"What a fool believes he sees, no wise man has the power to reason away. What seems to be, is always better than nothing"

In my last blog post I discussed the epic divergence that has opened up between mega cap Tech stocks and the rest of the market. In the meantime, that divergence has only grown larger.

As we close out the first quarter we learn that a mere eight mega cap Tech stocks account for all of the S&P's year-to-date gains:

What's even crazier is that the equal weight Nasdaq 100 peaked back in February. Of the eight stocks listed above (AAPL, MSFT, GOOGL, META, AMZN, NFLX, TSLA, NVDA), only three have exceeded their February highs: Apple, Microsoft, and Nvidia.

Here we see the equal weight Nasdaq 100 has yet to exceed the February high. In addition, new Nasdaq highs peaked two years ago and had a major divergence at the all time high in November 2021. Now we are seeing another major divergence on this right shoulder:

Zooming out to the weekly view. We see that this is merely a VERY weak correction in a bear market. Compare the rally off the low in March 2020 to this one. That was a straight shot higher. This has been a sideways to down choppy rally to nowhere.

Do you remember the high last August ('a')? We were told that the Nasdaq is in a new bull market. That was the end of the rally.

Now, we hear the exact same thing all over again, at a lower high:

The Nasdaq Just Entered A Bull Market

That's the good news.

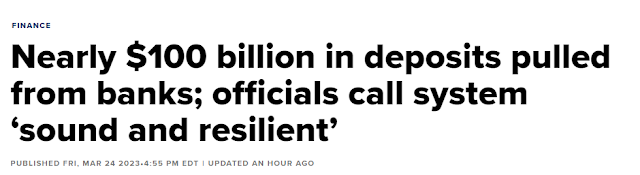

Unlike Tech stocks, banks have been unable to manage any sort of meaningful rally. Compare 2008's short-covering rally to this one. In addition, we see via the VIX there is no sign of fear in this market.

Belief in "just-in-time" bailout is total. Bulls now believe that the Fed can implode markets and rescue markets before they implode. This is the belief of the day.

As I have said many times, bulls are the reason the Fed must keep tightening. On this rally, once again the high yield spread has declined signaling an EASING of financial conditions in financial markets. The real economy is a whole other story.

History informs us that the Fed will reverse when the S&P is -20% lower from this level. And by that time, it will be far too late for just-in-time bailout.

This week, the most famous bear in modern history, Mr. Big Short Michael Burry inexplicably capitulated. He claims that he was wrong to say "Sell" back in February at the market's rebound high.

Bulls were ebullient.

But, it's pretty clear that he too has been suckered by this latest bear market rally.

Mark this date.

In summary, fittingly in a denialistic Idiocracy, the bullish hypothesis and the bearish hypothesis are the exact same now. Financial dislocation will force the Fed to reduce rates sooner than expected. However, what bulls seem to forget is that back in 2008, when the Fed cut rates, markets collapsed.

All of which makes this, the Big Long:

Any questions?