The bull case and the bear case for 2024 are now the same - lower interest rates. Bulls are convinced that low rates are good for stocks - and they are...Unfortunately, the record clearly shows that rate cuts are NOT good for stocks.

It took decades to reach this juncture at which bulls are now praying for a weak economy. The divergence between the economy and stocks began in the early 1980s with the implementation of free trade and mass immigration, but it was kicked off by Fed chair Paul Volcker who famously broke the back of inflation by pushing the economy into a double recession at 10% mass unemployment. Those events set-off a multi-decade deflationary era which has been incredibly beneficial to markets at the expense of middle class labor. Another unhealthy predilection that started in the 1980s was this market addiction to monetary policy which started in 1987 with Alan Greenspan. Over the course of the past three decades, each time the economy weakens, the Fed has arrived with greater and greater monetary bailout policy. Filed under moral hazard biblical scale.

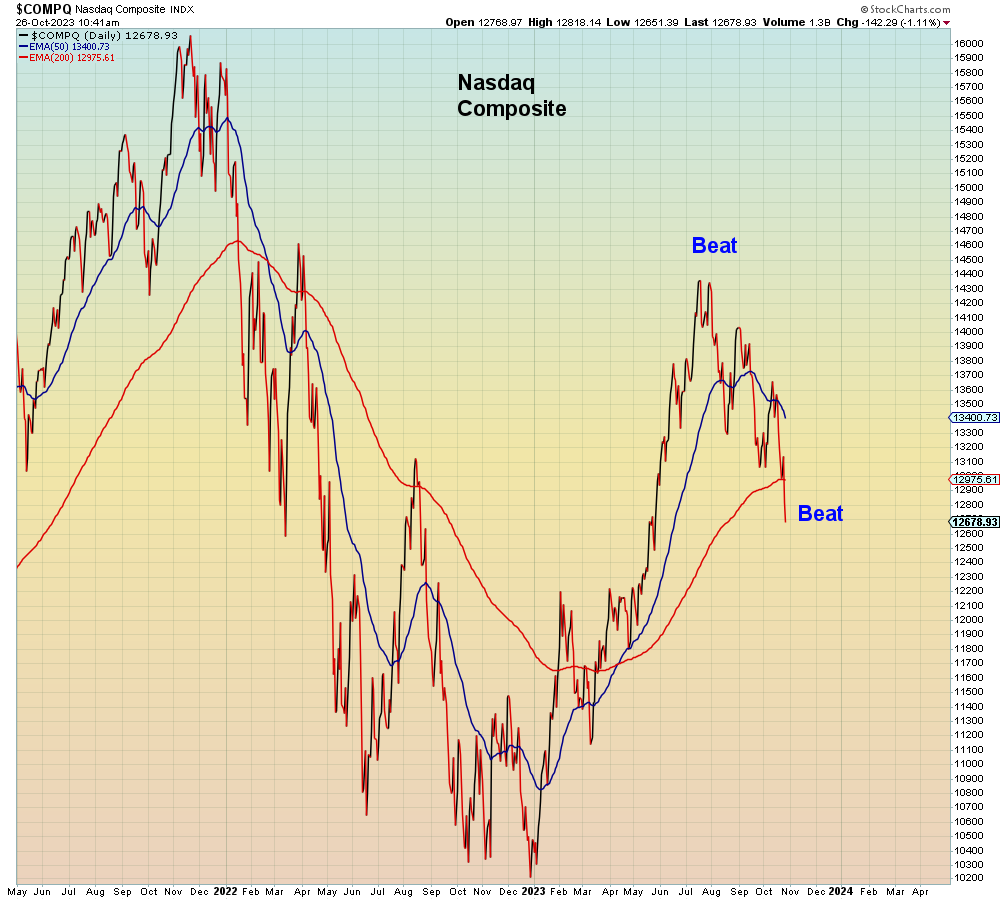

Therefore it can come as no surprise that for 2024 Wall Street expects a recession AND higher stock prices. A brief glance at the chart above will show that none of the most recent recessions led to higher stock prices initially. It took quite a bit of pain first: -50% in 2001, -55% in 2008, -35% in the case of the pandemic.

I didn't read that article, because I'm not interested in data mining ancient history to goal-seek stock bulls' requisite answer. We can see from my own chart above that this type of fool's errand is fraught with peril. Granted, the pandemic bear market was the shortest in history which is why it's an even greater fool's errand to believe that it was anything more than a speed bump in an aging bull market.

On a monthly chart, the pandemic "bear market" barely appears.

We were also informed this week that home prices have surprisingly reached a new all time high despite the Fed rate hikes. I'm sure the Fed was surprised to read that as well. It clearly shows that their rate hikes are not reaching asset markets.

Therefore we are now to believe that the Tech / housing bubble will continue to grow inexorably whether the Fed tightens OR the economy implodes.

Unfortunately for bulls, as I showed on Twitter this past week, delinquencies (adjusted for inflation) have now reached the same level as 2008. Except, the difference is that back then interest rates and home prices had ALREADY peaked and were coming down. Whereas now, neither is coming down yet.

More importantly, we see that delinquencies continued to rise long after home prices began to fall.

In summary, what we are witnessing is the largest policy error in market history. Bought with both hands by complacent bulls at the behest of known con men.

How this was always going to end.