Wednesday, March 17, 2021

PEAK SUGAR HIGH

Tuesday, March 16, 2021

Another Wall Street "Recovery"

"Automation, in tandem with the Covid-19 recession, is creating a 'double disruption' scenario for workers," said the report published Wednesday in Switzerland by the World Economic Forum, which warns that inequality is likely to increase unless displaced workers can be retrained to enter new professions."

Monday, March 15, 2021

Stimulated Prosperity

One year later and central banks have succeeded in creating human history's biggest pump and dump scheme. They couldn't have done it without Reddit, Robinhood, and comatose regulators. The over-stimulated losses will be astronomically unaffordable in the worst economy since 1930. All of today's economic predictions are now riding on the biggest bubble in human history...

One year since the steepest depths of the March 2020 crash and what has changed? Gamblers are throwing their third stimulus check into the casino this week in order to bid up their stimulated prosperity:

"During the “hope” period, between March and November, healthcare and technology stocks soared at the expense of financials, airlines and others hit by contracting economies and travel bans. The two sectors now comprise 42% of global equity market capitalisation compared with one-third before the pandemic hit."

On the chart below we see that at the February highs last month, the one year Nasdaq % gain equaled the melt-up in Y2K. As we see, the uptrend line was never broken. The "bear" market of last year doesn't even register on the weekly rate of change (lower pane), that's how fast the rotation from cyclicals to Tech stocks took place.

Now, deja vu of Y2K, markets are reversing out of Tech back into cyclicals. Gamblers are under the firm belief that cyclicals can take over from the Tech/healthcare sectors that now dominate market cap. Unfortunately, the Dow's outperformance into this top is the greatest in history, going back 100 years. Only today's copious fools would believe this will continue, which is why it goes unquestioned.

This is a far deadlier set-up than what occurred in Y2K.

"It is a common saying that smart money is out of market in such formation and market is out of control. In its formation, most of the selling is completed in the early stage by big players and the participation is from general public in the later stage."

"Retail investors are continuing to jump into the market in droves even after the dust has settled from the GameStop trading saga."

How to explain to the grandchildren that a massive pump and dump scheme was the reason traders flocked to the markets at the end of the cycle?

Of the three major rallies in the past five years - two of which already failed, this one is by far the fakest, and least questioned.

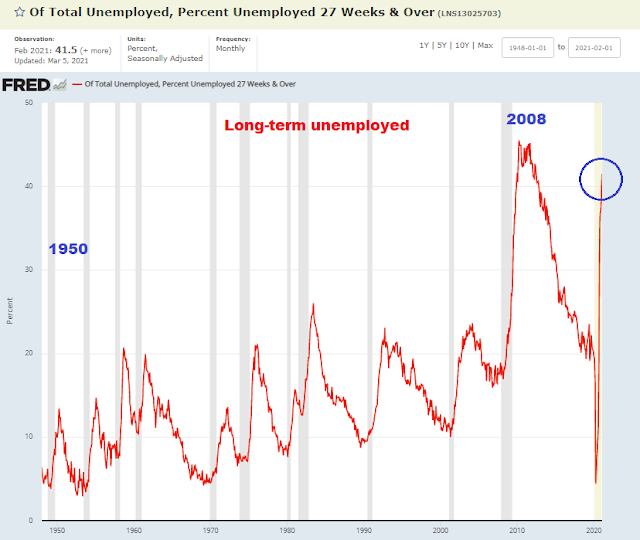

The global Dow has been decade overbought for four months now. Looking at this chart one would have no clue that this is the weakest global economy since the Great Depression. Job losses are four times worse than the 2008 Great Recession.

What all of today's "experts" have forgotten is that monetary policy no longer stimulates the economy, it only stimulates markets. On the fiscal side, the U.S. economic multiplier has collapsed to the point at which a 20% of GDP deficit is only producing 4% GDP growth in 2021. As the third stimulus gets distributed this week, risk markets are once again running on glue fumes. Policy-makers have succeeded in creating the biggest divergence between fantasy and reality in history.

Large even by today's dumbfuck standards.

The top performing sector making new all time highs this week happens to be micro cap stocks - the junkiest stocks in the entire market.

In summary, when the largest financial WMD in human history explodes at the new permanent plateau of delusion, "without warning", the financial dislocation will be epic.

And the sheeple will no longer trust stimulated prosperity and the "experts" telling them to believe in it.

All it took to achieve record complacency was a global pandemic depression, and record printed money, the secret to effortless wealth.

Sunday, March 14, 2021

Fake Recovery: MAX PAIN TRADE 2021

Saturday, March 13, 2021

2021: The Age Of Assholes Is Ending

Thursday, March 11, 2021

FOMC: Fear Of Missing Crash

The dumb money has only one thing going for them - printed money and a lifelong commitment to pursuing effortless wealth...

Recall what Hugh Hendry said about Disney markets and those who place their faith in them:

"The enlightened chose the red pill, and so are convinced that they understand everything which has become illusory about today's markets...They know that today's central bankers are spinning a falsehood of recovery; they steadfastly refuse to be suckered in by the euphoria of a monetary boom; and they are convinced that they will therefore be spared the consequences of the inevitable crash. Everyone else, currently drugged by the virtual simulation of prosperity and its acolyte QE, will be destroyed"

Any questions?

It's that time again, when all of the big central banks are reporting their money printing plans for the future. Today it was the ECB's turn to surprise investors with a bigger money printing plan than expected.

So far, this week is the exact inverse of last week. Last week the market was crashing from Monday to Thursday and then it rebounded Friday which set off this week's rally. In retrospect, last week was a bear trap. This has been the biggest five day rally since Biden was elected four months ago:

This is where it gets interesting.

Last March, Tech stocks became multi-year oversold and then bounced on a Friday. This current rally off of one year oversold conditions is the analog of last year's rally with a couple of minor differences. First off, this decline was larger in % terms than last year. And this rally has so far been one day longer and has reached a more overbought level (lower pane). However, clearly relative to the all time high, this year is a weaker retracement:

Moving on to the Nasdaq 100, we see a similar picture from last year. However, we see that down volume on the Nasdaq was epic this year meaning that dollar volume is already far greater than it was in all of March last year. And yet so far the price damage is far less than the full extent of last year's decline:

Of course, what is driving the Dow and S&P to new highs are cyclical stocks which are the INVERSE of last March.

Cyclicals are multi-decade overbought (top pane). A routine retracement back to the 200 dma is now a deep bear market away.

We learned this week that only six stocks out of 30 account for all of the Dow's gains year to date. Because the Dow is price weighted versus market cap weighted, Goldman Sachs alone accounts for 36% of the gains.

Only four stocks confirmed the Dow's all time high on Thursday:

Europe is now leading this global headfake rally, however we have reason to believe this latest fiscal stimulus rally is running on the same glue fumes as the Trump tax cut rally:

Outside of Europe, the global market that is most interesting is China where deja vu of 2015, Chinese policy-makers are doing everything possible to prevent a meltdown. Back in 2015, they banned short selling, they halted the market for days at a time, then they banned institutions from selling. Nothing worked. The total loss was -60% and the rest of the world was accidentally imploded.

A cautionary tale for those Millennials who assume central banks are invincible.

"Chinese stocks fell more deeply into correction territory despite state-backed funds, known as the "national team," intervening to ensure stability"

The Chinese stock market has dropped sharply from recent record highs over concerns that equities are overvalued and exposed to the impact of rising US bond yields."

What was it that imploded global stocks in 2015 and 2018? Rising U.S. interest rates: