Until now the past has belonged to those who traffic in economic and financial science fiction on behalf of an eager audience. We have now entered the most lethal phase of Kool-Aid addiction. What I call Monetary Euthanasia...

Other than lying continuously, there is no economic plan for the future.

This society has fully regressed into the infantile fantasy that the consumed past must be the same as the future. The MAGA Kingdom was the ultimate embodiment of this delusion - an exorbitant vacation from reality that accelerated the process of cannibalizing the future for a good time today. Which is why today's financial predictions are 100% science fiction extrapolated upon economic astrology. Never before has the gap between fantasy and reality been this wide. And why shouldn't it be, considering the fact that the world's wealthy have GAINED in wealth throughout this pandemic:

"40 million Americans filed for unemployment during the pandemic, but billionaires saw their net worth increase by half a trillion dollars"

There are a couple of reasons for this increase in billionaire wealth - the first reason, is the effect of monetary liquidity increasing global asset values. The second effect is even more destructive - the decimation of small business and the increase in market share accruing to global multinationals. This pandemic has massively increased corporate control over the erstwhile "economy".

Which is why today's economic predictions are a lethal fiction. The current depressionary level of unemployment will persist far into the future. Poverty has increased exponentially during this pandemic and the rate of job creation is far too slow to repair the damage in the short-term.

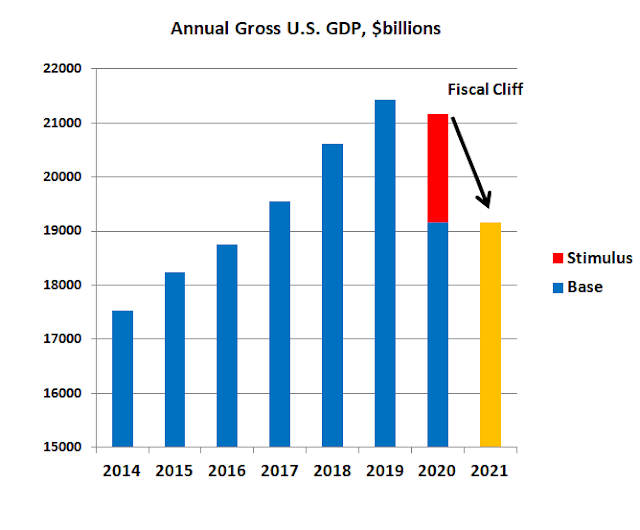

The economy has lost five years of jobs. Consider that fact in the face of record small business decimation.

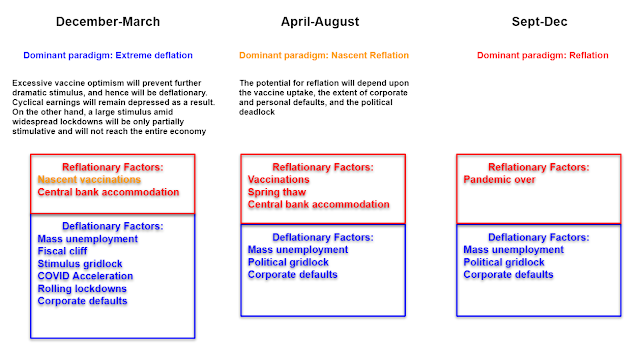

All of which means that the "economy" is broken and it's now permanently dependent upon fiscal and monetary stimulus. The Fed IS the economy now, to the extent that they can monetize Federal stimulus programs. However, none of this post-COVID economic reality is baked into today's rosy predictions of an imminent vaccine cure and sky-rocketing economic growth - the ubiquitous "v-shaped" recovery delusion. Add in political gridlock which will be inherently deflationary and a COVID mega spike into the darkest depths of winter. It's on top of this economic house of cards, that Wall Street extrapolates their stock market Ponzi forecasts for further record bubble expansion in 2021.

Those who have questioned this extrapolation of insanity have been pilloried by the media and other Ponzi pundits who predominate in this era:

The zero interest rate regime that has existed for over a decade has been a constant warning that the past will not be the future. Nevertheless yield-starved pensions have piled into secondary markets seeking a zero sum Ponzi gain from asset bubbles. Value investor John Hussman expounded upon the Grantham warning:

"It’s worth understanding what the present combination of depressed interest rates and extreme market valuations implies for long-term and full-cycle investment returns...In nearly a century of data, including the market extremes of 1929 and 2000, this estimate has never been lower than it is today"

The equity component, is more negative than at any prior point in history. I’m not terribly surprised that Grantham is presently advising a zero allocation to U.S. stocks here...I continue to view safety nets and tail-risk hedges as essential.

Over on Barron's this week we learned that those closest to retirement are now driving this manic reach for risk:

The financial services industry is in FULL Bernie Madoff mode now, aided and abetted by the financial media, and economists. Today's financial and economic pundits have happily squandered their credibility betting on this permanent plateau of mass deception.

As this deception reaches its most manic phase we are about to see a level of financial and economic dislocation few people could possibly imagine. And then in an economy and stock market entirely dependent upon debt accumulation, we will see mass corporate deleveraging, as Wall Street's earnings forecasts turn to dust and blow away.

Corporate debt, $ change:

We are about to fall into a massive deflation trap, which will require a paradigm shift in ideology in order to escape. A paradigm shift that the GOP and even many centrists will resist strenuously. I am referring of course to a universal basic income, which has now been necessitated by this serial economic con job.

Until that happens, deflation will continue to rise inexorably as will poverty.

At that point everyone will understand that this system of serial fraud has failed. And today's financial and economic pundits are con artists who can't be trusted.

The lesson these infants should have learned 12 years ago when they bailed out the criminals.