Today's gamblers appear to forget that we're already in a bear market for everything except bullshit. The days of recycling the same lies over and over again are coming to an exceptional end...

Over the past decade, with each monetary pump and dump, global markets have been slowly disintegrating along with the economy. Today's gamblers can't see this risk because they have conflated printed money for "reflation". Most of the damage has already been done. All we are waiting for now is the revelation, which will be appropriately biblical in scale.

The equal weight S&P 500 bears the scars of sector by sector disintegration - each decline becoming more explosive:

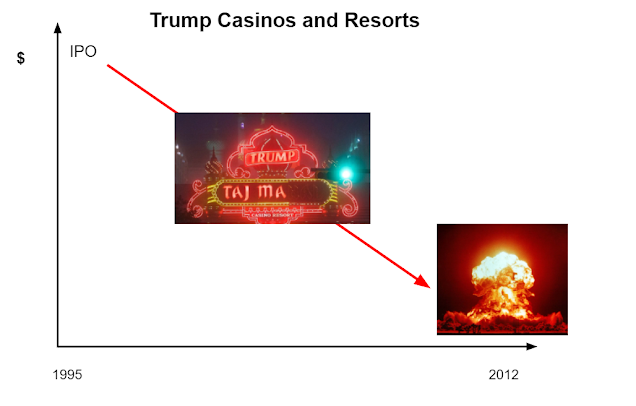

The economic cycle is over. However, we have entered a period of overwhelming denial. Disney markets on steroids. Aided and abetted by record levels of financial industry conflict of interest bullshit. These psychopaths have shunned traditional economics in favor of central bank pixie dust. This extended overtime for casino gambling is courtesy of monetary euthanasia creating a Tech bubble during a pandemic depression.

This chart gives an inkling as to the magnitude of dislocation that is about to arrive totally unexpectedly:

This is the near-term version of the same chart above.

I think we all see where I'm going with this:

Aussie stocks tell the tale of what's happening on a global basis.

The Casino Class is the sole recipient of monetary socialism which is why they are entirely blind to the mass poverty unfolding in broad daylight. Supply Side GOP policies have always been inherently deflationary due to the strip mining of the middle class to increase returns on capital. And yet for some reason these psychopaths NEVER stop expecting reflation to return. They never give up on the delusion that their failed policies will magically create the widespread prosperity that these same policies have destroyed.

Why? Because they're idiots who believe their own exceptional bullshit. What I call human history's biggest circle jerk.

And therefore they have no clue that the cycle is over. According to them, the longest cycle in U.S. history - that has been disintegrating over the past decade, is now early cycle.

You can't make this shit up:

"For the first time since February, more investors say the global economy is in an early cycle phase rather than recession"

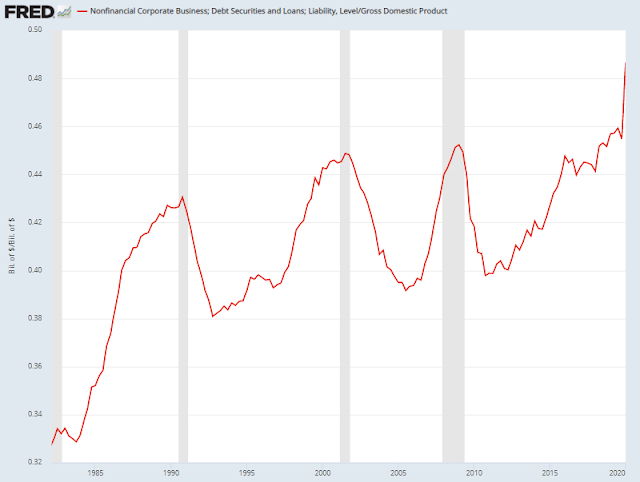

We are in sudden death overtime of the longest life supported cycle in U.S. history, and these dunces think it's early cycle. Which is why they've been onboarding debt at a lethal rate:

Corporate debt as % of GDP:

Continued from the article above:

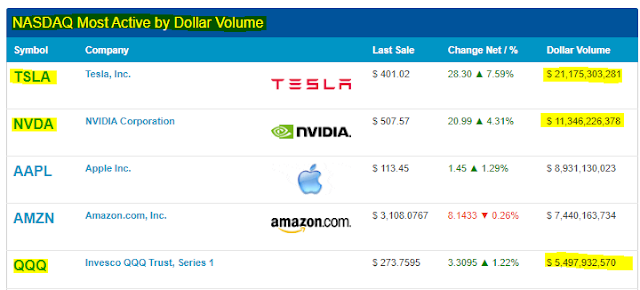

"investors allocated more cash to industrials, small capitalization stocks and value at the expense of technology, healthcare and large caps"

In summary, thanks to non-stop GOP propaganda, these morons are rotating out of an imploding Tech bubble into stocks that are already in a bear market.

Any questions?