Which is why so few see the Trump Circus ending. It's been that entertaining.

What history will say about this Roman spectacle:

2008 definitively proved that the Anglo-American post-WWII creation known as "Globalization", was a colossal human failure. It failed to raise the standards of living of the developing world, yet it did a fine job of collapsing the developed world middle class. It also put the natural environment at the brink of catastrophe. However the aging populace at large was in no way ready to accept failure. Several years of Japan-style monetary bailouts later, enter Trump and Boris Johnson. The white nationalist saviours with the mandate to rearrange Globalization to suit their own marginalized constituency.

Somehow Trump succeeded in convincing a downtrodden blue collar working class AND the big money Wall Street elite that he was their guy. He was a populist billionaire who lived in New York penthouse apartments and had a penchant for gold faucets. A Caligula of renowned sophistry and deceit, who imploded his own inherited business empire and then reinvented himself as a success on reality TV. On the way to becoming president. Outside is America.

His political strategy was to scapegoat the entire rest of the world for all of America's self-inflicted problems. He was the right man for the job, having a non-existent knowledge of history and world affairs. This gambit would require as little knowledge as possible as to how things really work in the real world. The goal being to explode the "deep state" with all of its ties to the status quo.

Trump's geopolitical mission impossible was to maintain and advance America's interests abroad while at the same time withdrawing American leadership from the world stage back to Twitter.

His number one goal was to defeat Chinese hegemony in Asia by imploding the world's second largest economy and marginal buyer of everything on the planet.

As I write, so far, so good.

In order to maintain control over a majority of the U.S. populace using only a minority of the popular vote, democracy needed to be duly destroyed. By whatever means necessary, and whatever foreign assistance necessary. He had ample Russian assistance in this regard.

Along the way, the Federal Reserve had to be commandeered to political purposes in order to monetize the astronomical pro-cyclical deficit which had cratered liquidity in financial markets.

The net result was human history's largest stimulus-driven asset bubble, using on the order of 10% (GDP) combined fiscal and monetary stimulus annualized.

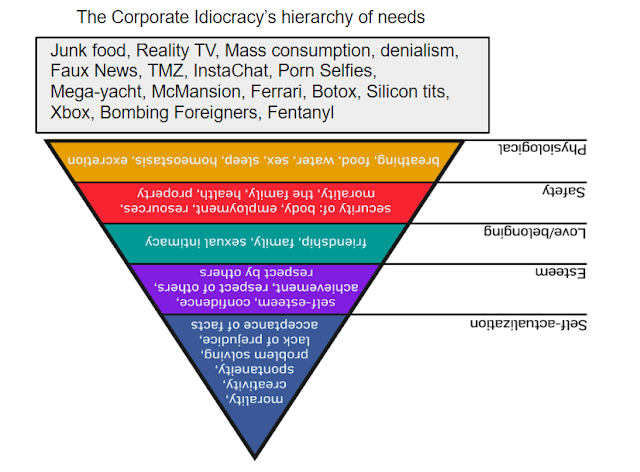

At the end, the populace at large was deep in a stimulus-addled stupor, amid record investor optimism. Wall Street analysts had systematically raised their market projections to keep pace with the melt-up. Economists of the day were as always predicting the future by extrapolating the past.

The crash came out of "nowhere" and was devastating. Global central banks were powerless to stop the meltdown, having squandered their dry powder creating the virtual simulation of prosperity and the mega asset bubble. Deflation was in the extreme. Sovereign debt markets collapsed among the weaker nations. Setting off a 1997-style currency crisis.

Rage was extant, as confidence in globalized capitalism collapsed back down to 2009 lows.

It was as if the entire decade of bailouts had never even happened.

The age of lying was over, and the inconvenient truth was large and in charge.

Hard to believe, I know.