Some developments have taken place since my last blog post, so here is an update...

In my last blog post (early Thursday), lawmakers were going home for the long weekend with a presumed default date of June 1st. Under those conditions, it appeared unlikely that a default could be avoided. Since that time, Yellen moved the default date back to Monday June 5th. And of course Biden/McCarthy just reached a debt deal "in principle". All of which puts the 2011 scenario back on the table, meaning a passed debt deal arriving just ahead of the default date.

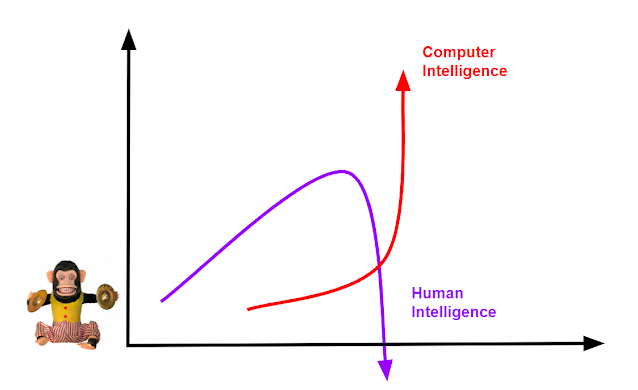

Here is how that would look overlaid on today's chart:

The deal would lead to a sell the news selloff early this coming week. Then, a short-covering rally ahead of the House/Senate vote. Followed by a sell the news crash. Of course if the deal doesn't pass, then markets would explode.

A couple of other things happened since Thursday, both of which are related. The Tech trade went parabolic due to the Nvidia AI blowout. The numbers were very impressive but somehow those Nvidia-specific numbers managed to levitate stocks that have been seeing declining earnings in the most recent quarter. As I showed on Twitter, semiconductor stocks are now four sigma overbought against the 50 day moving average which is a record. And Tech stocks overall are 3 sigma overbought, which is the most since Y2K.

2023 has been the year of the Fed pause rally which has benefited the Tech sector more than any other:

Which is interesting because just as the debt deal came into focus over the last two trading days, rate hike odds for June sky-rocketed. Now currently 65%. Friday's PCE inflation report showed that inflation is NOT coming down as quickly as expected.

"The Personal Consumption Expenditures price index rose 4.4% for the 12 months ended in April, up from a 4.2% increase seen in March"

The Fed is going to view a debt deal as market positive therefore they will be emboldened to raise rates again in June. Which means the Tech rally is OVER.

IF a debt deal is passed then there will be a tsunami of new debt issuance hitting the market at the same time the Fed is raising rates:

"This glut could cause problems at an already dicey juncture for markets"

Liquidity stresses for regional banks linger on, as suggested by their continued reliance on the Bank Term Lending Facility (BTFP)"

This was the level of t-bill rates that exploded banks back in March. But then rates backed down ahead of the debt ceiling deal, but are rising again:

What happens this coming week will depend a lot upon what happens in the rest of the world. Monday/Tuesday in Asia and Europe will set the tone for Tuesday's open in the U.S. Best case for bulls, an early week selloff leads to short-covering later in the week. Which as we see above, would be their last chance to get out.

Worst case, this is already over and bulls went ALL IN Tech stocks into an incipient global meltdown.

Yes again.