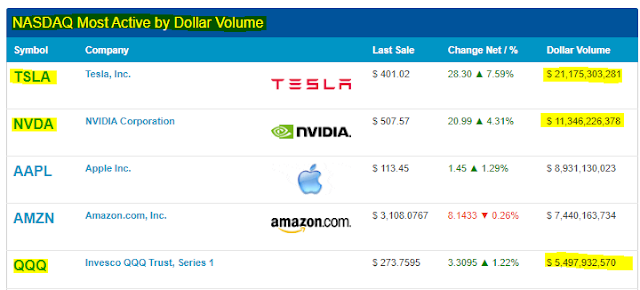

There is literally no hedging taking place anymore, because gamblers have 100% faith in printed money:

FULL Disloclosure: I am long brick shitting volatility (UVXY).

Gamble at your own risk.

This back and forth at a top is reminiscent of Vixplosion