For those who ask why I'm always bearish, it's simply because I'm not a true believer in Disney markets. Watching a generation pin their hopes and dreams on a central bank pump and dump never captured my enthusiasm. When Trump took over management of the Casino, I became quite a bit more skeptical. With his perfect track record for casino implosion, I figured he would be successful in imploding this one as well. Historians will never understand why anyone trusted a well known con man. The GOP will soon be recruiting Bernie Madoff for 2024...

Here we see that each fraudulent rally has been powered by more Trump bullshit and more Fed dopium than the last. Each pump and dump leading to a more vicious and out-of-control crash than the last. It's only a matter of time before they get it right.

This summer marked the pinnacle for manipulating markets to a chasmic divergence with economic reality. What I call Disney markets, in the Hendryite tradition:

"The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks"

What I also call, the Jedi Mind Trick for weak minded dumbfucks.

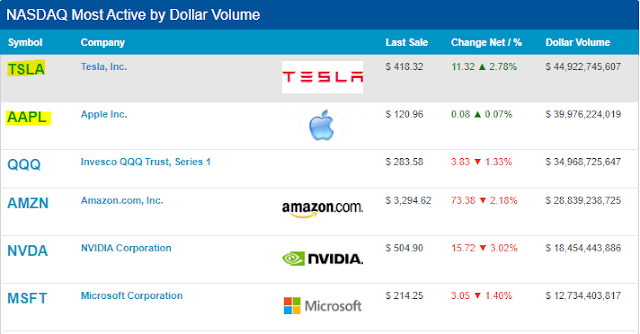

Record central bank liquidity injections, debt-funded tax cuts for the ultra-wealthy, stock buybacks to hide earnings decline and economic collapse - all widely embraced methods of manipulating markets away from the economy. Overnight we learned the identity of the gambling "whale" behind the massive Tech stock pump and dump:

“SoftBank is the ‘Nasdaq whale’ that has bought billions of dollars’ worth of US equity derivatives in a move that stoked the fevered rally in big tech stocks"

"Call option activity in the Nasdaq’s most popular stocks—the FAANG stocks plus Microsoft and Tesla —peaked at about 13 million contracts on Aug 21. That’s up almost 300% from a month ago"

This is all very deja vu of February except on a 10x scale. Recall this Bloomberg article from late February:

February 26th, 2020:

"Members of r/WSB believe they’ve discovered a kind of perpetual motion machine in the interplay of stocks with options contract...A favorite tactic on r/WSB is to swamp the market with call purchases early in the morning in an attempt to force dealers to keep buying stock. Up and up everything goes—supposedly. As the stock price rises, so does the value of the calls, often by far more."

Recall that this past month was the biggest monthly rise for "stocks" in August since 1984. Here we see that the best month in 36 years was vapourized in just two days this week:

Below we see via the S&P 500, similarities to the February COVID crack high. Back then as now, the market peaked on Wednesday and rolled over hard Thursday and Friday. On Monday (Feb. 24th) it surprise gapped below the 50 day moving average, exploded through the 200 day (red line) and short-term bottomed at the end of the week on Friday. The first leg down was -16% and lasted seven trading days.

If the sequence repeats, there will be a gap 'n crap below the 50 day on Tuesday. Followed by massively stained underwear. If my hypothesis is true, I highly doubt this leg down will end at -16%, especially given the fact that trading will begin Tuesday this time. A hard break below the February high (horizontal blue line) will make the August melt-up human history's biggest bull trap. I further predict that all of those still open gaps (green arrows) that are compliments of Fed overdose, will get filled sooner rather than later.

After two days of Tech carnage this week, today's pundits are now calling for a "correction" in stocks. However, as I have pointed out, the Nasdaq is overbought to the point that even a routine tag back to the 200 day moving average would exceed -20%. Which means that today's correction would be synonymous with a bear market. At least on the all-important Nasdaq.

There have been seven touch backs to the 200 dma in the past three years. Only a hyper-denialist would assume that this record overbought market will be the exception.

Notice the two day volume (circled):

Here we see that Momentum Tech blew through the 50 day moving average (blue) today, but then bounced back late in the day to camp at key support. The order of the day was "BTFD".

Making for a good cliffhanger for the long weekend:

Here we see the 1.5x leveraged volatility ETF was rejected at the 200 dma today on massive volume. However, the same pattern was evident in February - when the 200 day was breached all hell broke loose. Volume this time is much higher, however that may be because the competitor ETF (TVIX) was retired.

By no coincidence, the two stocks that had to finish green today did. However, after the close Standard & Poor's announced that Tesla was not added to the index. We will see how that plays out next week, as the stock got clubbed after hours.

There has been massive technical damage beneath the surface of the major indices. Most momentum stocks are now broken. Here we see that breadth and new highs (lower pane) are very similar to the February breakdown:

In summary, according to today's pundits, what we have is a routine correction, aka. a bear market.

However, the inconvenient truth is that the GLOBAL bull market ended in 2018 and this has just been one long topping process.

Each rally powered by more Trump bullshit and more Fed dopium than the last. Each pump and dump leading to a more vicious and out-of-control crash than the last.