An ill-fated strategy culminating in soiled underwear:

As always, we are informed that today's persistently lower bond yields are solely due to the rest of the world imploding. The U.S. now being its own separate planet.

"Move along, nothing to see here"

“America is working and there is a blue-collar boom,” he continued. “This a fundamentally very sound economy.”

History will say that under Forrest Trump, the unquestioning Borg borrowed their way into oblivion while being told the 'Conomy is fantastic.

Debt was the new "GDP".

Getting back to the casino, yesterday (Thursday), the market flash crashed just before noon, in a minor taste of what is about to come. Then the BTFD team rallied the casino back in a three wave correction. However, overnight on Friday (today), the futures opened down and the casino closed near the lows of the day (updated after the close).

Which puts into play my Efficient Implosion Hypothesis regarding options expiration. Also known as, "You know you're an optimist when..."

Here we see semiconductors rolling over again this week deja vu of late January when the casino gapped down on Corona Monday. The blue arrow was Friday. As we see, today's volume is already higher than it was on big Monday (Jan. 27th) gap open day.

This was a classic headfake overthrow, "designed" to show just how much risk these free money addled morons would buy. It turns out, all of it. Recall the news from Tuesday:

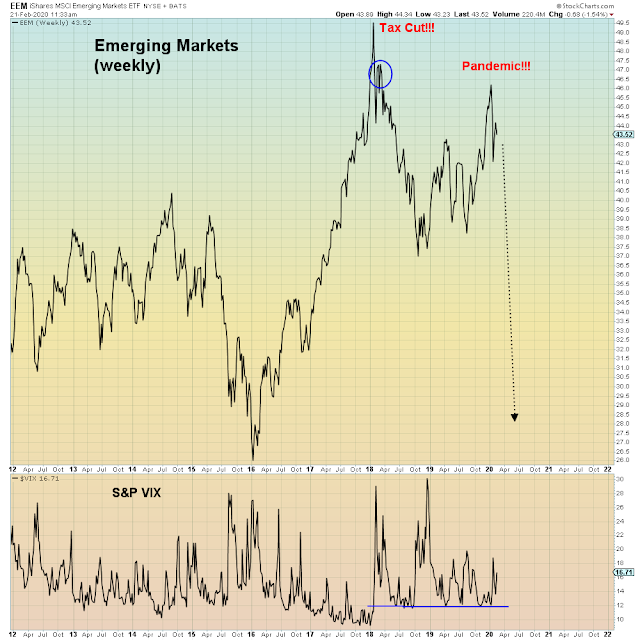

As the dollar rips higher, the Rest of the World (dollar terms) has been warning of what is to come.

A warning that as we see above, Lying Larry and others have assiduously ignored. This is setting up very much like 2015 smash crash.

Except it's not 2015:

To be sure, there have been many market headfakes that have defied the underlying inconvenient truth.

Which is why today's pundits ALWAYS side with the casino over reality. Gamblers misallocate their own capital and then point to rising asset prices as a sign of low risk.

Here we see the carry trade just spiked deja vu of October 2018, just prior to the S&P imploding -20%:

"Risk is low!"

The Australian market (local currency) continues to show the chasmic divergence between fantasy and reality that central banks have now created.

When in doubt, gamblers always choose their own positioning as indication of "truth":

This week, JP Morgan pointed out the fact that there are no more safe havens in the stock market. Traditional safe havens are now the most overvalued sectors.

“Bonds, momentum stocks, and low volatility stocks rallied – pushing the valuation spread between defensive and cyclical stocks to a level 2x worse than during the peak of the late-’90s tech bubble”

JP Morgan obviously can't say sell everything, that would be contrary to their own interest, so they recommend allocation to those stocks that are most highly leveraged to the imploding economy:

"JPMorgan reiterated its call to sell out of defensive assets and rotate into cyclical assets such as value stocks, commodity stocks and emerging markets"

In other words, the stocks that are now going into third wave down, are the new "safe havens". You just can't make this shit up:

"We really like banks here"

Continuing the 2015 analog, we are on the verge of an EM currency crisis, originating in China:

"At TD Ameritrade, million trade days reached 38 in fiscal Q12020 (Sept-December 2019), compared to 23 total million trade days in all of fiscal 2019"

"Retail traders have become manic"

In summary, global volatility has been feeding through to the S&P VIX for several months now, while being assiduously ignored.

Bringing the VIX just inches away from triggering VixPlosion 2.0.

At the same time as everything else goes into wholesale meltdown...