Wednesday, January 6, 2021

The Crack Up Boom And Bust

Tuesday, January 5, 2021

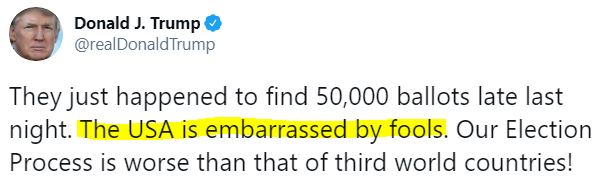

This Election Is Rigged. To Explode...

"Desperate, deluded and dangerous, President Donald Trump drove America deeper into a political abyss on Monday night in his zeal to steal an election he lost and to destroy faith in the democracy that fairly ejected him from office."

"Rarely, if ever, can a year have started with price levels in emerging markets looking so divorced from the fundamental backdrop"

Sunday, January 3, 2021

2021: Everything Is Broken

Saturday, January 2, 2021

The Millennial Asset Supernova

Central banksters, investment advisors, economists, and over-lubricated gamblers are of the groupthink mind that no amount of monetary heroin overdose is "bad" for Disney markets. That efficient money printing hypothesis is about to get system tested by a Black Swan event called "Sell". Something not one of them has thought about...

Millennials are throwing themselves at their first ever asset bubble, having never experienced a bear market in their lifetimes. They view their total lack of experience as their secret to being expert money managers. Old time pros who stick to arcane measurements such as valuation know nothing in this new world of pandemic investing. McDonald Trump's only legacy is that he turned being an idiot into a virtue for millions of aspiring followers. He broke down the IQ barrier, so now anyone can be president. A pioneer in his time.

"Why didn't anyone think of this sooner?"

Way back in Y2K when the Dotcom bubble imploded, Tech stocks (Nasdaq) lost -80% of value from high to low in a mere two years. The S&P 500 lost -50%. Now, amid record IPO issuance, record speculative trading volume, and Dotcom valuations, market bulltards are admitting that all signs are as frothy or worse than the Dotcom era, but don't worry, be fat and happy. We have depressionary interest rates to bail us out. What could go wrong?

The main difference between the Dotcom era and now is that during the Dotcom era the recession that resulted from the bursting of the fake wealth bubble was relatively mild. Why? Because the Fed had 6.5% of interest rate cushion and they used most of it to dampen the economic dislocation.

That won't be the case this time around - these same record low interest rates being used to justify infinite valuations, will be like landing on economic pavement when the bubble collapses.

Robert Prechter (EWI) talks about "all one market", meaning that in times of excess speculation all asset classes reach a correlation of 100%. We saw it again in March, when everything crashed at the same time: Stocks, junk bonds, corporate bonds, muni bonds, gold, Bitcoins, even Tesla. It was an everything crash. The Fed as I showed in my prior post, worked hard to get the Treasury bond market under control, because at first even Treasuries got monkey hammered. Everyone was clamoring for "cash" meaning money markets and t-bills.

By creating a far bigger asset bubble than the one that existed prior to COVID, central banks have encouraged Millennials and many others, to throw their precious savings and rent money into junk assets.

The economy that will abide on the other side of the asset explosion will be a depression. The Fed will have no control over that outcome. For many millions of service workers, it is already a depression. However, for the stay-at-home gambling class, this will be their turn to go under the bus.

Under the current deflationary paradigm known as "capitalism", Congress will always be behind the curve on stimulus. It took 7 months to reach a bipartisan agreement on this last stimulus bill, with millions on the brink of starvation.

There is going to have to be serious rioting to get the "system" to change.

So while there are no shortage of cheerleaders right now cheering the fact that Bitcoin keeps going higher, it's only a function of inflows of valuable savings getting thrown away. What is driving Bitcoin right now is a liquidity squeeze and "scarcity". The mantra of Bitcoin cult investors is the same as the mantra of Tesla investors, and for that matter the same for S&P 500 401k buy and holders - one must buy and hold and never sell. As long as you never sell, you never have a (realized) loss. In their view scarcity is what drives the price higher. Underlying valuation has nothing to do with prices. What these people are attempting to do is corner the market for Bitcoins and Tesla stock which has led to the parabolic ascent of both assets.

Unfortunately, these people have no clue how markets work. What some moron pays for an asset yesterday has no bearing on what it will fetch today. Just because someone pays a million dollars for a brick doesn't make all bricks worth a million dollars.

Scarcity and lack of liquidity cut both ways, which is why large institutions avoid illiquid asset classes. On the way up, illiquidity means that small trades can move the market. However, it works the same way on the way down. Small trades can push prices down very quickly. Lack of liquidity is a lethal proposition for speculative markets. It means that prices are prone to crash. It should come as no surprise that both Tesla and Bitcoin were down -60% in March, almost double the market decline.

"Investment inflows into the world's biggest publicly traded Bitcoin investment trust are pivotal to the price of Bitcoin (BTCUSD), according to a recent report from strategists at JPMorgan"

Whenever inflows are critical to the price of an asset class, you know that it's a Ponzi scheme masquerading as an investment.

"Wood left her closest competitor trailing by 60 percentage points"

She also delivered a total return (income plus appreciation) that is 11 times the gain for the S&P 500"

ARK Genomic Revolution has attracted record monthly inflows in December, bringing the fund's new money total for 2020 to $4.7 billion"

"How does she do it?"

"Romney's statement comes as the federal government's Operation Warp Speed had promised that 20 million doses would be administered before January 1...only 2.79 million have actually been administered."