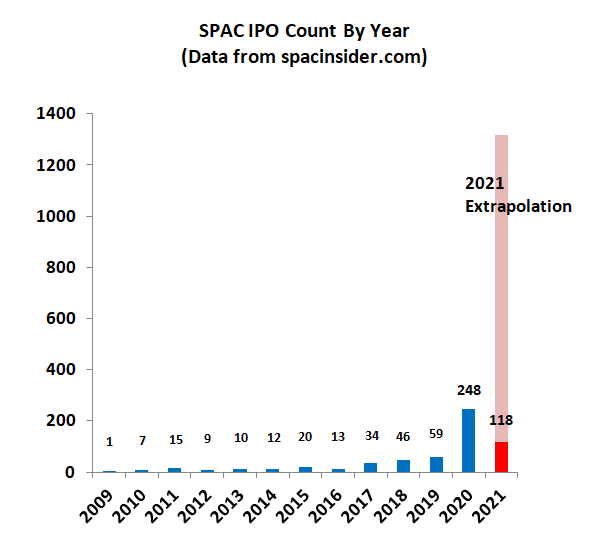

This era will forever be known as the time when Ponzi schemes went mainstream. Bernie Madoff is wondering why he is still in jail...

The fates have allowed for one more post prior to the end of the week.

It's a timely moment to reflect on the fact that ALL asset melt-ups end badly. There have been no exceptions in human history. Asset bubbles form slowly and imperceptibly, however as they continue they become more and more asymptotic aka. vertical. Along the way they attract more leveraged momentum capital - short-term speculators looking for a quick buck at everyone else's expense. By the end there is far too much leveraged capital chasing glue fumes. When the momentum reverses the leverage unwinds, painfully. Hot money is what implodes asset bubbles.

In every bubble there are of course the true believers. The buy and holders who believe the underlying narrative driving the bubble. These are the people who get demolished by the inevitable bubble implosion. Most bubbles turn out to be ephemeral, however, a handful go on to become the household names of our time - Microsoft, Amazon, Apple etc. Nevertheless each of those aforementioned stocks during their time has exploded and lost the majority of their value. In the curious case of Apple, that company went from being the most successful personal computer company of all time (early 1980s), to being crushed by Microsoft (late 1980s), to $3.56/share and bailout from Bill Gates (1997), and now back to the most valuable company in human history with a market cap of $2.25 trillion. For Microsoft the last major wipeout was Y2K when at all time peak revenue and earnings growth the stock went vertical and exploded in 2000, losing 70% of value in one year. The most profitable company in history that everyone assumed could never go down, was dead money for 15 years. Yes, you read that right. The Y2K high was finally eclipsed in 2015. That is the best case scenario - a software monopoly having the largest profit margins in U.S. history. For every other asset bubble it goes downhill from there. In a market such as this one, most of today's bubbles are merely call options on the cycle. At the moment they have unlimited access to cheap capital to fund their profitless ambitions. What today's newbies call "total addressable market" (TAM), which is code word for no revenue and no earnings. In this environment it is widely believed that fundamentals do not matter. However, when the cycle ends and the credit markets slam shut, companies with a high cash burn will implode. That is the fate that met most Dotcom companies. This time however, the capital lockdown will be far more brutal.

The last time we saw a spike in the Russell / Dow ratio on this magnitude, was the last time the credit markets slammed shut:

Fittingly, Bitcoin which creates absolutely zero value, has become the locus of this global everything bubble. Bitcoin is up 175% since the election - from $13,000 to $49,000 - making it the most overbought asset class on the planet. However, in addition it is now massively over-owned, as hedge funds have belatedly jumped on board the runaway train. In addition, Square and Paypal are now allowing their users to buy Bitcoin directly through their mainstream Fintech platforms. One analyst stated last Fall that Square and Paypal are now the largest buyers of Bitcoin. However, more recently, other analysts have claimed that the Bitcoin trust has become the largest buyer. And who is the largest buyer of the Bitcoin trust? It's the Ark Funds Web ETF run by the "Money Tree" Cathie Wood, head of the fund family that has garnered the largest asset flows since the pandemic began. And then of course Tesla now owns Bitcoins.

The three largest holdings within the Ark Web ETF are now levered to Bitcoin:

There is now a Ponzi Bitcoin, inside a Ponzi Bitcoin trust, inside a Ponzi ETF, all of which are seeing record fund flows:

As with all bubble narratives, there is a grain of truth at the center of the Bitcoin bubble. Gamblers now believe that all of this stimulus will lead to hyperinflation and dollar debasement, and of course it very likely will in the fullness of time. However, to believe that the dollar is a greater risk than a Ponzi asset class with a past history of crashing 80%, is a fool's gambit of the highest order. It's jumping out of the pan into the fire. Long before we get to hyperinflation, the asset bubble fueled in no small part by front-running hyperinflation, will explode. An event that will lead to hyper-deflation.

The $.9 trillion in stimulus that was passed less than two months ago is already wearing off. Apparently a trillion dollars doesn't go as far as it used to.

Today's newbie gamblers can be forgiven for never having experienced a Dotcom bubble or a housing bubble. They have no idea how much fun it can be when it all explodes "without warning". Nevertheless, they are making up for lost time in this everything bubble.

When everything explodes at the exact same time, they will catch up fast.

Gold knows what's coming, which is why I still believe it will bottom first.

So the question on the table, will Bitcoin be the wafer thin mint that explodes the pyramid asset bubble?

We will soon find out, in any time zone.