A Black Swan nuclear event. What's not to like? Gamblers can finally say "No one saw it coming". And Wall Street now has their excuse to bury clueless gamblers deep in end of cycle trades...

We are late in the crack up BOOM AND BUST. The only thing that can stop Fed-precipitated meltdown, is meltdown. Bulls are optimistic...

On the topic of the war between Russia and Ukraine, the only thing that's clear is that both countries are turning into failed states. Russia has become the new North Korea. We can pray that it doesn't turn nuclear but Putin is desperate and he may deploy a tactical nuke to keep NATO at bay.

In the meantime, the nuclear economic option has now been deployed - a ban on Russian oil and gas. Today the White House announced the U.S. ban and Europe announced they will seek to ban a majority of Russia natural gas over the course of 2022.

In retaliation, Russia is threatening to cut-off ALL oil and gas to the West.

This is now officially the largest global Energy shock since 1973 when OPEC embargoed oil shipments to the West due to U.S. support for Israel during the Yom Kippur war. That event led to U.S. and global recession and the 1974 bear market.

Going into this fiasco, the global economy was already facing tremendous end of cycle risk. So it's highly likely this event has pushed the global economy over the cliff.

Talk of recession is now circulating Wall Street desks, but so far that scenario has remained well out of the purview of Main Street investors who are now trapped in end of cycle trades. Wall Street is now free to say whatever they want to clients, because they can blame this "Black Swan" event for what comes next.

Which is where this all gets interesting.

For the moment, oil is the wrecking ball creating "demand destruction" across the entire economy. However, this event has teed up the U.S. to become the only safe haven on the planet.

Before this war started, China was already imploding due to their real estate meltdown and COVID zero tolerance policy. The PBOC has been in easing mode for several months.

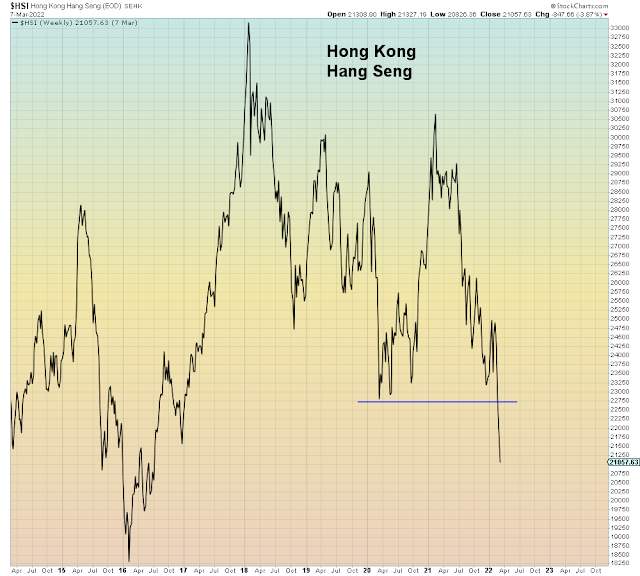

Hong Kong stocks are now well below the COVID lows and totally bidless as one China policy has destroyed their status as a global financial center.

The European Central Bank which meets Thursday this week will likely return to a neutral stance as their Energy markets are massively exposed to this Russian oil embargo. European recession is now getting priced into markets as European stocks go bidless:

EM currencies, EM bonds, and EM stocks are all imploding due to the various meltdown factors and the rising $USD which I will discuss in a moment:

Next comes Japan. Normally, in a crisis scenario the Yen catches a massive bid due to the global carry trade unwind. However, this time the Yen remains weak due to the commodity shock and the record trade deficit. Which is why there is now a massive policy divergence between the U.S. and Japan.

Shock Commodities Spike Threatens to Push Yen to Six-Year Low - Bloomberg

"No chance monetary easing will be reduced"

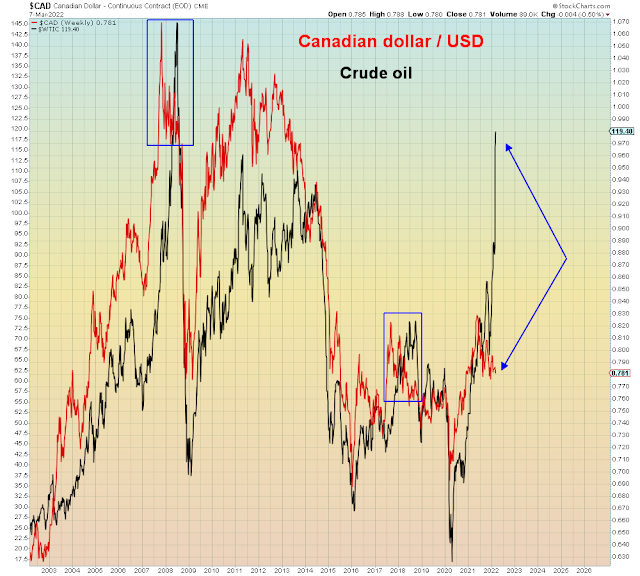

Normally in a commodity super cycle Canada and Australia would be massively outperforming. So far their stock markets are holding up better than most. However, currency wise we now see a massive disconnect between the C$ and oil. This is further indication that oil is totally disconnected from global economic growth. This is the largest divergence we've seen since 2008 and we see how that worked out for oil:

All of which means that the U.S. is the ONLY safe haven left in the world. Which is why the dollar is rising in lockstep with this parabolic ascent in oil.

Whereas oil is currently the global wrecking ball, soon the $USD will become the REAL global wrecking ball. Oil has boxed the Fed into tightening. So either something breaks THIS week due to oil. Or something is going to break NEXT week due to the Fed. The only thing that will stop meltdown is meltdown.

Dollar funding stress is already showing up in global markets this week:

Funding Stress Indicator Surges to Widest Levels Since May 2020 - Bloomberg

"The fear that the impact of the war will create a dollar shortage is rippling through the system"

What would a dollar super spike do to all of the above markets?

In particular it will implode oil, gold, and Emerging Markets post haste. Followed by massive global deflation.

This Thursday we get another CPI report which is expected to run hot.

At least bulls can honestly claim no one saw it coming.

Again.