Thursday, November 23, 2023

BLACK FRIDAY

Friday, November 17, 2023

END OF YEAR: END OF CYCLE

The market is peaking too soon this year for an end of year rally. It's now overbought and investors are ALL IN. Therefore, the bull case is now based upon presumed recession...

This week's "weaker than expected" CPI added fuel to the burgeoning end of year rally. Somehow a core CPI of 4% - twice the Fed's target average - has given investors the belief that Fed rate cuts are imminent. Of course, that delusion was aided and abetted by copious pundits who have no skin in the game other than to placate desperate bulls. As the article above states, the only way the Fed will cut rates is in a recession. Under a recession scenario, stocks are now massively overvalued compared to Treasury bonds. Recall that the mantra of bulls since rate hikes began is that inflation is good for stocks and bad for bonds, because earnings can grow faster than inflation. In a deflationary environment, that mantra reverses as earnings collapse.

Just on time: Walmart's CEO warned this week that deflation is now imminent due to the weakening consumer:

"Prices have fallen, especially on general merchandise and on some key grocery items"

"Yet the discounter struck a cautious tone, saying customers continue to watch their spending"

Lower prices AND cautious spending, that's a precursor to recession.

I would suggest that deflation has already arrived for Walmart's stock which made a new high earlier this month and has now collapsed. Note that this WMT implosion is occurring exactly where I marked wave 'iii' down on the S&P 500. And where wave 'iii' down occurred in 2022.

In another sign of deflation, oil is collapsing, which comes as a total shock to every oil analyst on Wall Street.

Far worse yet for bulls is the fact that Tech stocks are now completing the fifth wave blow-off top that started in the fourth quarter of LAST year. As we see below, the pandemic was the steepest part of the Tech rally, leading to the wave '3' top. Then a pullback to the 200 wma, and now the final rally.

And yet bulls honestly believe that this is the beginning of a new end of year rally driven by imaginary Fed rate cuts.

They are fantastically delusional.

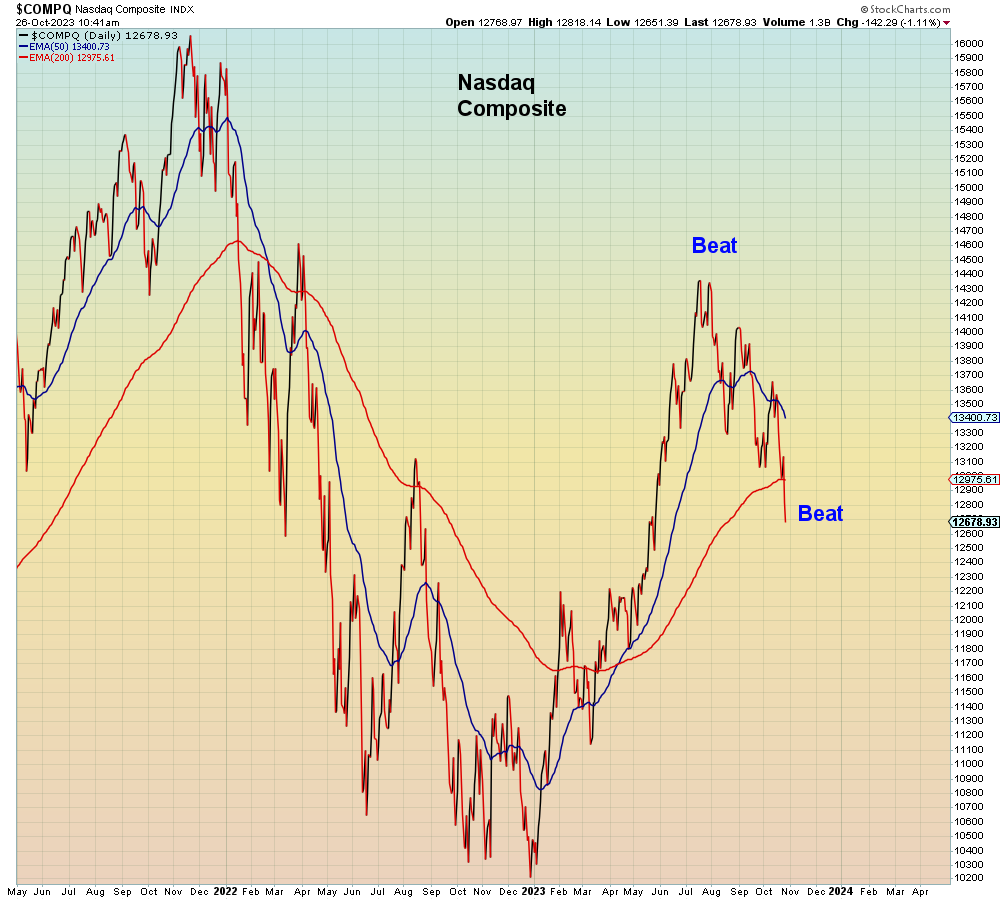

Zooming in on a tighter timeframe, we see that Nasdaq new highs are deja vu of the November 2021 top. In the case of the Nasdaq however, that index along with the broader market was not able to confirm the new Tech top. Which should have been another warning sign to bulls. Note also that this year the broader market peaked in July versus November.

The Tech high which is unconfirmed by the entire rest of the market is why this is the weakest rally in terms of breadth of the past year. Note that the average stock has not even made it back to the 200 dma while the Tech ratio goes parabolic:

In summary, the market is now overbought, but this time Tech can't save the market from imploding as it did earlier this year during the bank run. Which means bulls are now facing bank run and Tech collapse at the end of the year.

And the end of the cycle.

Just like last time.

Friday, November 10, 2023

FRONT-RUNNING EXPLOSION

It's that time again when bullish investors are tripping over each other to onboard risk ahead of year-end. All signs indicate bulls may have peaked too soon. Again...

Below we see the S&P 500 volume oscillator. While there have been many bear market rallies from this level of oversold, there were no long-term buying opportunities at this current level. In addition, we see that this indicator is now three wave corrective.

Compare this current set-up to the one last year.

On the monetary policy side this week, several Fed members including Powell were yet again forced to inform markets that inflation is not yet under control. This repeating cycle of markets front-running Fed easing followed by a tighter Fed has been repeating for over a year now.

Nevertheless, it's that time of the year when the "seasonals" are positive which means that fund managers are aggressively putting money to work. In addition retail investors have also aggressively switched from bearish to bullish. Notice the pattern below (AAII) of u-turn positioning is deja vu of the all time high in November 2021. Also, crypto Ponzi schemes have been leading the market lately as proof that risk appetite is fully lubricated. Nevertheless, we are informed that crypto Ponzi schemes are a "safe haven" from global markets, just not a safe haven from rampant criminality. It's totally fitting that in the week after Sam Bankman was indicted for massive fraud, that this society is now embracing a level of general market fraud that will make his pissant FTX seem like chump change. Deja vu of Bernie Madoff circa 2008, all eyes are on the small scam artist while the big guys are getting away with deception on a biblical scale. It's like the scene in Airplane! where the old lady is getting the shakedown from security, while armed mercenaries are walking through with machine guns.

One article I read this week couldn't understand how Bankman's upstanding Stanford Professor parents allowed him to commit such fraud. It's easy - we live in a morally dead society. Case closed. No ads to sell.

On the topic of flirting with disaster, global carry traders are now ALL IN the $USD/Yen carry trade despite the fact that the BOJ is removing all easing and the Fed is trying to pause.

This chasmic central bank policy divergence that grew larger and larger for the past two years is now closing, and it's the biggest risk that no one is discussing.

Notice the difference (lower pane) with the $USDJPY now versus during prior Fed pivots:

Another colossal risk being ignored is the total collapse in market breadth. Today, Microsoft made a new all time high which was unconfirmed not only by the Nasdaq 100, but also unconfirmed by every other mega cap Tech stock.

Which is why the Tech/equal weight ratio is now vertical.

And then there's this impending government shutdown which perfectly sets the table for a totally non-functioning government in the depths of winter meltdown. The last Speaker (McCarthy) was shit canned for making a deal to keep the government open, so we are told the new Speaker who is even more conservative will make another deal with Democrats?

Putting it together gives the worst end of year risk profile since 2018. Which was the last time markets imploded at year end.

Bought with both hands.

Sunday, November 5, 2023

2023: REVISITING REALITY

Thursday, November 2, 2023

FOMC: FEAR OF MISSING CRASH

"There are four forces working against Apple in the December quarter: An unfavorable comparison, a strong dollar, iPhone supply issues, and a cautious consumer"

Thursday, October 26, 2023

THIS IS CRASH

"Circuit breakers were installed after the October 1987 crash, making a 20% decline "almost impossible"