Wednesday, April 21, 2021

Nothing Matters Until It Explodes Spectacularly

Tuesday, April 20, 2021

Pigs To The Slaughter

In what can only be described as human history's biggest mass con job, central banks have systematically desensitized gamblers to all risk. They are now cycle high fat, dumb, and happy. I call it monetary euthanasia...

Compliments of central bank alchemy, the shortest bear market in history yielded the best one year market gain to an all time high in market history. In addition, inflation expectations are the highest since the end of the last cycle, retail investor speculation is cycle high, and now we learn that the market is two decade overbought.

All late cycle indicators peaking at "the beginning of a new cycle".

One of the indicators I haven't shown recently, shows the ratio of mid cap stocks to the large cap Dow. What we see is that mid caps peak relatively early, they underperform for a while and then they burst higher at the end of the cycle due to short covering. In addition, commodity stocks (second pane) outperform at the end of the cycle and of course inflation expectations are highest at the end of the cycle:

This fraudulent recovery which is based solely upon asset inflation has seen some ludicrous moves in asset prices. However, few sectors are as insane as the retail sector which was blighted by the pandemic. And yet, it's the top performing sector over the past year. This entire sector has been "Gamestopped" higher amid record store closures.

Which has fulfilled the circular mirage of "recovery" based upon capital misallocation.

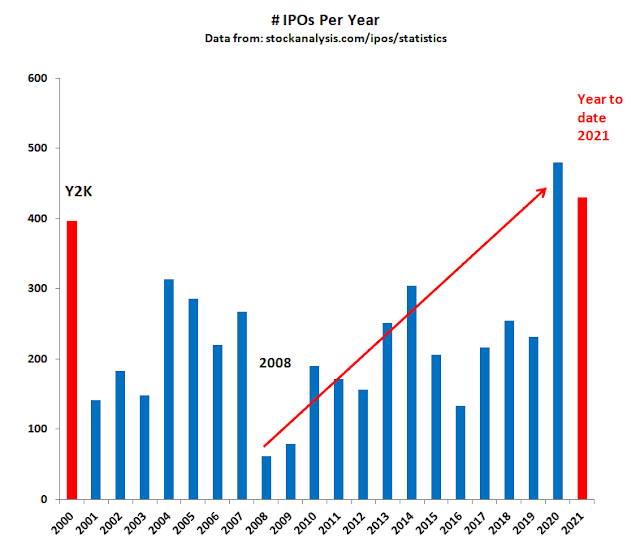

Another thing you don't see at the beginning of a cycle is cycle high IPO/SPAC issuance:

Herein lies the problem:

Over the course of this 12 year continuous monetary bailout cycle, investors have become more and more complacent. I use a ratio of NYSE down volume over up volume to show the degree of panic selling.

Back in 2008 when it was the end of the cycle, panic selling peaked. Subsequently, we have seen lower peaks over the course of the cycle. We are to believe that the lowest level of selling in the entire cycle marks the beginning of a new cycle.

Sure.

What we are about to witness is 12 years of pent up selling, which will make 2008 look like a picnic.

And then everyone will know what we know. It's the end of the cycle.

And this is no time for bullshit from the same proven assholes who lied last time.

Monday, April 19, 2021

This Orgy Of Excess. Is Leveraged To DogeCoin

We still don't know why the cryptos crashed. It could be that the last fool was found. Like Gamestop, cryptos are uniquely suited to the Congressionally approved Ponzi investment strategies hatched on Reddit...

The intended design behind Bitcoin and other cryptos is to create scarcity. As price moves higher, the amount of supply becomes increasingly constrained by the mining algorithms, difficulty level, and available hashrate/computing power. Therefore, liquidity becomes constrained as well. These were precisely the conditions that attended the massive Gamestop short squeeze. However, the scarcity factor for Gamestop came from the fact that hedge funds had borrowed the shares and were forced to buy them back. Low liquidity is a critical requirement for parabolic price moves, but unfortunately it cuts both ways. Which is why Bitcoin is known for its two way volatility. It will never be a stable currency. It's a speculative toy. The rest of the cryptos are even worse. There are now over 6700 cryptos and they are proliferating like rabbits. The fact that they are all 100% correlated should serve as a warning sign to speculators.

New "flash loans" are allowing crypto speculators to use cryptos as collateral to buy other cryptos. In the same way that 2007 era subprime CDOs were built upon other subprime CDOs creating instantly exploding CDO "squared", which had the shelf life of a rotten banana.

We now have a similar thing in Crypto Ponzi schemes:

“In a way, flash loans make everyone a whale” said Nikola Jankovic, community manager at flash loan provider DeFi Saver, referring to the crypto industry nickname for large investors who are often able to move markets by themselves."

Leveraged cryptos are the ultimate form of speculation. It's the crack cocaine of gambling, so it should come as no surprise that the crypto bubble is one of the last and largest speculative bubbles to burst.

Ponzi King Mike Novogratz warned last week that we are seeing a blow-off top in crypto speculation:

"I've seen a lot of weird coins like dogecoin and even XRP have huge retail spikes, which means there's a lot of frenzy right now."

"In the next week, certainly we could have some volatility because of the excitement around Coinbase."

Indeed, we have already started to see some volatility. I showed this chart below on my Twitter feed which overlays the Google trends search term "Crypto", onto a graph of the Global Dow. As we see, they peaked simultaneously in 2018. This time, crypto searches peaked back in February with the Nasdaq and is having a double top now with the Global Dow. We also see that margin debt peaked in early 2018 when the crypto bubble exploded. This time however, a "washout" in crypto could have carry-over effects into mainstream financial markets. Why? Because now, BitCon has gone mainstream and is the "most crowded" hedge fund trade of 2021. In addition, Robinhood now allows stock gamblers to buy cryptos on their platform.

It's the equivalent to linking the U.S. banking system to the subprime housing market in a speculative housing mania. It's a bad idea, considering there is now record margin debt AND crypto is a $2 trillion market cap - almost three times larger than in 2018. It's a disaster wanting to happen.

The way I see it, the same way Gamestop fueled a manic reach for risk that exploded in February, the Coinbase IPO fueled a manic reach for risk that is peaking now.

The question on the table is if a $20 billion pump and dump scheme almost crashed the market, what does that portend for a $2 trillion pump and dump scheme that is 100x larger?

Feb. 17th, 2021:

April 17th, 2021:

“It’s reminiscent of GameStop”

Indeed.

Sunday, April 18, 2021

Buy And Explode

Saturday, April 17, 2021

Chain Reaction

Friday, April 16, 2021

Rigged To Explode

This cycle will end the exact same way it started, with broke Millennials protesting Wall Street corruption. This time however, there will be no rich assholes laughing at them, because their last bailout is in the rear view mirror...

As the market approached the February high I said there were more red flags than a Chinese parade. Since the Nasdaq crashed and burned and was resurrected, the red flag parade has become far larger:

The market is now a giant casino. Everyone is now playing against everyone else. It's clear that today's gamblers enjoy looking around the Blackjack table at all the people they hope to plunder in a zero sum game. Today CNBC and Marketwatch were lauding a crypto called "Dogecoin". It was started as a joke on the crypto market, but then it garnered the attention of billionaires Mark Cuban and Elon Musk so now it has zoomed from four cents to forty cents over the past few weeks "minting overnight millionaires". What they forgot to mention is that these millionaires are benefiting at the expense of those coming in at the end of the pump and dump. The many are minting the wealth of the few. Sound familiar? It's the S&P 500 in crypto form. Somehow a forty cent pump and dump scheme is now front page news.

As I pointed out yesterday, the Nasdaq has now round tripped back to the February opex high. Both stimulus rallies lasted the same amount of time - six weeks. The Nasdaq has now filled all of the open gaps from its breakdown in February. Now all of the open gaps are below the market and the options manipulation "stimulus" is set to expire.

Revisiting the red flags that were evident in February, we notice that risks have only grown exponentially in the meantime.

First of all, the SPAC bubble (not shown) with respect to listings has doubled in magnitude over the past two months, even though many deals are now failing and many SPACs are trading below net asset value.

Next, from a positioning standpoint, the Rydex ratio peaked in February and it's making an even higher peak this month:

Active Managers were extremely bullish in February, then they got extremely bearish and now they've round-tripped back to la la land. In addition to gamblers going ALL IN at the end of the cycle, this robo rally has been fueled by bears capitulating en masse:

The crypto market was at $1.4 trillion in market cap in February and now it's at over $2 trillion. So that Ponzi scheme grew much larger. As a measure of social mood we can see that Dogecoin fever peaked in February as well, however that % gain was TWICE as large as this recent rally:

Those are the similarities to February - all indicating that risks have grown in the meantime. Here are the major differences:

First off, most Tech stonks did not join this latest round trip to all time highs on the Nasdaq. Here we see the ultra popular Ark ETF is obeying the opex rollover signal:

Unlike the Nasdaq, the NYSE keeps making new highs, but it too is highly manipulated by the monthly options cycle. New lows keep expanding with every passing opex and are correlated to Nasdaq new lows:

Here we see options expiration relative to the S&P 500. As we see, new lows on the NYSE and Nasdaq are becoming more sensitive to declines in the S&P 500:

Wednesday, April 14, 2021

The Madoff Moment

Systemic risk is record high right now because gamblers have been assured it's low, so they were given free money to leverage up to infinity in a "risk free" market. Bueller?

"Leverage is the use of debt (borrowed capital) in order to undertake an investment or project. The result is to multiply the potential returns from a project. At the same time, leverage will also multiply the potential downside risk in case the investment does not pan out"

Way back in 2008 as the banking dominoes fell one by one, corrupt policy-makers jailed Bernie Madoff for his collapsing Ponzi scheme at the exact same time as they were bailing out Wall Street for imploding the global financial system. It was a reward for corruption that would spawn an ensuing decade+ of ever-increasing decadence that will cost today's true believers in criminality far more than they can afford...

We got news today that Madoff died after serving time in jail for a crime that is now commonplace in today's markets. By today's standards, Madoff was a pioneer in Ponzi markets. A man before his time.

Step back and realize that it's no one's job to predict when it's the end of the cycle. Economists are always wrong in real-time which is why they always back date recessions after the fact. They are always driving the car forward by looking in the rear view mirror of stale data. When they finally realize the economy is off a cliff, it's far too late. Wall Street is even worse. Money managers don't get paid to sit in cash. They are not paid to time the market, so they don't. Which means they will never reach a consensus to sell everything. Or anything for that matter. That's the "buy side". The sell side of course is far worse, since they get paid to sell stonks and bonds to their clients. So their research is riddled with conflict of interest. Therefore what do all of these "experts" do? They ALWAYS assume we are in an expansion and a bull market. Because most of the time they will be right, and if they happen to be wrong, they will all claim that it was a Black Swan event. Nassim Taleb's theory of Black Swan events has been used to exonerate Wall Street from rampant malfeasance time and again. All of which means that home gamers are blissfully clueless. They eagerly believe the eternally bullish forecasts they are fed, because don't want to believe anything else.

What this means is that anyone who wants to REALLY know what is going on in the economy has to do their own research and form their own viewpoint, based upon logic, facts, and history.

The lies that have piled up since 2008 have become ever larger and more ludicrous. Each resulting crash has been more sudden and brutal than the last. The epicenter of today's big lie is very similar to the one perpetrated in late 2008. A fake recovery attended by a failed bailout. As the financial dominoes fell in late 2007 and early 2008, policy-makers remained optimistic that the financial crisis was under control. Even after Lehman declared bankruptcy (Sept. 15th 2008), policy-makers, banksters, and investors were optimistic that the risk was contained. The massive monetary and fiscal bailout had worked and therefore the dreaded end-of-cycle de-leveraging was avoided. Except the bailout hadn't worked, because there had been no real de-leveraging in the mortgage market, in the corporate debt market, and of course in the stock market.

Sound familiar?

Fed Chief Jay Powell was on Sixty Minutes Sunday Night:

SCOTT PELLEY: "The chances of a systemic breakdown like in 2008 are what today?"

JEROME POWELL: "The chances that we would have a breakdown that looked anything like that where you had banks making terrible loans and investment decisions -- and having low levels of liquidity and weak capital positions, and thus needed a government bailout, the chances of that are very, very low. Very low."

There are many extreme risks being ignored right now. I posted them on my Twitter feed this week, here they are again.

However, suffice to say that by assuring investors there are no risks and then by inoculating them from losses and providing infinite leverage, the Fed itself is by far the biggest risk.

"We’ve had many more inquiries over the past year than we would normally about people wanting to utilize their assets to get transactions"

In a bull market, share pledging can make the bets more lucrative...But the risks are also doubling when the market turns volatile"

Fortunately, central banks have dampened volatility and given everyone a false sense of low risk.

On the topic of fraudulent recovery, yesterday we got consumer inflation data and based upon the headlines one would assume the U.S. is becoming Zimbabwe. This latest "surge" in inflation leaves the CPI 4% lower than it was in 2008 right before the Lehman crash.

Somehow serial inflation fearmongers have never once been right, but they still assume they know what they're doing. As always, arrogance and ignorance are a bad combination.

What we notice is that even though the CPI is 4% lower than it was in 2008, the concern over inflation via Google Trends (lower pane) is higher today. This is what happens when you impoverish the middle class, even small price increases seem like a big deal. Wages and prices can go lower but they can never go higher.

Today I had a major epiphany that the Nasdaq and momentum stocks are now 100% driven by the monthly options expiration cycle. Which explains why these tops keep occurring four weeks apart.

The massive call option buying by the Reddit gang is literally pushing the market higher into opex week. And then the "gamma" lift runs out of gas and then reverses creating a gamma crash. Gamma is the variable hedging factor that market makers use to hedge their call option (delta) exposure arising from selling call options. As these options head towards expiration, the amount of stock that market makers must hold to offset their short call position declines with option decay, so they sell. Essentially option gamblers are renting capital to manipulate the market. All of this Reddit-driven market manipulation is of course widely accepted and widely ignored.

What happens at 'c' is TBD.

This week combined crypto market cap surpassed $2 trillion up from $1 trillion at the start of the year. Up 1,000% year over year.

There are thousands of cryptos now and they are all predicated upon the greater fool theory.

Looking back on this era, historians will say that ironically the week Bernie Madoff died, is the week that Ponzi schemes became widely accepted.

According to the New York Times:

"Digital currency, once mocked as a tool for criminals and reckless speculators, is sliding into the mainstream"

Traditional banks are helping investors put their money into cryptocurrency funds"

On Wednesday, digital or cryptocurrencies took their biggest step yet toward wider acceptance when Coinbase, a start-up that allows people to buy and sell cryptocurrencies, went public"

Got that? A late cycle tool for criminals and speculators is sliding into the mainstream facilitated by the very first criminals who were legitimized in this cycle.

You can't make this shit up.