Friday, April 8, 2022

WARNING: HARD LANDING

Wednesday, April 6, 2022

GLOBAL CRASH AND EXTREME DEFLATION

In this post I will focus on the commodity markets and the prospects for imminent crash which would be extremely deflationary...

This linked article makes the case that $150/bbl oil is still likely. Let's tackle the bullish argument before we get to the bearish points. The bullish argument is based upon the fact that the global spot oil market is extremely "tight" meaning there is no excess supply. So tight that the market is in backwardation meaning spot prices are higher than future prices, which is extremely unusual. The other part of the bullish argument assumes that Europe will ban Russian oil and therefore global supply will tighten further. These are the exact same arguments that were used prior to the war. In the months prior to the war, oil was trading in a very wide range between $60 and $90. Volatility was extremely high. When the invasion began, oil sky-rocketed from $100 to $130 in a matter of days. In other words, those who are piled into commodity trades and waiting for the melt-up should be aware that it ALREADY took place.

On the chart below on the left side we see the post-Crimean war collapse. Followed by the China/Fed policy error collapse. In the middle the 2018 Fed policy error crash followed by pandemic. As we see, realized volatility is at a record. The lower trend-line is -50% lower from high to low.

Does anyone remember August 2014? (see circle with "Crimea"):

“I’ve been surprised at the market and have actually taken a loss on Brent and North Sea crude,” he said. “It seems like the world has accepted war in the Middle East. After a while investors say: ‘OK, that’s the way it’s going to be,’ and production hasn’t been cut off any place.”

That $100 prediction didn't last two weeks.

So we see this is all very deja vu, nevertheless I will tackle these fundamental arguments:

First off, the tight spot oil market and backwardation are very likely a short-term phenomenon. The futures market is clearly expecting oil to decline. In addition, if there is a global recession, which appears highly likely, demand will fall. At the same time, supply will adjust to the higher prices and reach market at a time when demand is falling.

We have seen this OVER and OVER again during the past decade. Supply adjusts at the worst possible time.

This chart shows all of the recent times the oil market was in backwardation meaning the USO ETF (futures-based) was gaining value as it approached the spot (front-month) expiration. Each time USO/WTI rose, the market collapsed:

This chart shows that from a global growth perspective commodities diverged the most from China GDP in 20 years. The last divergence in 2014 resolved to the downside to the surprise of T. Boone Pickens.

The second bullish argument is that soon Europe will ban Russian oil imports. We've heard this many times before. The Germans have recently said that won't happen BEFORE the end of this year.

"Germany, the continent’s biggest economy, still gets 40 per cent of its gas from Russia, even after cutting its reliance.

It aims to end Russian coal imports this summer, oil imports by the year's end, and be largely independent on gas by 2024, German Economy Minister Robert Habeck said"

Just this week, German bankers warned that cutting off oil and gas imports will cause a deep recession:

Those are the bullish arguments, now here come the bearish ones:

Every commodity shock since 1970 led to a U.S. recession - 1973, 1980, 1990 (Gulf War), 2008.

Now, both the Fed AND European central banks are in a box. They can't ease policy until they see major economic and financial dislocation. European inflation is running at record levels:

"there are other side-effects from the war, most notably higher energy prices — which are driving up inflation across the bloc. European Central Bank President Christine Lagarde said earlier this week that “three main factors are likely to take inflation higher” going forward"

The global economy cannot AFFORD higher energy prices. Because the current prices are already driving a far too rapid monetary tightening.

In addition, the dollar is now heading higher into the upcoming FOMC:

Last but not least, the International Energy Agency today announced that they will join the U.S. in releasing oil from their strategic reserves:

"Between the IEA and the United States, 240 million barrels of crude oil is set to be released from the world’s strategic energy stores"

The U.S. release of 180 million barrels will be the equivalent of 1/3rd Russian production for the next six months. However, Russian production is still likely to reach the market.

Here we see what happened the last time the U.S. released oil from the SPR - it crashed. This time it's far more technically at risk of...

Margin call.

In summary, it's HIGHLY likely we are on the verge of a massive deflationary commodity crash. And when that happens along with the coincident crash of real estate and stocks, everyone will realize that inflation is no longer the problem.

Tuesday, April 5, 2022

THE BRICK WALL OF "MORE"

Monday, April 4, 2022

Q2: THE MAIN EVENT

Thursday, March 31, 2022

THE GOLDEN AGE OF FRAUD

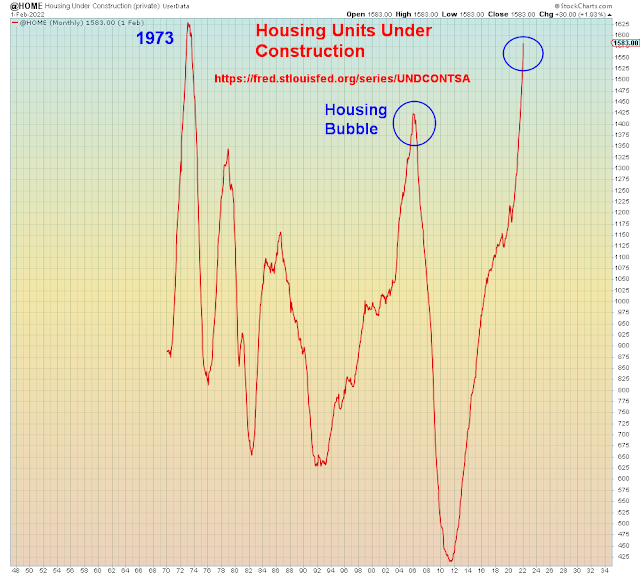

This is a society with a lethal case of hubristic dementia. What we are witnessing is a centrally managed collapse in broad daylight. The Sheeple are eagerly following their trusted psychopaths deja vu of 2008...

This society has survivor bias on steroids. No matter how many people go under the bus, the mainstream message remains rinse and repeat. The ultra-wealthy beneficiaries of fraud continue to push the standard narrative at the expense of the silenced majority.

U.S. policy-makers are trapped in a past that no longer exists. In a stimulus dependent economy, conventional economic models no longer work. The U.S. is now at record economic policy divergence vis-a-vis Japan and China. Those two countries have already learned to respect deflation, and they are both currently in easing mode. Whereas U.S. policy-makers are operating on the basis of extreme hubris in a torrent of disinformation at the end of the cycle.

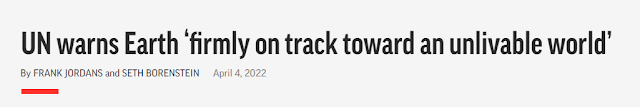

In the meantime, today's CEO salesmen are delighted to push the stagflationary hypothesis to record profit. Stagflation is a call to buy everything - durable goods, cars, homes, stocks, cryptos, gold. Which is why after tax corporate profits just grew the most on record, going back to 1948. It's called profiteering from inflation hysteria, also known as "Shock Doctrine". Never let a good crisis go to waste.

"When taxes are factored in, last year’s corporate profit increases were even more of an outlier. They soared 37% year over year, more than any other time since the Fed began tracking profits in 1948"

Of course to believe today's business pundits, the only "bad" inflation is wage inflation. They are more than happy to turn a blind eye to rampant profiteering. And therein lies their blindspot. They fail to see a consumer on the verge of collapse as prices of EVERYTHING skyrocket at the same time.

Wages are up 8% versus profits up 37%.

Meaning that none of this end of cycle consumption orgy is the least bit sustainable. Somehow it never occurs to these people that THEY bid up all of these prices.

It gets far worse on the market side, because this stagflationary hypothesis which was also extant in 2008 has caused an EPIC misallocation of capital. And ironically it's this misallocation of capital that has emboldened the Fed to embark on the fastest and most brutal tightening in history.

In Q1 global bonds experienced their worst selloff in history. Meanwhile, the Fed stress indicator which includes metrics such as credit spreads, credit conditions, and other risk premia, just this week collapsed to the lowest level on RECORD. The divergence versus 2020 and 2008 is asinine:

Here we see gamblers crowding into commodities and Google searches for "stagflation" are the highest since 2008.

Bubble denial is rampant

"It’s highly anomalous for housing prices to rise over 32% in a span of two years, and so the trend is causing some economists to start worrying about a possible bubble"

The growth rates we are now seeing exceed those immediately preceding the Great Financial Crisis"

The article goes on to rationalize away bubble risk by saying that in this era there are no "shady lending practices taking place" unlike last time. What happened after 2008, is that large banks were forbidden from making "risky" loans to marginal borrowers. So a new industry of shadow banking hedge funds sprung up to be the intermediaries between the banks and the low quality borrowers. These intermediary lenders have "pristine" balance sheets because they were created AFTER the 2008 financial crisis. However, they are borrowing bank money as a pass through to subprime borrowers. I know all this because for two years out of business school our middle son worked for one of these companies, which will remain nameless. He said that just before the pandemic, many of his portfolio companies were running out of cash and were about to get cut off from funding. The pandemic saved them by allowing them to borrow MORE money. In other words, in this cycle credit risk is "hidden" behind a layer of obfuscation, but it's still there and banks are still very much exposed.

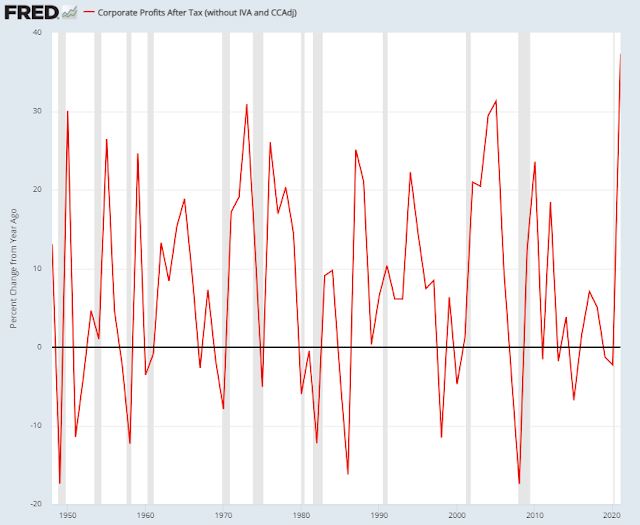

Another thing the article asserts is that this entire melt-up price move is due to the "mismatch" between supply and demand. We heard the exact same argument during the last bubble. When demand reaches a hyperactive state because everyone assumes prices can only go up, that is not sustainable. In addition, in-process supply is at decade highs:

Today's pundits are sanguine because despite yield curve inversion which is now widely discussed - meaning long-term yields are lower than short-term yields - pundits believe that recession is at least 12 months away. For that conclusion they are data mining prior recessions.

However, what they are ALL ignoring is the asset crash risk which will pull that timeframe forward by 12 months.

The impending asset crash will bring recession forward to NOW.

In summary, stonks just ended the worst quarter since March 2020, despite the fact that all risks got bought with both hands:

I call it the "We love rate hikes rally". Which will be followed by the "bidless market collapse".

Tuesday, March 29, 2022

THE END OF THE PONZI CYCLE

In this market, when one fraud ends, another begins. Bulls have an insurmountable advantage in the war of words - not only do they have the full weight of deception on their side, but they have an audience of eager accomplices. Meanwhile, us critics of criminality are the enemies of all that's fun in manipulated markets, and hence perma-boring...

Sadly, as they will all learn the hard way, having your head up your own ass is not a Black Swan event.

There's a scene in the movie Sling Blade where the father (Robert Duvall) excoriates his son (Billy Bob Thornton) for killing the wife/mother for cheating on him. So the son kills the father too.

Here we are - there are no innocents left in these markets. There can be no defense from the supposed unpredictability of a "Black Swan" event as so many have done in previous selloffs.

This is Q1 in a nutshell:

Highest CPI in 40 years (which led to recession in 1980)

Largest oil shock in 50 years (which caused recession in 1973)

Largest global bond collapse on record

Fastest Fed tightening on record (which preceded EVERY recession)

War in Ukraine

And yet all bought with both hands. The ultimate example of moral hazard. Far too many bailouts have led the masses to run towards risk.

Which is why markets just made a round-trip of record deception. Institutions sold, while retail investors bought the dip with both hands:

Individual investors have purchased a net $39 billion of stocks since January, the largest at this point in at least five years"

Institutional selling at market tops has been a "feature" of every end of cycle bull market in history. And late stage retail bagholding has also been a "feature". It's called distribution - and it means large investors selling stocks to the masses.

If at the beginning of the year anyone told you those above risks would abide in three months, would anyone believe the "market" would still be near all time highs? Of course not. This is now entirely about misallocation of capital.

Deja vu of last year when the growth stock led deflation trade melted up and imploded spectacularly in Q1 - we just saw the exact same melt-up in the reflation trade, led of course by commodities. The war was the catalyst for the manic blow-off top, however the reflation rally had been gaining steam since the election, vaccine rollout, and global re-opening in late 2020.

Which is why for the first time in this entire rally since the March 2020 lows, BOTH the NYSE and Nasdaq are now overbought at the same time.

You will note that S&P breadth (top pane) made a large leap up in June 2020 which was accompanied by a record breadth thrust in the NYSE (mid pane). Now we see another surge. Also last year saw the manic melt-up in growth stocks, followed by this echo surge. Anyone can see however, that overall S&P breadth has basically collapsed.

So what we are witnessing is an end of cycle melt-up in ALL risk assets at the same time, amid daily increasing odds of recession. All accompanied by mass denial that it's the end of the cycle.

Many pundits have been saying recently that as long as the twos/tens didn't invert that the rest of the yield curve inverting did not mean recession. Well, now they are wrong, because twos and tens just inverted:

"Some analysts say that the Treasury yield curve has been distorted by the Fed's massive bond purchases, which are holding down long-dated yields relative to shorter-dated ones"

[There is only one problem with that hypothesis which is that the Fed is no longer buying bonds]

"Analysts say that the U.S. central bank could use roll-offs from its massive $8.9 trillion bond holdings to help re-steepen the yield curve if it is concerned about the slope and its implications"

This last part is the dumbest thing I've read in a while. The Fed's asset purchases aka. QE inflate markets and increase reflation expectations. The Fed's asset unwind aka. QT does the opposite - it tanks asset markets and it increases deflation expectations. So how could it possibly steepen the yield curve?

But here is the key takeaway all bulls were waiting for:

"The time delay between an inversion and a recession tends to be, call it anywhere between 12 and 24 months"

Still plenty of time for gambling, so says Wall Street.

Which gets us to the casino:

At today's close, the NDX (not shown) was RECORD overbought going back to 1998.

Here is the Nasdaq Composite with the Nasdaq breadth oscillator:

As I said above, NYSE breadth is the most overbought since June 2020. Which is the last time bond yields spiked this amount. After that reflation trades (Energy, Financials, Industrials, Transports) imploded.

Crude has tested the 50 dma twice. If it breaks, next support is -25% lower at the 200 dma. With far greater potential downside if that breaks.

Recession stocks are leading the end of cycle rally.

Go figure.

In summary:

Here we are back at multi-year overbought. The epic risks of the last three months were sold by the smart money institutions who raised cash. Therefore knowing what we know now. Buy or sell?

If you had been bearish and you wish you had been bullish, here's your chance. And if you had been bullish, and wish you were bearish, you can now flip.

BUT, this time EVERYONE knows the risks.