The market is peaking too soon this year for an end of year rally. It's now overbought and investors are ALL IN. Therefore, the bull case is now based upon presumed recession...

This week's "weaker than expected" CPI added fuel to the burgeoning end of year rally. Somehow a core CPI of 4% - twice the Fed's target average - has given investors the belief that Fed rate cuts are imminent. Of course, that delusion was aided and abetted by copious pundits who have no skin in the game other than to placate desperate bulls. As the article above states, the only way the Fed will cut rates is in a recession. Under a recession scenario, stocks are now massively overvalued compared to Treasury bonds. Recall that the mantra of bulls since rate hikes began is that inflation is good for stocks and bad for bonds, because earnings can grow faster than inflation. In a deflationary environment, that mantra reverses as earnings collapse.

Just on time: Walmart's CEO warned this week that deflation is now imminent due to the weakening consumer:

"Prices have fallen, especially on general merchandise and on some key grocery items"

"Yet the discounter struck a cautious tone, saying customers continue to watch their spending"

Lower prices AND cautious spending, that's a precursor to recession.

I would suggest that deflation has already arrived for Walmart's stock which made a new high earlier this month and has now collapsed. Note that this WMT implosion is occurring exactly where I marked wave 'iii' down on the S&P 500. And where wave 'iii' down occurred in 2022.

In another sign of deflation, oil is collapsing, which comes as a total shock to every oil analyst on Wall Street.

Far worse yet for bulls is the fact that Tech stocks are now completing the fifth wave blow-off top that started in the fourth quarter of LAST year. As we see below, the pandemic was the steepest part of the Tech rally, leading to the wave '3' top. Then a pullback to the 200 wma, and now the final rally.

And yet bulls honestly believe that this is the beginning of a new end of year rally driven by imaginary Fed rate cuts.

They are fantastically delusional.

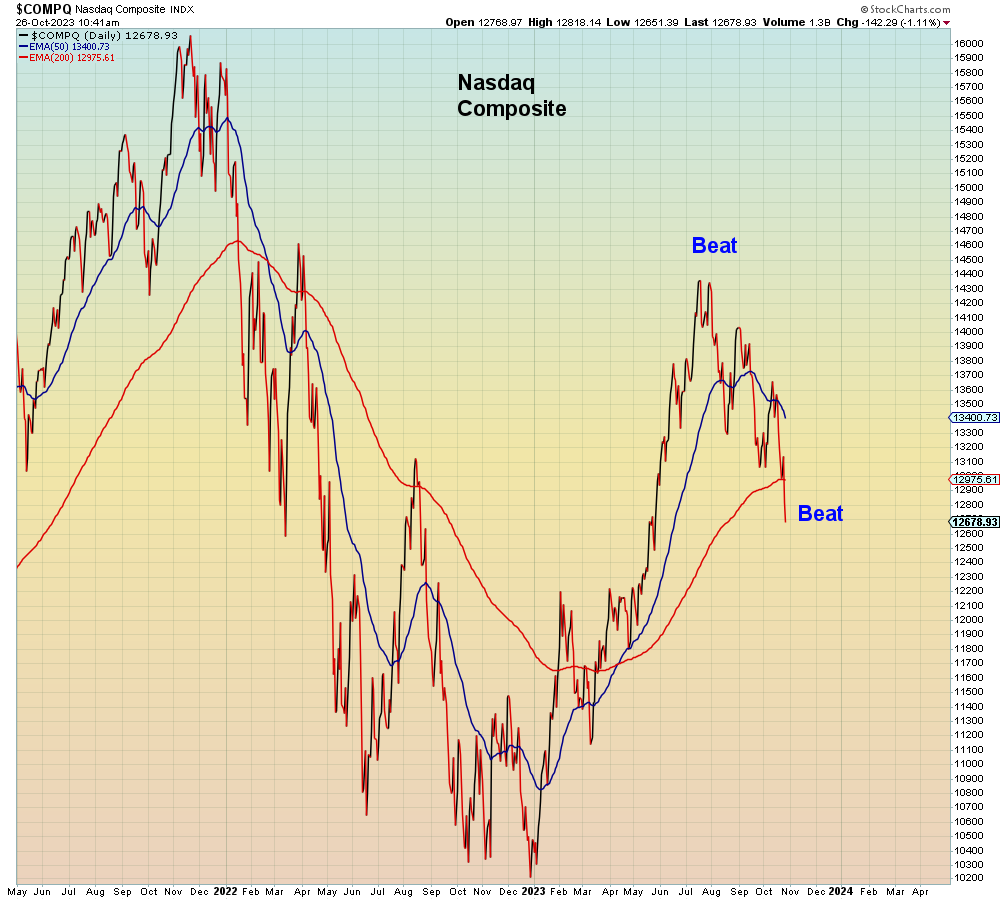

Zooming in on a tighter timeframe, we see that Nasdaq new highs are deja vu of the November 2021 top. In the case of the Nasdaq however, that index along with the broader market was not able to confirm the new Tech top. Which should have been another warning sign to bulls. Note also that this year the broader market peaked in July versus November.

The Tech high which is unconfirmed by the entire rest of the market is why this is the weakest rally in terms of breadth of the past year. Note that the average stock has not even made it back to the 200 dma while the Tech ratio goes parabolic:

In summary, the market is now overbought, but this time Tech can't save the market from imploding as it did earlier this year during the bank run. Which means bulls are now facing bank run and Tech collapse at the end of the year.

And the end of the cycle.

Just like last time.