"Nursing losses in 2022 that are worse than the rest of the market’s, amateur investors who jumped in when the lockdown began have now given back all of their once-prodigious gains"

Tuesday, May 10, 2022

SLOWLY AT FIRST, THEN EXPLOSION

"Nursing losses in 2022 that are worse than the rest of the market’s, amateur investors who jumped in when the lockdown began have now given back all of their once-prodigious gains"

Sunday, May 8, 2022

THE MINSKY MELTDOWN

This week the Fed pulled the trigger on the first .5% rate hike in twenty-two years. In the process they very likely initiated global financial meltdown. The general consensus is that it was not enough. You can't make this shit up...

The Financial Instability Hypothesis

https://www.levyinstitute.org/pubs/wp74.pdf

"Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance. If an economy with a sizeable body of speculative financial units is in an inflationary state, and the authorities attempt to exorcise inflation by monetary constraint, then speculative units will become Ponzi units and the net worth of previously Ponzi units will quickly evaporate. This is likely to lead to a collapse of asset values"

This week Larry Kudlow deemed the .5% rate hike as "dovish":

"The basic inflation rate is running around 8%. That would require a 9% or 10% Fed funds rate, or even higher in the days of Volcker shock and awe. Volcker also reined in money supply growth and here, Powell completely struck out"

The 30 year mortgage is currently at 5.25%, can you imagine a 30 year mortgage at 18% which was the 1980 level?

We are constantly reminded this is the highest level of "inflation" in 40 years (despite nominal oil prices still below 2008 levels). However, the rate of change in interest rates is the highest level EVER in the biggest housing bubble in HISTORY.

"It's going in the right direction ... hopefully we'll be able to get away from this behind-the-curve characterization soon," Bullard said.

Indeed. Much sooner than anyone can possibly imagine.

All of the above means that the Fed's mandate is to cool the economy and bring down inflation. NOT to save asset markets from collapse.

This change in policy taking place after FOURTEEN straight years of bailing out markets, is NOT priced in to any asset market right now. Investors are still under the delusion that the Fed can slam on the brakes as hard as possible for price inflation AND yet keep asset markets inflated. It's the delusion of the CENTURY, and it has been assiduously cultivated by Wall Street and their media acolytes.

Not everyone took the bait:

"Wall Street titan Jeremy Grantham has been warning of a “superbubble” in the U.S. since last year, arguing the S&P 500 is set to be cut in half as an era marked by exceedingly risky investor behavior begins to fade."

Now, with interest rates for a 30-year fixed-rate mortgage rising to 5.27% this week, their highest levels since 2009, he sees that point coming ever closer"

Of course, not everyone is convinced that the housing market is set for a dramatic drop"

Got that? We can't even agree on what is a "bubble" anymore. In my neighborhood prices went up 30% in the past year. Apparently that's NOT a bubble, but eggs going up 30 cents, that's existential inflation.

What a bunch of fucking morons.

Clearly these people can't spot an asset bubble over and over again in their lifetimes, so how do they know what is inflation? In other words, what if all of these asset prices are temporary? That would mean they could all come crashing back down and leave the Fed "dick in hand", just like last time. Then you will see rampant morons rioting in mass protest. Wondering how they are going to pay for cheap eggs when they don't even have a job. Buried by another housing bubble.

What economists never noticed is that consumer sentiment NEVER recovered after the pandemic. Corporate profits sky-rocketed and consumer sentiment went in the other direction.

We've never seen this much disconnect between consumer sentiment and corporate profits. One is inflated, and one is deflated.

The Tech bubble is DOOMED. It's collapsing for the same reason it collapsed in Y2K - slowing growth AND a Fed eager to make up for lost time. Back in 2000, the Fed purposely held off on rate hikes until after the millennium date change, because they were worried computer systems would fail. When that didn't happen, the melt-up accelerated into March 2000. By May 2000 the Fed was doing everything possible to contain inflation. Sound familiar?

The Tech sector just got rejected at the 200 dma for the first time since 2008:

In summary, the Fed and its inflation acolytes have triggered global Minsky Meltdown. Which in today's Idiocracy means they didn't do ENOUGH.

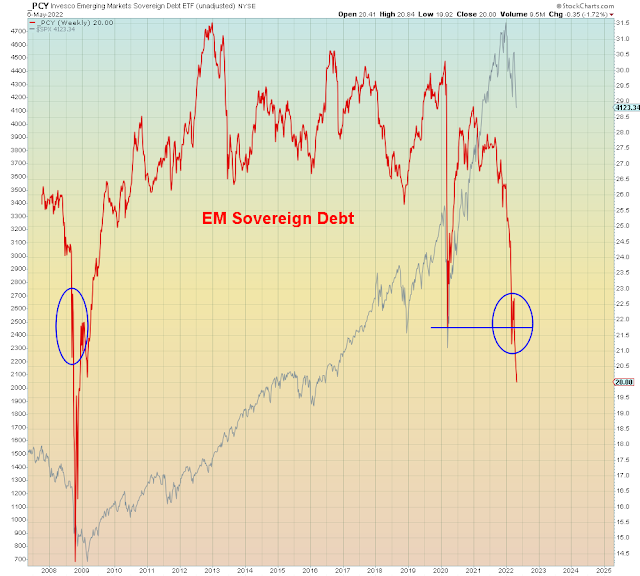

Why? Because SO FAR, most of the pain has been in non-U.S. markets.

2008 sans bailout aka.

MONETARY POLICY FAILURE.

Thursday, May 5, 2022

THE BIG LONG 2022

Tuesday, May 3, 2022

BLACK SWAN DIVING INTO PAVEMENT

The plans are now set for a hard landing at the zero bound.

Everything EXCEPT, seeing it coming...

With each FOMC meeting, the Fed keeps upping the ante. Now, the stakes have NEVER been higher, but you would never know it by today's circus quality financial commentary - by far the dumbest we've seen in our lifetimes. The longest bull market in history has succeeded in making everyone forget what a bear market looks like. The crash in March 2020 was of such short duration that it doesn't even show up on a monthly chart. All it was is a corrective pullback on the way to a pandemic-driven Tech bubble blow-off top.

Deja vu of Y2K:

Contrary to popular belief, the Fed's REAL mistake was keeping their balance sheet inflated for far too long while investors gambled with impunity. Investors only finally took notice when inflation seeped into the actual economy. Prior to that there was no complaining as profits and stocks sky-rocketed to RECORD highs.

NOW, EVERYONE knows the Fed made a big mistake. So to make up for it the Fed is making a much bigger mistake. And the same people who ignored the first mistake, are ignoring this one as well.

NONE TOO BRIGHT.

Unbeknownst to all of today's pundits, in the period while the Fed was asleep at the wheel, the bond market did their job for them. The two year sky-rocketed at the fastest rate in history.

Here we see the two year yield is above the Fed rate by the most since the last two recessions.

Which is where this all gets interesting. In the sense that watching an Idiocracy self-destruct is fascinating.

The Treasury market has collapsed. Therefore the spread between junk bonds and Treasuries has narrowed. Which gives the Fed the illusion of LOW credit risk. Usually spreads compress when the junk bond market rallies. This time, spreads are compressed because Treasuries have collapsed.

Which is why the Fed's proprietary financial risk index is at RECORD lows despite the largest bond market collapse in HISTORY.

Giving a totally erroneous signal of "low risk". When nothing could be further from the inconvenient TRUTH:

The stock bulls' case is that despite the obvious risks, there is too much pessimism in the market to allow a meaningful break lower. So far in 2022 that has been the case. The market has pounded the FOMC support level multiple times this year only to bounce higher. Which has kept everyone guessing: is this a correction in a bull market, or a top in a bear market? Most of today's investors are in the former camp - short term bearish and long-term bullish. They see this FOMC rate spurt as a mere speed bump to the next bull market.

IF the bulls are right, there is currently TOO much bearishness. for a bull market. However, in the context of a bear market, there is not nearly enough bearishness to keep this market from breaking lower.

LONG-TERM active manager risk exposure has been above 50% for seven years straight:

The abiding delusion is that in the event of major selloff the Fed can pivot from max hawkish to max dovish quickly enough to keep markets from exploding.

Which is why we find ourselves camped at a similar breadth level as 2018. EXCEPT, back then, the Fed rate was ALREADY at 2.5%, the balance sheet had been reduced considerably, inflation was muted, and of course Trump demanded the Fed reverse policy.

This time NONE of those factors apply. And yet, today's investors are even MORE sanguine than they were back then, now facing DOUBLE the level of tightening.

It's MORAL HAZARD on steroids. Investors have been bailed out so many times that they no longer manage risk. So much for the "too bearish" theory.

In summary, despite the Fed's KNOWN prior error in keeping policy too loose, and their latest error in tightening TOO fast, today's investors maintain their belief that central banks are INVINCIBLE. And can bail them out of every situation, even when they themselves are no longer hedging. It's the imaginary Fed put.

The Fed on the other hand is hellbent on restoring their LOST credibility. Therefore, they are not focused on the implosion of global markets and the Nasdaq.

So it is that we are pile driving straight into the zero bound at MAXIMUM VELOCITY.

And so it is that no greater fool wants to see it coming.

Thursday, April 28, 2022

PAINTED INTO EXPLOSION

When I tell people that market explosion is inevitable, they always ask me "when is that?". The fact that most people will get wiped out by it is apparently of no concern...

Most people these days assume the past is the future. They are set in their ways and have no intention of changing. Therefore, they happily extrapolate mass insanity into the indefinite future and sacrifice their mental health on the altar of mass consumption. A lifetime of bad habits doesn't change at the end. The idea of adapting to a new reality of less is more or quality over quantity, is never under consideration. This society has been brainwashed from birth to consume at any cost.

We see this all around us at the personal level, people consumed by their addictions. But we see it at the societal level as well. No politician or pundit on either side can tell the public what they don't want to hear. There is no market for the truth these days.

Meanwhile, the average IQ has been collapsing, thereby front-running the next level of widely ignored corruption. Which has left us skeptics of rampant fraud constantly playing catch-up to the next level of delusion. Our many critics claim we have been "wrong" timed in our prediction of the inevitable. Their ONLY concern is "when" NOT "if". The fact that this will all explode one day with extreme dislocation can wait another trading day. In the meantime, THEIR beloved financial weapon of mass destruction grows from one magnitude of destruction to the next.

Granted, no one can predict the future with 100% accuracy. The best we can do is measure the amount of buffoonery that precedes collapse. Which in the current case is on the scale of biblical. Through necessity, the level of buffoonery has had to increase from one larger bubble to the next, according to the law of magical thinking. Central banks in their infinite hubris have constantly bailed out the masses from impending reality. And in doing so they have painted this society into a corner. At this latent juncture, rampant corporate profiteering has forced the Fed into record tightening. They are now hellbent on creating a global depression. At the same time, home gamers are widely told to expect a "soft landing".

Today we got news that Q1 GDP was NEGATIVE. The first quarter of incipient recession. The Dow gained 700 points on the news.

THIS will be the epitaph for this era:

A Fed worried about inflation expectations becoming embedded in a COLLAPSING economy, oblivious to the fact that inflation expectations are ALREADY embedded in inflated stock market valuations:

"The analysis of SEC filings for 100 US corporations found net profits up by a median of 49%, and in one case by as much as 111,000%. Those increases came as companies saddled customers with higher prices and all but ten executed massive stock buyback programs or bumped dividends to enrich investors"

The level of denial is very similar to 2008.

We are constantly told "The consumer is strong", but it's a massive lie as anyone can see:

The Nasdaq is at critical support:

Globally things are far more dire, as the relentless dollar rally collapses the various dominoes which are heading inexorably towards U.S. markets:

Beneath this market is a wall of put options. Bearishness is the highest since October 2008. For a time, a high level of hedging can keep the market from imploding, especially around a major event such as this impending FOMC meeting, which is what happened during the TARP bailout of October 2008. Back then, many investors hedged that meeting so the market rallied into the news. Soon after, the puts expired and the market collapsed.

The next major financial event is what I call "Millennial Margin Call" or MMC. It started last year with the Gamestop debacle and so-called "democratization of markets". Which was merely a euphemism for the ensuing RECORD Wall Street pump and dump.

2022 has the dubious distinction of having the WORST Nasdaq breadth (highs - lows) in market history:

So far miraculously across Cryptos, Biotechs, junk IPOs, SPACs, Chinese stocks, and Ark ETFs there has been NO capitulation. These newbie investors have been taught to "HODL" which means hold on and never sell. Because as long as you never sell, you never have a loss. Of course, this theory means nothing to margin clerks:

"The number of active users fell 8% as compared with December 2021, mostly thanks to users with lower balances engaging “less in the current market environment”

Tuesday, April 26, 2022

WORST CASE SCENARIO

Up until now the bullish pundits have been causing all of the problems, with their perpetual Disney World bullshit. However, now it's the latecomer bears with their half-assed predictions who are causing the most confusion...

So allow me to elucidate what's coming:

It's called THE WORST CASE SCENARIO. Featuring a Fed tightening into global meltdown.

Any questions?

Let's see, worst Nasdaq selloff since 2008. Biggest commodity spike since 2008. Worst consumer sentiment since 2008. The most global rate hikes since 2008. The biggest housing bubble since 2008. The most institutional selling since 2008. And the largest recession stock outperformance since 2008.

Therefore, it MUST be a soft landing, with an 11% probability historically:

"On the morning after Lehman Brothers filed for bankruptcy in September 2008, most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis"