Tuesday, September 13, 2022

GLOBAL LIQUIDITY COLLAPSE

Thursday, September 8, 2022

ENTER LEHMAN WEEK

Wednesday, September 7, 2022

OFFICIALLY, THE WORST CASE SCENARIO

Monday, September 5, 2022

PREPARE FOR SYSTEM TEST

Gamblers are convinced it's different this time.

They're right, it's far worse...

Let's see, newbie gamblers piling into a bear market lured by Reddit-ordered pump and dump schemes. Peak Boomer retirement. Central banks correcting their massive over-easing error by massively over-tightening. Europe's Lehman Moment. China's Lehman Moment. Japan-U.S. largest monetary divergence since 1998. Tech bubble imploding, housing bubble imploding. Record low liquidity.

What's next? System test.

This coming week is all about Europe because Russia finally cut off natural gas supply and stated that it won't be coming back online. The nuclear option.

Back in June, many pundits warned this would catalyze Europe's Lehman Moment:

June 23rd, 2022.

As we see in the bottom pane, in August German economic confidence was already the lowest since 2008, even before this latest gas cutoff. Now consider this chart in the context of an ECB STILL planning to raise interest rates on Thursday.

It's totally ludicrous.

This past weekend, in a very rare warning El-Erian told investors to get the hell out of these "distorted" markets.

"Stock and bond markets appear "distorted," meaning it's high time for investors to tweak their portfolios, according to Mohamed El-Erian... El-Erian's embrace of cash is somewhat contrarian, as historically high inflation is eroding the value of currencies"

Contrarian indeed.

El-Erian's warning is far too little, too late.

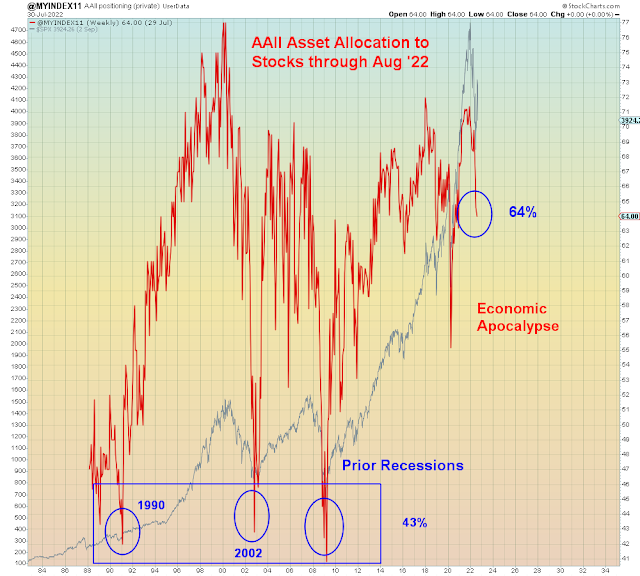

As we see above, the August AAII positioning report indicates that investors are far too over-loaded on stocks going into recession. This is because they believe the inflation hysteria and are convinced "Cash is trash". Which means the impending losses will be exorbitant.

As I showed on Twitter, investors are now in a bind between a Fed intentionally forcing recession and a Fed rate that is currently nowhere near high enough to offset recession. In both 2000 and 2008, the Fed had to cut rates by 5% to forestall depression. However with the CPI far higher today, the Fed has no choice but to keep pushing rates higher. All of which means that the 2000/2008 -50% stock decline is now the best case scenario. It also happens to be the least likely scenario.

The most likely scenario is markets meltdown and a lack of stimulus at the zero bound.

Bailout failure means system failure. First and foremost because it portends extreme volatility and market dislocation. Secondly because it means that people will lose faith in the "system". They have poured their life savings into a dead end Ponzi scheme. As John Hussman constantly points out, at these levels of over-valuation, future returns are deeply negative years into the future. However, that's not how it happens in the real world. What really happens is that losses are "front loaded", after which forward returns become positive again. Once the masses panic out of the casino at the bottom.

"Prepare for an epic finale," Grantham said. "If history repeats, the play will once again be a Tragedy."

Zerohedge: In Order To Hit New Lows Markets Would Have to Do Something They've Never Done Before:

"The S&P has never set a lower low in any of the 13 post-World War II bear markets after recovering 50% of its peak-to-trough decline"

Pre-War World II. The most famous crash in history.

Finally, investors will ask themselves the question ALL pundits should be asking right now - Why are WE different than Japan and China, who are already stuck at the zero bound? And the answer is because we're not.

Friday, September 2, 2022

COUNTDOWN TO MELTDOWN

Tuesday, August 30, 2022

GLOBAL COORDINATED COLLAPSE

Sunday, August 28, 2022

THE BAILOUT TANTRUM

The full cost of sugar coated bullshit is about to be revealed...

Allow me to be the first and last person to inform today's bulls that their final season of Bailout Watch is over.

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

That last line is a nod to the 1970s when the Fed eased too quickly following a tightening regime only to watch inflation surge back even stronger. As I've shown many times, this period is nothing like the 1970s with respect to unionization, employee job security, capacity utilization or bond yields. Oil prices are lower than they were in 2014 and 2008. Therefore this idea that the Fed can keep tightening with impunity until the CPI returns to 2% is lethally delusional with an economy already in recession.

The risks of a global market crash have now risen to record levels. Far from being a "Black Swan" event, a global Minksy Moment is now the most likely scenario. It's what I call a Brown Swan event - what happens when bulls have an "accident" because they don't get bailed out for the first time since 2008. The Fed has never been this far from an easing bias. Featuring double tightening at both ends of the yield curve at the same time.

It's abundantly clear that most people have never heard of or don't understand the concept of moral hazard. Which is why the most widely telegraphed hawkish pivot in history came as a shock to markets. A warning to bullish investors that the market is no longer discounting any form of reality. The only thing that was priced into markets up until Friday is bailout fantasy.

The conference kicked off on Thursday and the conference host Esther George gave an interview to Bloomberg prior to Powell's speech. She indicated she had already previewed Powell's speech but she couldn't comment on it. But she believed that rates would have to be raised north of 4% and remain there for an extended period of time. Only a hyper fool would believe she would contradict her boss in the 12 hours prior to his seminal speech. Right up until Powell's speech, Wall Street had been assuring investors that Powell would not be overly hawkish.

Zerohedge:

Goldman's Biggest Bear Expects Powell To Be Dovish

Goldman Sachs doesn't have any bears. That's not how the model works. Giving investors false hope is the Wall Street business model. The stock market is now badly lagging the economy. Over on Marketwatch, Mark Hulbert asserts that the fundamentals of the market have improved since the beginning of the year. Which is a load of crap. What he means is that the price / earnings multiple has improved IF we assume that today's earnings projections can be relied upon. Unfortunately, at the end of the cycle, Wall Street earnings extrapolations have the veracity of a Magic 8 ball. What most people call "fundamentals" is merely a guess at where things will stand a year from now based upon where they are today. That type of "prediction" doesn't make the turn. The game Hulbert and company are playing works great through most of the cycle and then fails catastrophically when it causes the most pain to investors.

Taking 4% as a likely end target for the Fed Funds rate, means that the Fed is about halfway done tightening. Hence, bulls made a very bad miscalculation when they bid the market following BOTH the June and July rate hikes.

What I call premature misallocation.

What comes next I call "System test". It's what happens when a generation of new gamblers discovers the sell order for the first time.

Those who tell themselves that the "smart money" this time around are the ones who trusted Wall Street, will soon realize they are the dumb money.

In summary, what was widely viewed over the summer as the last chance to buy, was very likely the last chance to sell. The exact opposite. So far, the Nasdaq has declined -30% in 2022. So about half way to a bullish Fed "pivot".