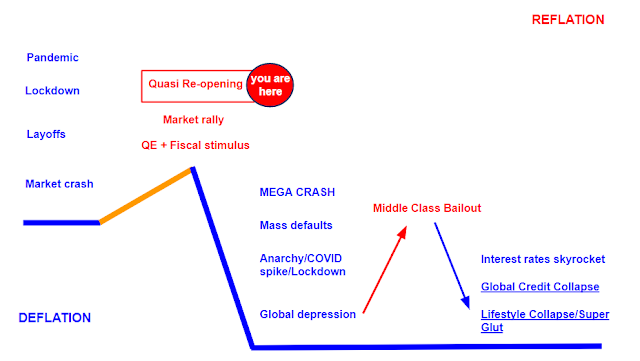

The confluence of risks that attended the Corona top led to the fastest and most violent crash from all time highs. This one will make that one look like a picnic. Having led the market since the 2016 election, The MAGA stocks are finally imploding...

Overnight tonight (Thursday in Hong Kong), the Chinese congress is widely expected to pass the new controversial Hong Kong security bill essentially eliminating Hong Kong's special status from a civil rights perspective. A move that will very likely prompt the U.S. to do the same, from a trade perspective.

Which would be the "nuclear" option:

"The Trump administration is considering imposing the same tariffs on exports from Hong Kong that it puts on goods from mainland China, according to officials with knowledge of the discussions. That could happen soon after the Chinese government approves the national security law on Thursday."

As usual, my view of this situation is not quite the same as the pablum served on U.S. lamestream news. Some of us may recall the 1997 handover of Hong Kong from Britain to China and the tremendous nationalistic pride in Hong Kong emanating from the liberation from Britain. Fast forward 23 years and the British rule is now the good old days. Hong Kong's "special rights" under the China reunification were supposed to last 50 years, however, only an arrogant fool would believe that Beijing would allow the free-wheeling former colony to retain privileged status for that long. It's amazing it lasted as long as it did. In the meantime, half of Vancouver and Sydney real estate was bought up on the prospect that this day was inevitable. At least now all of those empty condos will have someone actually living in them, instead of being safety deposit boxes in the sky.

If the U.S pulls the trigger on revoking Hong Kong's special trading status, it will very likely trigger global meltdown. Why? Because China's currency has been weakening into the event, and once again global gamblers have been partying like it's 1929. Overlay that with the Chinese stock exodus risk hanging like a Damocles Sword over the Nasdaq which could not come at a more lethal time. Picture a global currency crisis and Mega Tech meltdown at the same time. Smash Crash 2015 x 10.

There is no ETF for the mega cap "MAGA" stocks (Microsoft, Amazon, Google, Apple), however this ETF "O'Shares Giants" does a decent job, brought to us by Mr. Wonderful himself.

Here we see the weekly reversal of fortune:

Short-covering in cyclicals is leading this last gasp rally.

Why shorts are covering ahead of this all important overnight event is not for me to say.

Nevertheless, it's a necessary and sufficient condition to trigger meltdown.

China Tech stocks bounced at the same level as in March:

Now that the economy is "re-opened", the staycation stocks are getting pounded. As of now, there is still no Cramer COVID-19 index, so we can use video game stocks as a proxy:

"China’s offshore yuan tested the weakest level on record on speculation the government would be willing to permit a weaker currency in response to fresh punitive measures from the U.S."

The last time we saw this much short-covering was the last time everyone believed the Fed B.S. had saved the day: