When policy-makers such as Trump get desperate, they use measures such as promoting stock market bubbles in order to bolster their approval ratings. Trump learned well from the Chinese who first invented the Shanghai Surprise back in 2015, the heyday of Imagined Realities:

"The red satin shorts with gold trim, available for $69.42, feature a Tesla logo on the front left side and have “S3XY” written across the back"

Today, Tesla is trading three times as much dollar volume as the Nasdaq 100 market ETF (QQQ). The last time we saw this was in February just prior to super crash. Good times.

Skew - out of the money option bets on a crash - now back at February COVIDIOT levels:

"The dramatic moves in Chinese stocks over the past week are inviting comparisons with a bubble that burst spectacularly five years ago."

The advance is also being aided by an enthusiastic chorus from the nation’s influential state media. A front-page editorial in the China Securities Journal on Monday said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever. Chinese social media exploded with searches for the term “open a stock account,”

Of course this time around, the bubble in China is minor compared to what is taking place in U.S. Tech. Whenever Chinese markets implode the U.S. implodes at the same time: 2015, 2018 etc. The largest Chinese Tech stocks are all cross-listed on the U.S. Nasdaq:

When the bubble burst in 2015, the PBOC which had sponsored the chimerical bubble, did everything possible to stop it from bursting. Including mega stimulus, trading halts, banning short selling. Nothing worked.

In the litany of things that can and will go wrong, is the fact that Trump is currently mulling over the best way to monkey hammer the Chinese economy:

Getting back to the virtual economy: Today's bulltards are of the belief that more stimulus is imminent and hence today's ludicrous stock market valuations are justified. They are completely ignoring the now toxic level of political acrimony taking place ahead of the election.

The abiding belief among America's casino class is that these millions of jobs lost to date are low wage inconsequential jobs that are irrelevant to the economy and corporate profit. Amid the now chasmic wealth divergence they are of the belief that their well-paid jobs are safe. Unfortunately that is the assumption that is about to get tested. And fail. Corporations have laid off their contractors, and hourly workers and in the next round of layoffs to make the quarter they will be cutting into the salaried ranks.

The existential bet of this era is that the losses will always fall on the same silent middle class while the gains accrue to the same vocal winners.

The existential bet of this era is that the losses will always fall on the same silent middle class while the gains accrue to the same vocal winners.

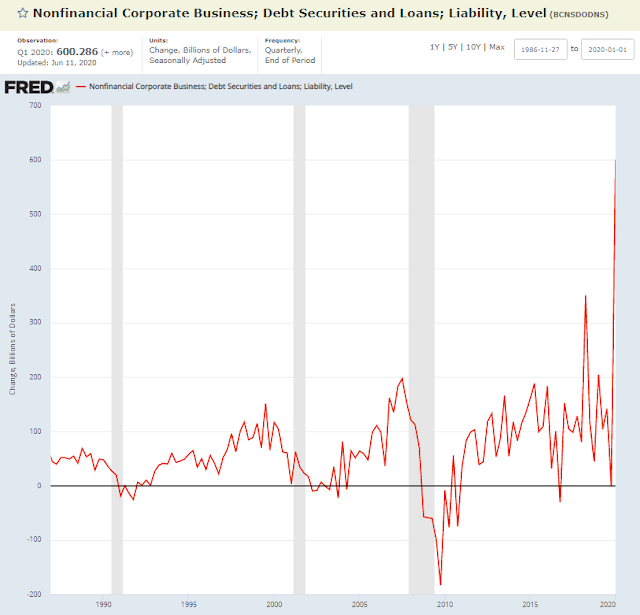

Unfortunately, this impending second mass layoff to meet the quarter will not be accretive to GDP nor multinational corporate revenue. Combined with the fact that the personal savings rate is at an all time high, leaves the economic multiplier collapsing like a cheap tent. Add in widely ignored corporate debt defaults that have only been forestalled by onboarding massive amounts of new debt. A one time trick that will not be repeated.

And of course, the massive new COVID spike is also being ignored by greed-addled "investors".

The holiday weekend saw a new surge to record high daily cases:

What this all adds up to is a third wave down in the S&P 500:

"The red satin shorts with gold trim, available for $69.42, feature a Tesla logo on the front left side and have “S3XY” written across the back"

Today, Tesla is trading three times as much dollar volume as the Nasdaq 100 market ETF (QQQ). The last time we saw this was in February just prior to super crash. Good times.

Skew - out of the money option bets on a crash - now back at February COVIDIOT levels: