"Investors are looking beyond a looming global recession and they see one country – and its financial markets – emerging strongest on the other side"

Monday, October 17, 2022

THE FULL COST OF DENIAL

"Investors are looking beyond a looming global recession and they see one country – and its financial markets – emerging strongest on the other side"

Thursday, October 13, 2022

THE EFFICIENT EXPLOSION MODEL

Wednesday, October 12, 2022

DEEP BURIAL

No excuse this time...

"How anyone over the age of 40 didn't see this coming is a riddle. The answer is Greed."

Pollyanna predictions still abound. There is no shortage of pundits willing to tell people what they desperately want to hear. Blowing smoke up people's asses became the primary financial model after 2008. Each time markets get bailed out, fraud and corruption increase. However, this time gamblers are sky-diving without a parachute. The one time they didn't hedge is the one time they won't get bailed out. As I said in my last post, this is extreme moral hazard.

A new and extremely dangerous myth has been created that the dumb money is the new smart money. This myth was cultivated during the Gamestop debacle which saw a massive rush of gamblers into the casino. During that pump and dump, the Reddit mob took down a couple of over-leveraged hedge funds. However, there were many MORE hedge funds that shorted Gamestop from the top all the way down. The REAL losers were the legions of newbies who were late to the party and got crushed by short sellers at the end of the pump and dump. Funny how that part of the story never got told.

This newfound *smart money* theory is just another way of ensuring bagholders remain in the market while conflict of interest continues to be assiduously ignored. We need not expect Wall Street to question such a lucrative fantasy.

History says that people who do nothing get officially buried by serial financial psychopaths.

Wall Street keeps downgrading their market predictions while maintaining buy ratings on every stock. They've been behind the curve all year and they will happily remain far behind the curve, selling stock to useful bagholders.

The never-ending pivot fantasy remains the clarion call of denial:

What is happening right now in the UK is a warning to stock market bulls as to what happens when a central bank tries to pivot in an inflationary environment. It backfires. Expansionary monetary policy only works in a deflationary environment. It does not work at the end of the cycle. Which of course is Econ 101, cycle theory:

"Instead of boosting growth, the IMF made it clear it thought the government’s policies ran a serious risk of provoking a deeper downturn once inflation had stayed too high for too long."

The Bank of England initiated a temporary bond market intervention two weeks ago, but they are warning markets it will end this coming Friday. The BOE has now officially put their credibility on the line and markets will soon test their resolve. Recall that George Soros made his fame and fortune shorting the Pound in the early 1990s. Now there is blood in the water all over again.

The critical question on the table is how can the BOE defend BOTH the bond market AND the currency market at the same time? They can't. All they can do is sponsor ever-weaker global short-covering rallies, each one conflated as a "new bull market", until the wheels come off the bus for good.

The RBA is another example of a failing pivot. On October 3rd they shocked markets by raising rates by a much less than expected quarter of a % point. Since then the currency has been bidless, accelerating imported inflation and exacerbating slowdown.

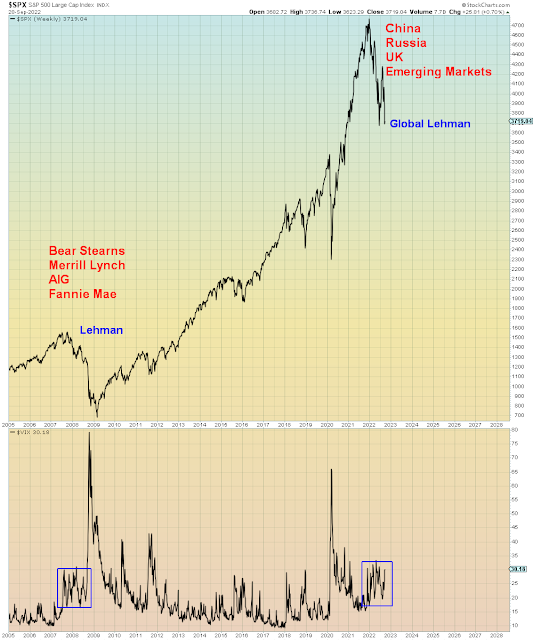

Here in the casino, the market keeps stair stepping lower amid mass complacency. A Lehman-equivalent crash now would equal -60% down, from all time high to low. If this slow bleed lower continues, the final low will only be far worse. Picture a market that trickles down -40% and then explodes lower. Because that's the way things are heading.

Monday, October 10, 2022

MORAL HAZARD. INDEED.

mor·al haz·ard

"Lack of incentive to guard against risk where one is protected from its consequences"

Wall Street has converged on the seamless bailout hypothesis. What could go wrong?

It's a very sad day when all of investing has boiled down to begging for central bank bailouts. The entire bullish thesis now rests upon central banks capitulating against inflation.

The consequence of the 2008 Wall Street bailout and subsequent continuous monetary bailouts is that central bank invincibility is no longer questioned. Even in a high inflation scenario such as the one we face, the inevitability of higher markets is largely unquestioned.

Over the course of 2022 as the market has stair stepped lower, Wall Street has slowly and surely downgraded their price forecast to a "worst case" consensus level of 3000. Which is a 40% total decline and roughly 15% from the current level. That point of view is now shared by Bank of America, Morgan Stanley, JP Morgan/Dimon, Gary Shilling, and the once uber-bearish Jeremy Grantham, who now finds himself with plenty of company. The outlier is John Hussman predicting a 50-70% decline. Michael Burry does not give price targets.

This article lays out the "bull case" of a fast -20% decline followed by a certain Fed bailout and 50% rally. In doing so, the article inadvertently lays out the 1929 scenario of a ~45% initial decline followed by a 50% rally. Which by the way, would still leave the market 10% BELOW the all time high. Basic math now being beyond the capacity of this society. In other words, the bull case and the bear case are largely the same now. Which means that a TRUE bear case precludes a seamless bailout scenario. Which I will discuss further below.

Going the exact other way, Peter Schiff expects hyper-inflation due to a Fed pivot that reinflates the everything bubble. He asserts that today's central banks lack Volcker's fortitude to deflate markets. What he doesn't understand is that the bond market is not going to allow rampant inflation. Real yields as measured by the nominal yield - CPI are ALREADY the lowest in U.S. history. According to Schiff they are about to go much lower. We are to believe that the Minsky deleveraging moment can be deferred forever while market rates sky-rocket. Sure. It's tremendously ironic that in 2022 inflationists have finally been proven right after 40 years of continuous deflation. However, in this year the dollar has sky-rocketed meaning their trades have imploded anyways.

Fed governor Chris Waller astutely laid out the Fed's dilemma last week - which is that shelter costs in the U.S. as determined by rents, are going to continue to keep CPI elevated for months into the future. Each month only a subset of leases expire and are rolled over to the new higher rates. Therefore, older lower rents will inexorably rise.

"The inflation statistics use a six-month average when calculating rent growth. Asking rents and rents on new lease contracts—which do reflect contemporaneous rental market conditions—have been rising at a fast pace for more than a year. These increases have fueled shelter inflation so far this year, and they should continue to do so for at least the next six months"

The Fed is in a sense lucky, because if they measured inflation based upon the cost of carry for homeowners, the current inflation rate would be FAR higher than it is currently. The combination of house prices and interest rates has raised owner-occupied carrying costs by 100% in the past year. You read that right. That fact has priced new homeowners out of the market and placed even more pressure on rents. In other words, the Fed itself is STILL a key source of inflation by raising shelter costs.

The Fed used their balance sheet to inflate the housing market and now they are using interest rates to bring it down. It's two policy errors for the price of global meltdown.

All of which from an investment standpoint leaves just the now universally anticipated "accident" scenario followed by bailout. We can surmise that the bar is now VERY high for what would force a Fed pivot. Something on the order of a 1998 Russian Default/LTCM meltdown. The problem is that such an event would immediately tip the world further into global depression. In other words, trapped bulls will realize far too late that they bought a false promise of seamless bailout.

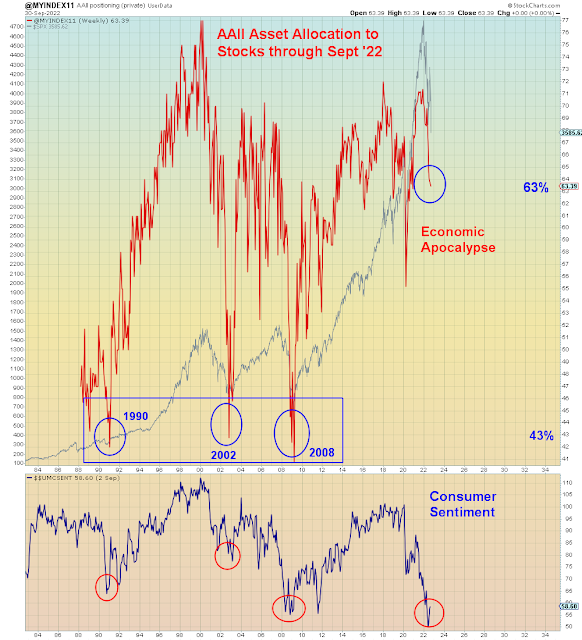

Any blind man can see that U.S. consumer sentiment is at an all time low whereas in 1998 it was at an all time high.

Subtle difference.

All of which means this market is tradable but no longer investable. There will be large trading rallies followed by large declines. So far, we've seen small trading rallies followed by new lows.

This roller coaster scenario is what Japan and China have already experienced at the zero bound. And what the U.S. experienced in the 1930s.

Arguably gold is a long-term hedge against inflation and monetization of deficits. However, we must go through the deleveraging phase first which will be highly deflationary. I have no long side conviction in gold at this juncture.

In summary, the KEY point Wall Street never admits is that you can't always put the toothpaste back in the tube.

Position accordingly.

Thursday, October 6, 2022

COLLAPSE IS RIGHT ON SCHEDULE

"A large quantity of gilts (UK Treasury bonds), held as collateral by banks that had lent to these Liability Driven Investment (LDI) funds, was likely to be sold on the market, driving a potentially self-reinforcing spiral and threatening severe disruption of core funding markets and consequent widespread financial instability.”

Monday, October 3, 2022

STILL FRONT-RUNNING COLLAPSE

"What is becoming more apparent, however, is that it will be difficult for the U.S. — and other major economies — to wean themselves off the extraordinary support the Fed has given it in the past 15 years"

“Their own policies created the fragility, their own policies created the dislocations and now we’re relying on their policies to address the dislocations”.

Good luck.

After 2008, Zerohedge emerged as the leading critic of centrally managed markets. That skeptical view lasted all the way until the pandemic when whey emerged post-pandemic as newly converted believers in monetary bailouts. It was their chance to shed their perma-bearish image and join Wall Street in propagating the myth of perpetual market manipulation. So it is their fate that stocks are now having the worst year in 50 years. That sort of late stage "pivot" is called capitulation. What you would expect at the END of a bull market.

Now in 2022 JP Morgan's markets "guru" Marko Kolanovic has been bullish all year. However, this past week he turned bearish and admitted that his assumption central banks would NOT make a massive policy error in 2022 was wrong. Central banks just made a massive policy error in 2021, so in 2022 he believed they were going to get it just right. You have to be an Ivy League PhD to believe that moronic delusion. What we are witnessing is BULLISH capitulation.

Also capitulating, the aptly named BEAR Traps Report, now expects a Fed pivot by November.

"In the coming 2-4 weeks, we expect a meaningful walk-back from Powell with a focus on financial stability"

Likewise, here is what the most bearish Wall Street pundit Michael Hartnett said this past week - Markets are breaking so get ready to buy stocks:

"Spiraling losses on Wall Street are now snowballing into forced asset liquidation, according to Bank of America Corp. strategists"

BofA strategists said to “bite” into the S&P 500 at the 3,300 level -- about a 9% decline from the latest close, “nibble” at 3,600 and “gorge” at 3,000. Hartnett and his team added that a drop of 20% below 200-day moving average has been a good entry point back into stocks in the past 100 years."

In other words, Wall Street pundits are converging on a NEW CONSENSUS view - MINOR additional downside followed by a seamless bailout.

It's a similar consensus from the one this past summer, but the stakes have been raised in the meantime. It indicates there has not been any TRUE capitulation, because these new pivot believers are once again positioning investors AHEAD of the pivot.

Barron's ran an article over the weekend which spells out the Russian Roulette investors are now playing. A Fed put that is now far below the market:

Front-running the Fed is a very dangerous game to play right now. Why? Because the assumption investors are making is that the Fed can engineer a controlled explosion and then bailout markets with limited dislocation. What these people didn't learn is that in March 2020 the Fed required $2.5 trillion of IMMEDIATE QE to get the market under control. Yes you read that right.

Confounding this new bailout delusion is the fact that the Fed themselves are not nearly as worried as investors desperately NEED them to be:

September 27th, 2022:

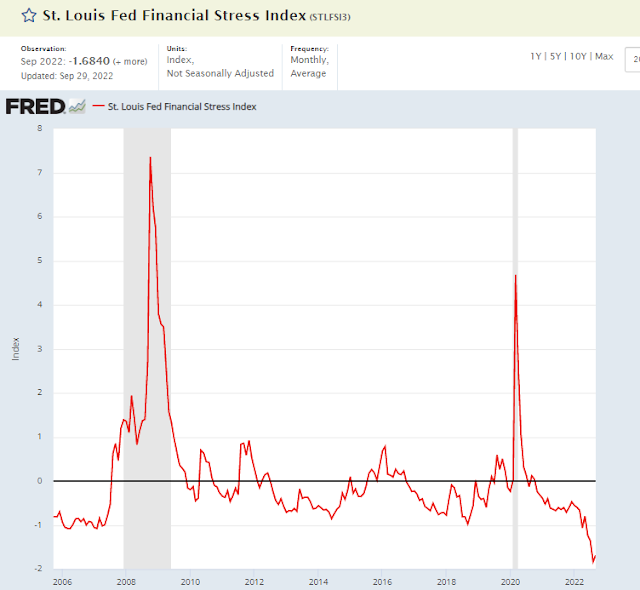

The Fed's own financial stress index remains NEGATIVE:

What we have right now is make-believe capitulation.

The AAII (Retail investor) positioning update for September indicates there is still a high degree of stock ownership:

https://www.aaii.com/assetallocationsurvey

In summary, the Fed and investors are now dead-locked. Each side expects the other side to capitulate. Neither side is backing down, which means the Fed will continue to ratchet up the pressure. At this late juncture, investor capitulation has been delayed to the point that the systems won't be able to handle a global RISK OFF event. The inflation-trade has seen massive flows from bonds to stocks during 2022. A reverse flow from stocks back to bonds will break the market in such a way that the Fed will NOT be able to put humpty dumpty together again.

What bailout follows will be solely dependent upon the political regime that exists at the time. Which right now is the most polarized in modern U.S. history. Only a fool believes there will be a Congressional bailout in 2022.

Last week, Corporate bonds saw their biggest liquidation since March 2020. However, the *special* bailout powers that were granted to the Fed during the pandemic were rescinded in 2020.

Which means the deleveraging event that Wall Street never sees coming is ALREADY underway.

When the masses finally panic out of the totally unhinged market, you can rent stocks, but you can't own them. The days of owning stocks for the "long term" are over. In the 1930s there were 10 bull markets and 10 bear markets, about one a year for a decade.