His four year unfettered abuse of power has created the largest financial weapon of mass destruction in human history. There is only one event left. Revelation.

Believe it or not I used to be a hardcore conservative. Business school in the 1980s, ideological brainwashing, I bought all of it. I was the Alex P. Keaton of our household, constantly explaining reality to wayward liberals. Which is how I know ALL of the lies and where all of the bodies are buried. Over time I observed that the ideology of unfettered greed was destroying the middle class. A process that went into overdrive with Supply Side Economics and "Free Trade". Actually, Bruce Springsteen figured it out long before I did. For decades, multinational companies have strip-mined the middle class of employment benefits from stable full time jobs, to decent pay, pensions, and now healthcare. During that time, governments worldwide faced a choice to step in and fill the void caused by capitalism's destruction of widespread prosperity. However, in the U.S. that approach was deemed "socialist". Hence any and all attempts to prop up the middle class by government were blocked by the GOP. In other words, not only was the right at the forefront of industrial arbitrage they were also at the forefront of hijacking the Federal government to pay for tax cuts. Specifically the Social Security and Medicare surpluses, which grew during the Boomer peak working years and have now of course turned to deficits during their peak retirement years. What remains of that accumulated surplus is a bunch of worthless "IOUs" from Treasury back to the Social Security plan, as the paycheck deductions were absconded to the Cayman Islands. What any developed country would call theft, but in the U.S. these plundered programs are now called "entitlements".

My disillusionment with the conservative movement took place at the same time as today's aging Boomers were making their generational paradigm shift from left to right which started 52 years ago at the seminal 1968 Democratic National Convention. Many of the Trump geezers of today were Boomer Democrats at that time. These shape shifters have abandoned the idealism of their youth for the cynicism of old age. They are of the belief that they were wrong then and right now. Nothing could be further from the inconvenient truth. They have mistaken the mind-enfeebling effects of Faux News and record hubris, for a cogent view of history. In the process they have fallen under the persuasion of a well known con man and his fantasy Kool-Aid.

History will not be kind.

Compared to the fracas in Chicago 52 years ago, this past week's Democratic Convention was a bizarre dystopian affair. A social distanced mock convention with a Hollywood Squares audience on TV. I am now of the converted view that Kamala Harris would make a far more capable leader than either Biden or Trump. However, the fact that the more cogent and continent leader must take a backseat to two doddering geezers is a sign of our times. This country is STILL not ready for a mixed race woman to be president. Or any type of woman for that matter.

The final implosion of the Banana Republican Party will be due to rampant greed AND what I call the pervasive and enduring GOP double standard. The will and ability to abuse power on a scale that no Democratic president could even possibly imagine. At this latent juncture, while Joe Biden must constantly virtue signal his support for racial diversity, Trump is constantly virtue signaling his overwhelming support for white supremacy. In politics, Trump has done more to destroy U.S. democracy than all former presidents combined. After four years of continuous election rigging consisting of voter suppression, gerrymandering, tax cuts, asinine deficits, and of course Russian assistance, Trump is now trying to implode the U.S. Postal Service ahead of the election to prevent mail-in voting.

Much of what Trump's Twitter chaos creates is a backlash of unintended consequences against his own policies. Specifically, in the area of the environment where Trump's policies have been absolutely hideous. Not willing to wait for another rigged election, concerned investors took matters into their own hands this year via the ESG (Environmental, Social, and Governance) movement, and via direct divestment in fossil fuels. A paradigm shift that fueled the clean energy bubble in 2020 and caused the oil sector to go bidless. In other words, Trump inadvertently created the Tesla bubble, amid the highest daily oil production in U.S. history.

By the way, that super bubble stock is now up 50% in eight trading days. Yes, you read that right:

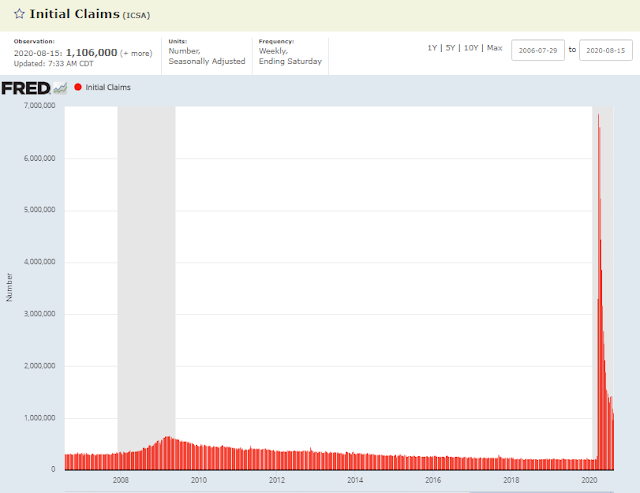

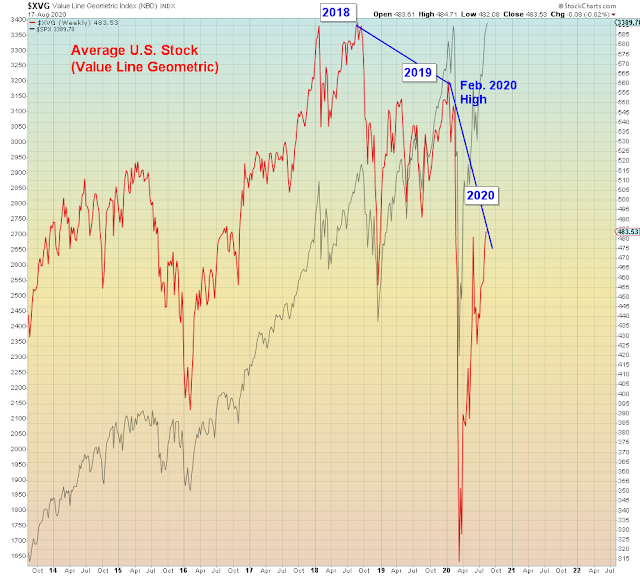

But of course, the far greatest abuses of power and hence unintended consequences are in the area of the economy and Trump's farcical "greatest economy ever". Which history will view as the largest Financial Weapon of Mass Destruction ever created. It was almost four years ago (September 2016) when Trump excoriated the Yellen Fed for creating a big, fat, ugly bubble. But in reality, he found her to be far too Democrat, far too timid, and far too female for the job. So upon being elected, he quickly fired her and installed Jerome Powell, a lifelong Republican alpha male to the job. Over the course of the past four years Trump has continually badgered and cajoled Powell into lowering interest rates. Powell finally capitulated late in 2018 with the S&P down -20%. Then the repo crisis arrived last year due to the financing of Trump's chasmic deficit. When Congress raised the debt ceiling in July 2019, there wasn't enough liquidity in global markets to absorb the avalanche of Treasury issuance. Which led to the overnight "repo" (debt repurchase) liquidity crisis. The Federal Reserve was forced to monetize Trump's deficit leading to the repo bubble which exploded in March of this year.

The U.S. budget was in shambles long before COVID hit:

U.S. Debt, $ change one year:

All of the above is what history will say about this fraudulent era, so now we just need to decide what side of history do we want to be on. And what part of the Trump WMD do we really want to own?

Knowing full well that it's the endgame for the age of criminality and its morally challenged leader.