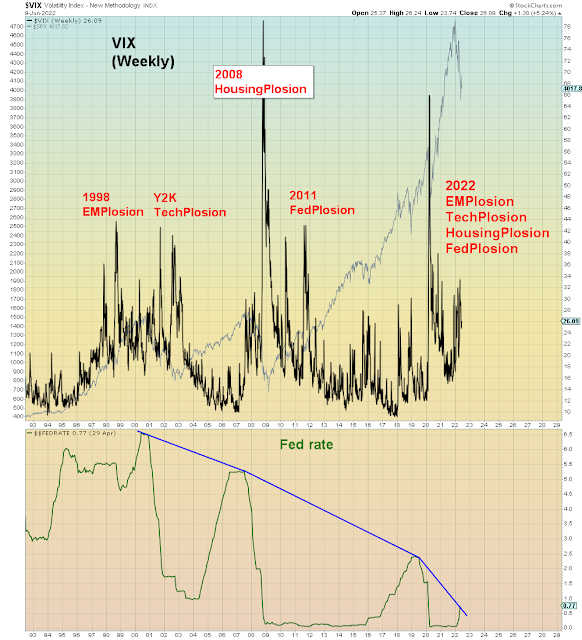

The post-2008 era of monetary euthanasia has been a con man's paradise. Any false narrative could be bought and sold under the assumption that central banks were standing by to bail out markets. Sadly, none of today's fairy tales will end with happily ever after this time around...

So many fairy tales, where to begin...

During the pandemic lockdown investors were told that the Tech bull market heralded a new "virtual economy". All of the non-profit startup companies were "disrupting" traditional industry, rendering in-person business models soon to be obsolete. Any and all business could be conducted over the internet. They were selling dollar bills for 90 cents, financed by free capital. Then, in early 2021 as the lockdowns ended, left for dead shopping mall stocks and retailers suddenly exploded higher, led by the Gamestop mega short squeeze. We were told it was the new small investor revolution. Retail investors were the new "smart money" and the professional investors shorting stocks were now the "dumb money". Managing risk in the age of central banks, was viewed as foolish and obsolete. The mainstream media quickly ran with this new specious narrative under the guise of "democratized markets". Record new brokerage accounts opened and money flooded into the markets at the fastest pace in history. Throughout 2021, Wall Street mercilessly exploited this playground of non-profit concept stocks and democratized pump and dump schemes, for maximum profit. Featuring the largest issuance of IPOs and SPACs in history. Most of which are now on the verge of becoming worthless. Crypto currencies were bought under the assumption that the Fed money printer would render the U.S. dollar worthless. However, when the Fed "pivoted" to the most extreme tightening regime in history, the narratives never changed. Despite the fact that the rationale for buying no longer existed. Since then, all of the "cheap money" trades have collapsed. Because that's all they ever were - cheap money chasing fantasy narratives.

This latest housing super bubble is deja vu of the last bubble. Back then adjustable rate mortgages and packaged subprime mortgages were blamed for the 2007 bubble. However, the REAL underlying cause for both bubbles is/was cheap money. Both times industry hacks convinced policy-makers that a shortage of supply was fueling higher prices. Therefore the solution to rampant speculation was to massively increase supply. It was a lie last time and it's a lie this time as well. And yet no mainstream pundits question it. We continue to turn to the same "experts" who were wrong in 2007 to seek their counsel this time as well. Back in 2007, the ratings agencies played a pivotal role in the overall housing Ponzi bubble. They gave the AAA ratings to the exploding packages of subprime mortgages cranked out by Wall Street. The same ones Michael Burry of "Big Short" fame predicted would explode the economy. Now he's predicting the same fate again. However, Fortune magazine instead of asking Michael Burry what he thinks, they are asking Moody's what they think of this housing bubble. No surprise they assume modest downside.

National housing prices rose 30% year over year. But they only see 5% downside on a national basis. Worst case scenario:

In other words, the home gamer fool reads the mainstream media moron who asks the corrupt rating agency if we have a problem. No problem.

Greed is out of control. Von Misers tell us that greed is not the problem, only government bureaucracy is the problem. Unfortunately, that's another massive lie. Unfettered greed IS the problem and now it has spread to government institutions. During the Gamestop debacle last year, Congress and SEC wanted to know why retail brokers had prevented small investors from buying Gamestop - prudent restrictions which in the end saved people a lot of money. What most people don't realize is that Wall Street came in at the end of the super spike and shorted Gamestop at the top. THEY made the most money. But the common narrative is that small investors made the money at *smart* money's expense. Most small investors came in late and got wiped out.

When greed is not held accountable then you end up in the situation we are now in, wherein every type of lie now gets bought and sold. Meanwhile government regulators look the other way or help to "democratize" fraud. One wonders how much of this monetary policy error is due to the fact that Fed members were trading stocks LATE into the largest asset bubble in human history. When they were forced to sell, that was the top for stocks. And one wonders how much of the regulatory lapse is due to the fact that Congress is STILL actively trading stocks.

Last but not least is this cyclical inflation fraud masquerading as secular stagflation. The last and greatest bubble that has aided and abetted record inflows into passive stock market indexes at the apex of the largest stock bubble in history. Coming at a time when Boomers are at peak retirement and hence exposed to maximum risk aka. WORST CASE SCENARIO.

No one believes this secular inflation narrative more than the Fed despite the fact that they were the last to be converted. Now, their belief in this latest fraud has put the entire system at risk.

Perma-bull Jim Cramer sums up the Fed conundrum:

“If Powell can get this market to go down and stay down, repealing much of those gains, then the rich are less likely to spend aggressively and a lot of people are more likely to remain in the workforce when they might otherwise have retired,”

Wow. That is the most bearish thing Cramer has said in a LONG time. Contrarians would jump all over that and presume that means a bottom. What they ignore is the fact that the Fed has ALL the power to crash this market and it doesn't matter anymore what market participants believe. Otherwise we would believe the current PRIMARY fantasy that the Fed can CREATE massive bubbles, but they can't burst their own bubbles.

And yet, according to Goldman Sachs and Zerohedge, this is bullish.

ZH: Nasty Short Squeeze On Deck

In summary, anyone can believe whatever they want in Disney markets. Pundits are standing by to satisfy any and all denialistic fantasy.

Sadly, the middle class can't sustain the high price of EVERYTHING at the same time. Which is why the first order effect we are seeing is falling sales quantity - of homes, cars, and durable goods. The second order effect will be falling prices.

At the aggregate level, Price x Quantity = GDP.

Which means that the Fed is actively crashing the markets AND the economy at the zero bound.

With ZERO chance of a successful bailout.