No excuse this time...

"How anyone over the age of 40 didn't see this coming is a riddle. The answer is Greed."

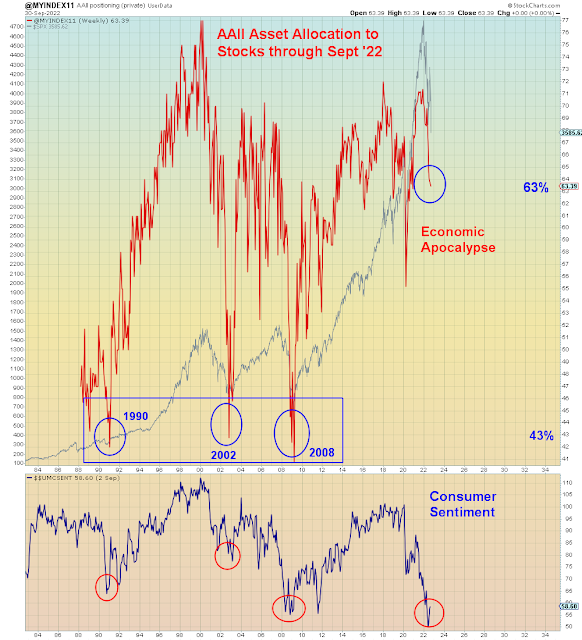

Pollyanna predictions still abound. There is no shortage of pundits willing to tell people what they desperately want to hear. Blowing smoke up people's asses became the primary financial model after 2008. Each time markets get bailed out, fraud and corruption increase. However, this time gamblers are sky-diving without a parachute. The one time they didn't hedge is the one time they won't get bailed out. As I said in my last post, this is extreme moral hazard.

A new and extremely dangerous myth has been created that the dumb money is the new smart money. This myth was cultivated during the Gamestop debacle which saw a massive rush of gamblers into the casino. During that pump and dump, the Reddit mob took down a couple of over-leveraged hedge funds. However, there were many MORE hedge funds that shorted Gamestop from the top all the way down. The REAL losers were the legions of newbies who were late to the party and got crushed by short sellers at the end of the pump and dump. Funny how that part of the story never got told.

This newfound *smart money* theory is just another way of ensuring bagholders remain in the market while conflict of interest continues to be assiduously ignored. We need not expect Wall Street to question such a lucrative fantasy.

History says that people who do nothing get officially buried by serial financial psychopaths.

Wall Street keeps downgrading their market predictions while maintaining buy ratings on every stock. They've been behind the curve all year and they will happily remain far behind the curve, selling stock to useful bagholders.

The never-ending pivot fantasy remains the clarion call of denial:

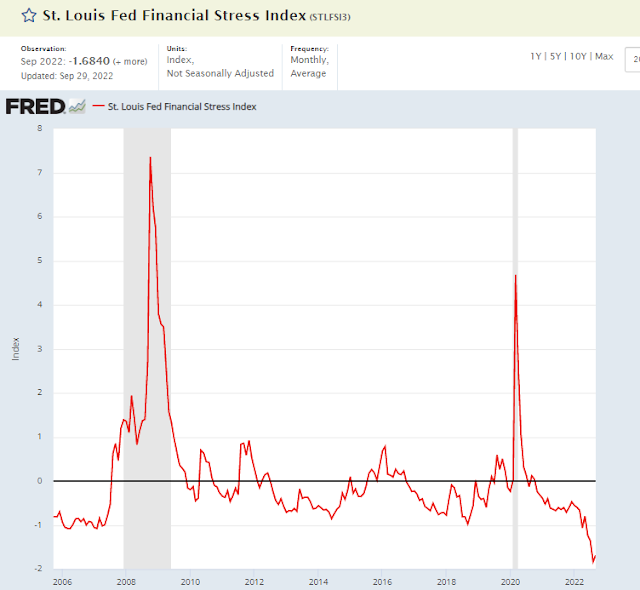

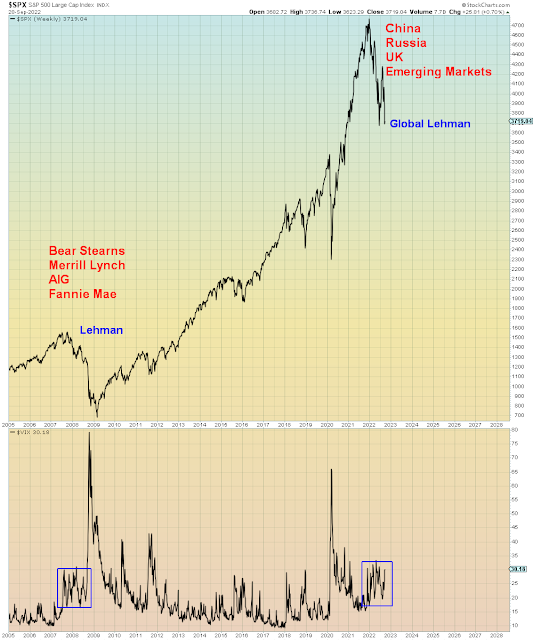

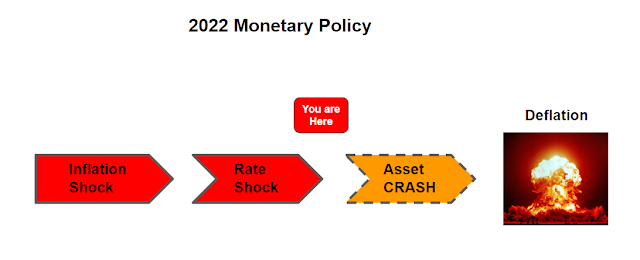

What is happening right now in the UK is a warning to stock market bulls as to what happens when a central bank tries to pivot in an inflationary environment. It backfires. Expansionary monetary policy only works in a deflationary environment. It does not work at the end of the cycle. Which of course is Econ 101, cycle theory:

"Instead of boosting growth, the IMF made it clear it thought the government’s policies ran a serious risk of provoking a deeper downturn once inflation had stayed too high for too long."

The Bank of England initiated a temporary bond market intervention two weeks ago, but they are warning markets it will end this coming Friday. The BOE has now officially put their credibility on the line and markets will soon test their resolve. Recall that George Soros made his fame and fortune shorting the Pound in the early 1990s. Now there is blood in the water all over again.

The critical question on the table is how can the BOE defend BOTH the bond market AND the currency market at the same time? They can't. All they can do is sponsor ever-weaker global short-covering rallies, each one conflated as a "new bull market", until the wheels come off the bus for good.

The RBA is another example of a failing pivot. On October 3rd they shocked markets by raising rates by a much less than expected quarter of a % point. Since then the currency has been bidless, accelerating imported inflation and exacerbating slowdown.

Here in the casino, the market keeps stair stepping lower amid mass complacency. A Lehman-equivalent crash now would equal -60% down, from all time high to low. If this slow bleed lower continues, the final low will only be far worse. Picture a market that trickles down -40% and then explodes lower. Because that's the way things are heading.