Wednesday, November 4, 2020

NO LEADERSHIP

Monday, November 2, 2020

Epic Clusterfuck: Base Case Scenario

All of the pundits are out war gaming the election scenarios and market outcomes, so I have to do my part. The biggest risk markets face is the fact that if Circus Donny doesn't get his way, he is going to have a biblical temper tantrum...

Soon we will know whether or not human history's largest pump and dump will continue. Or explode.

First off, we know that with less than two months to go Wall Street is leaning hard into the end of the year. They can't afford another SNAFU like 2016 when Trump won and the market exploded higher to everyone's surprise. Which is why CNBS all star bulltards such as Tommy Lee are saying that every election scenario, including a contested election will bring a happy ending for gamblers. This guy should have never quit his day job as drummer for Motley Crue. Nevertheless, he predicts a blue wave as his base case scenario, so let's start with that possibility.

He admits that under a blue wave scenario the Democrats are going to come out swinging against the mega cap Tech cartel. So take the largest sector off the table. He neglects to mention that Democrats are also going to monkey hammer Wall Street back to Dodd-Frank land. So take the second largest sector, Financials, off the table. Then they will go after the healthcare cartel, so take the third largest sector off the table. After that they will put taxes back to where they should have been this entire time. What the barely recognizable drummer from Motley Crue turned investment guru forgets is that before any of the aforementioned takes place, Big Donny is going to have a big hissy fit and pass nothing until inauguration. Leaving the cyclical trade also bidless.

That's the best case scenario.

The second scenario he posits is a Trump win. For some reason, Lee doesn't consider who wins the Senate. He fantasizes an even bigger rally than the blue wave, so we have to assume a red Senate, meaning the exact same gridlock we've enjoyed for months now. First off, what no one expects is that China will implode if Trump wins. The top performing stock market of 2020 will get monkey hammered one day ahead of the largest IPO in history.

Meanwhile, the stimulus impasse that has continued non-stop since stimulus lapsed at the end of July will continue. McConnell has already said there will be no stimulus until 2021 at the earliest. A Trump win will only encourage him to continue his overarching goal to implode blue states. In that scenario, bond yields collapse, the muni bond market explodes, and the cyclical trade goes bidless.

The scenario that Tom Lee omits is a Biden win with a red Senate under McConnell. In that scenario, stimulus impasse deepens and Trump throws a bitch fit until inauguration. Not pretty.

Last but not least is the wholesale clusterfuck that I expect. A contested election that drags on for weeks. Tom Lee expects markets to defy the Y2K analog and rally, albeit on a muted basis. One would have to be smoking crack to believe this guy, which is why he is the go to guy on CNBS.

If we look to one chart that sets the table for Tuesday, it would be this one of the almighty Dow.

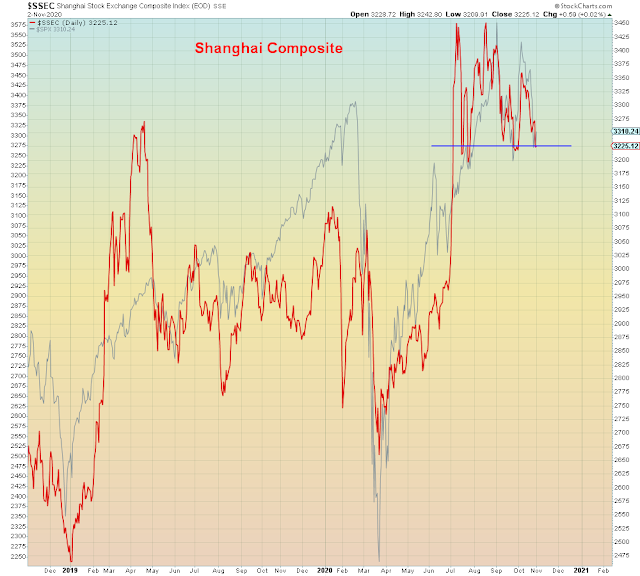

The Shanghai Comp is standing by to get monkey hammered by an unhinged nut job and history's most leveraged IPO:

“This is huge: the largest IPO ever, priced at the top end and now this huge premium in the gray market,”

“It’s pretty extraordinary given the backdrop and it shows you how much Asia is decoupling from the United States.”

What could go wrong?

The virtual economy is at the precipice

In summary, we are about to find out whether or not four years of incessant bullshit is about to turn back into a pumpkin.

The Global Dow peaked in early 2018, almost three years ago, when the rest of the world decided they had seen enough greatness to know that it should never get re-elected.

"Seven Billion Morons Can't Be Wrong"

Sunday, November 1, 2020

Rapacious Criminality Rigged To Explode

Saturday, October 31, 2020

Slowly At First. Then Sumamabitch!!!

Picture the March market meltdown, but this time with the economy pre-imploded, no fiscal stimulus, and no Tech stock "safe havens". Because that's what's coming...

The best case scenario for today's capitalist stimulus whores, post election, is three months of lame duck inaction deja vu of 2000 and 2008. The worst case scenario is civil war.

As always, the burden of proof is on us skeptics of denial.

History will say that after 2008 the world went full Japanification - the overuse and abuse of monetary policy to offset extreme economic deflation, in the absence of real economic growth. The increasing use of debt to paper over the deflationary impacts of too much debt. Because who wouldn't believe we could borrow our way out of a debt crisis? It was all running out of gas four years ago in 2016 when Trump did what every Ponzi economist had been recommending for a long time - he jacked up the fiscal stimulus to level '11'. Reflation soared for a while in 2017, but then the sugar high wore off and was replaced by the higher interest rates Trump himself had predicted, but before he became president. Net of the one time tax repatriation gimmick in 2018, Trump's tax cut had a negative economic multiplier due to the higher interest rates. In the fourth quarter of 2018 the economy lapsed back into deflation and the market crashed. Then the Fed pivoted in early 2019 back to easing mode. Once again, reflation expectations soared and then crashed towards the end of the year. Since 2008, with each iteration of stimulus driven "reflation", the Tech bubble grew in magnitude as the real economy disintegrated. Each rotation saw a larger migration of market cap towards the "virtual economy". For a few of us realists this term "virtual economy" is merely a clever play on words. For most people today, it's the core of their portfolios.

Then of course COVID came along and accelerated all of the trends that had been growing since 2008. After the March COVID crash, the virtual economy trade sky-rocketed. For a while, the reflation trade played catch-up but then it imploded in June when the stimulus ran dry. At that point the virtual economy trade went into melt-up mode into September. Then it crashed. Shorts moved in for the kill as Nasdaq futures short interest sky-rocketed. Then the blue wave fantasy took hold and the fake reflation trade was revived one last time. Every day for almost a month Pelosi and Mnuchin told us a stimulus deal was imminent. It was never going to happen. The work from home trade made one last blow-off peak in mid-October amid record call option speculation.

All of which means that central bank managed social mood is finally rolling over hard in front of the election.

The worst possible time for King Donny:

Bears got rinsed at the bottom in September, and bulls got rinsed at the top in October:

All of the above points to the fact that after over a decade of rotation, the virtual economy and the real economy trades are finally on the exact same footing: Bidless.

Visa has been a key beneficiary of the COVID cashless virtual economy. And yet that stock exploded back down to March levels this week, due to its exposure to the travel sector:

This past week, stocks had their worst week since March, as ALL of the MAGA Tech stocks reported earnings. Despite exceeding Wall Street's massaged "expectations", they all tanked, except Google which gapped up to the highs of the day and sold off all day on massive volume.

We have now seen peak Tech:

As far as the continuing stimulus impasse now several months old, Nouriel Roubini does a great job summarizing all of the dirty tricks Republicans will employ next week to subvert democracy. None of which will be "market friendly". Unlike Al Gore in 2000, we can be assured that Trump will not graciously concede for the good of the nation. He will fight on tooth and nail until he is either in the White House or jail.

As far as the pandemic goes, we are now entering the parabolic phase of the virus. Cases are expected to peak in November and the death rate will peak in December:

"The top five records in daily cases have all been reported within the last eight days, according to Hopkins data"

In summary, we are entering a period that will feature extreme political dysfunction/stimulus impasse, record pandemic impact, and an exploding Tech bubble. All while the economy implodes without stimulus.

Right now, there is no bullish case. There is only record amounts of bullshit. Hanging by a thread of well-cultivated delusion.

Buckle up.

Soon everyone who didn't see this coming is going to be pissed off. Meaning everyone we know.

Friday, October 30, 2020

Gambling Through Civil War

"Exxon is confronting one of its biggest crises since Saudi Arabia began nationalizing its oilfields in the 1970s. If the company takes the full $30 billion impairment, it will be the industry’s worst in more than a decade, according to Bloomberg data."

Thursday, October 29, 2020

Party Like It's 1929

No, they don't see it coming. They have a perfect track record to maintain, and easy money to count on...

Watching Fast Money tonight, one of the guests was Tony Dwyer of Cannacord Genuity. He enumerated all of the unprecedented risks - the raging pandemic, existential election, stimulus impasse, geopolitical rancor, but he forgot a few things: the imploded economy, record jobless claims, record Federal debt explosion, technology bubble, global deflation, looming credit crisis, and the bear market in the average stock. Which is why he's still bullish. Because to offset all of those ludicrous risks, he believes the Fed can support the market through it all. Free money. That's it. The Fed versus $350 trillion in misallocated capital in a 1930s economy. He got no pushback from the Fast Money traders.

Over on Marketwatch, behind their new paywall which I have yet to sponsor, this is one of the top headlines:

First off, this is the type of headline for some reason I would never publish. It's called tempting fate to destroy all future credibility. Secondly, it's patently not true, as indicated by current level of bullish active manager positioning (NAAIM), the Barron's October Big Money poll, record call option buying, Rydex bullish asset positioning, the Ameritrade Investor positioning index, and then there is the CBOE Skew index itself which was created specifically to measure crash risk sentiment:

"Prior to the stock market crash of October 1987, investors were not sensitive to tail risk and the curve of S&P 500 implied volatilities had the shape of a smile. Post-crash, investors started to hedge their exposure to tail risk by purchasing S&P 500 puts with low strike prices. This shift in demand bid up the prices of these puts relative to their value under a normal distribution. Black Scholes implied volatilities calculated from their prices therefore increased and transformed the implied volatility smile to a skew. When investors become more concerned about the potential for a market decline, SKEW increases and the implied volatility curve tends to steepen"

In other words, when skew is high, it means that gamblers are actually positioned for a crash. What they say in a sentiment poll, is another matter.

The current skew is not high. The highest level was two years ago in October 2018 right before the mid-term election, when the market tanked -20%.

Apparently, risks have receded in the meantime.

On the side of not seeing it coming, is history's largest IPO and Alibaba fintech spinoff "Ant Group", now scheduled for right after the election:

What could go wrong?

The locus of thermonuclear detonation will be the well conditioned rampant denial over the economy. No matter how bad the economy becomes, Republicans never stop believing that reflation is right around the corner. After all, their portfolio balances reflated months ago.

This past week we got news that net bearish Treasury bond shorts reached a new record. These people have been wrong for two years straight, as deflation has been continuous since the tax cut. Now in the depths of an accelerating pandemic, they've decided to go ALL IN on a position that exploded after the election in 2008.

Suicidal.

Sadly, the Fed can't bail out everyone.

And when the riots start they won't.

One more reason to buy stocks:

Civil war

“Maybe I’m just looking at the news too much, but there are hints of civil war depending on who wins,” Ms. Johnson said