In the age of scams, the burden of truth is on the truth. The bull case at this latent juncture is 100% fairy tale...

The only good news is that I can confirm for you that this lamestream Cirque Du Jerk is in no way prepared for what is coming.

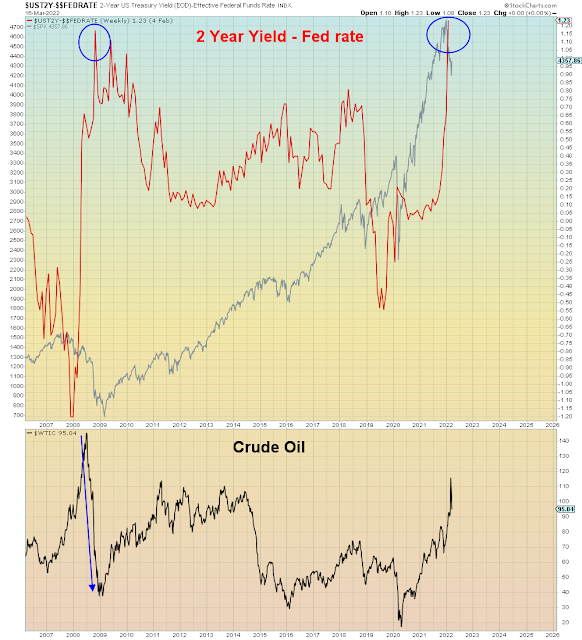

What we witnessed this week will soon be known as the biggest policy error in human history. And who can we thank for that but all of today's bulltards who are convinced that inflation is as bad as 1979. For some reason these people can remember 40 years ago better than they can remember 14 years ago. Why? Because they've assiduously blocked that event from their minds. They forget that commodities were hyper bid in the early Fall of 2008 when Lehman was the last banking domino to implode. They forget that the Fed was preoccupied by inflation.

And they forget that by the time the Fed got around to a full and proper bailout it was too late.

This time last year featured a Tech stock melt-up coming out of the pandemic. It was the deflation trade driven to record extremes by the belief that work-from-home cloud technologies were in the early part of the growth cycle. Deja vu of Y2K when the millennial date change accelerated the expenditure on new technology, the same thing happened during the pandemic. Pull forward of Technology expenditure, featuring the biggest IPO/SPAC pump and dump in world history. By all rights Cathie Wood should have her own miniseries on fraud by now. But instead she is a regular feature on CNBC, the longest running documentary on excess greed in world history.

It was a year ago that the Gamestop pump and dump scheme democratized fraud:

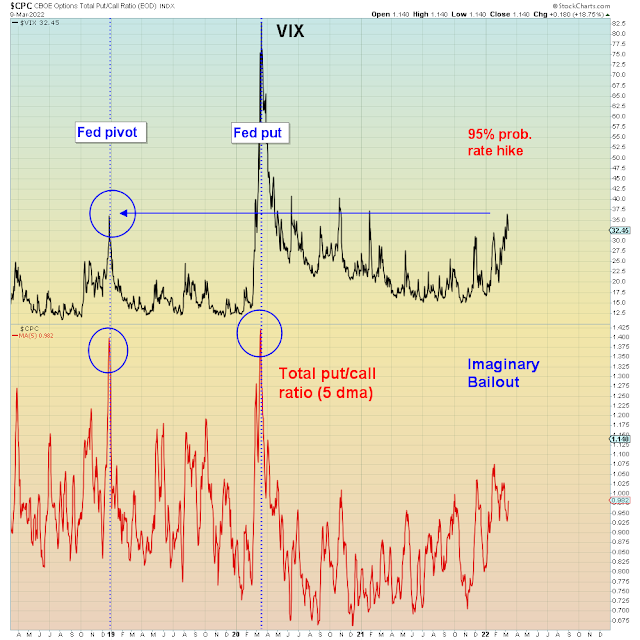

Fast forward one year and instead of the deflation trade scam, we now have the reflation trade scam. Deja vu of 2008, the Fed has now been convinced via commodity Ponzi reflation that inflation is the greatest threat to the economy. What I call the "Stimulus Ponzi cycle": The Fed is chasing their own tail. They inflate markets, they create inflation, and then they pop their own bubble and create deflation. Today's so-called "experts" trust the Fed's ability to create inflation, but they totally ignore the deflationary policy taking place RIGHT NOW.

Coincidence or conflict of interest? You be the judge.

And that is halfway through the month.

Clearly we will see volumes that far exceed today's record level and I predict there will be a long red wick on that nascent reversal of fortune.

This week Tech stocks had their best week since the March 2020 lows. What happened is that hedge funds were force delevered when their record long commodity position exploded into bear market. In the event they were forced to "degross" and therefore buy back their consensus Tech stock short position. Which was widely conflated as a new Tech bull market.

Suffice to say, this is the most deflationary set of circumstances we've seen in two years. Last year was the best shot at inflation due to maximum stimulus combined with the vaccine rollout and global economic re-opening. And yet even then we see that the 30 year peaked in March and imploded lower. This current set-up by comparison will see a MUCH faster collapse in bond yields and return to uncontrolled deflation.

However the scam-riddled stock market is getting bought with both hands under the ubiquitous belief that the pandemic strengthened the global economy.

But really, who to believe? The bond market, or every dunce you know?

The SEC: