"There is no means of avoiding the final collapse of a boom brought about by credit expansion"

- Ludwig Von Mises

If the Fed accelerates rate hikes they bring forward recession and asset meltdown. If they ease off rate hikes, they won't have dry powder for a recession and asset meltdown. Either way, investors are trapped at the END OF THE CYCLE...

Today's pundits who still believe in this "market", no longer believe in any element of TRUE financial analysis. They ignore eroding profit margins, they ignore collapsing P/E multiples due to high interest rates. They ignore cycle risk and recession indicators. They ignore consumer sentiment. They ignore Fed tightening policy. They ignore global risk factors. And of course they ignore ALL concept of over-valuation. All they believe in is the efficient Bailout Hypothesis, despite the fact that the Fed itself has repeatedly warned them that it's not happening this time.

Mostly what pundits ignore is the risk of being wrong when the Fed is tightening liquidity at the fastest pace in history NEAR the zero bound. There is no monetary safety net beneath this lethal gambit. This is the monetary equivalent of Russian Roulette.

The real policy error started 14 years ago when the Fed began conditioning investors to expect a bailout at the first sign of trouble. Prior to 2008, the Fed's mandate was price stability and full employment. The post-2008 mandate is full employment, price stability, and Dow making all time highs in perpetuity. Unfortunately, this untimely combination of end of cycle/supply chain bottlenecks now makes it impossible for the Fed to fight inflation AND save markets.

"Federal Reserve Bank of Kansas City President Esther George said the “rough week in the equity markets” was not surprising, and doesn’t alter her support for half-point interest-rate hikes to cool inflation"

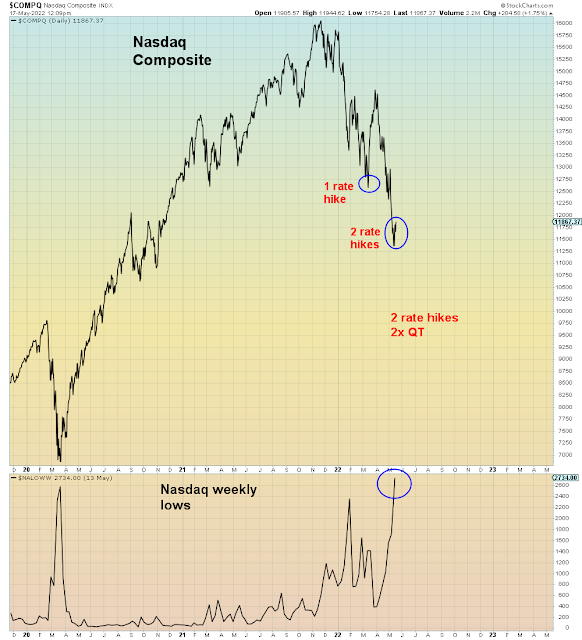

Going into this year, financial advisors told their retail clients that stocks usually perform well during the first year of a new rate hiking cycle. Fast forward five months and the Nasdaq is deep in bear market territory and the S&P 500 is now just points off of a bear market.

What went wrong? Several widely unquestioned assumptions were invalid this time around. For one thing, the Nasdaq asset bubble started imploding a year ago. Secondly, the Fed tapered their balance sheet expansion in record time leading to further weakness in Tech. Thirdly, as I showed in my prior post, bond yields and mortgage rates sky-rocketed as the Fed continued to escalate their ever-more hawkish tone ahead of each FOMC meeting. In June, the Fed is planning to double tighten rates AND double tighten the balance sheet. Which would be the most extreme tightening measures in HISTORY.

All of this rising risk hasn't stopped today's pundits from continuing to propagate belief in the Fed put. This idea that the Fed is always ready to step in to save markets. Which is why investors are now counting on the Fed to bail them out of a nascent bear market.

"Bolstering his opinion is a conviction that US inflation has probably peaked, or is about to do so, paving the way for a pullback in price pressures that will eventually allow the Federal Reserve to moderate the pace of monetary tightening"

This is the Goldilocks and NO BEARS economic fairy tale - not too hot and not too cold. And they lived happily ever after. The fact that this outcome WON'T allow the Fed to normalize policy is of no concern. Nor is it explained how we go from 8% inflation down to 2% in a few months, which has never happened before EXCEPT in the 2008 market meltdown. The fact remains that the ONLY way to get inflation from 8% down to 2% quickly is via market crash. Anything less, and the Fed will continue tightening long after inflation has "peaked". They won't be satisfied with a 5% inflation rate.

Getting back to the topic of policy error, the Fed has systematically conditioned investors to misallocate capital throughout ALL points in the cycle. To actively embrace risk rather than protect capital. Which ironically is why the Fed sees no major market risk on the horizon. The Fed's own proprietary financial stress index is a mirror image of the stock market VIX - both are stuck at a relatively low level. No surprise, the VIX is one of the constituent data elements of the Fed's index.

Both the VIX and FSI are confirming MASS COMPLACENCY in financial markets. And therefore the Fed feels free to continue tightening.

In summary, the S&P 500 is at the precipice of a bear market, and yet complacency reigns supreme. End of cycle risk is coalescing in the background while the Fed is systematically taking liquidity out of the market. Investors are no longer hedging because it's too expensive and they assume the Fed will bail them out sooner than later.

Unfortunately, this time they can't afford to be wrong. Because a crash coming AFTER a -20% decline is WORST CASE SCENARIO and will stress test these Disney markets far beyond their breaking point.

So the only question now is "What could go wrong?"

And the answer is ANYTHING.