The modern version of "capitalism" consists of absconding with as much money as possible from any source available. What used to be called "theft", is now called "Trumponomics":

Today on CNBS, Jim Cramer said this in regard to all out government efforts to curtail mass layoffs:

"I hope this means that capitalism won't turn out to be as rapacious as we all expected it would be under these circumstances"

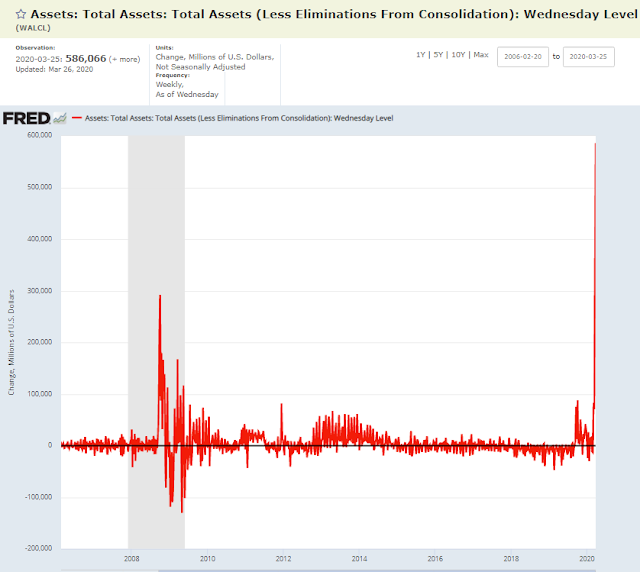

Cramer knows full well what is going to happen in the coming weeks as the jobless claims swell from 280,000 two weeks ago, to 3.3 million last week, to potentially double that number this current week. Cramer knows that the good old days of rapacious capitalism will soon be "ESG'd" out of existence. Which is why he and all of the other "capitalist" observers assiduously ignore the embarrassing fact that once again this latest massive effort to bailout capitalism is coming from the public sector.

Another example, Stephen Moore, the co-author of Trumponics, penned similar sludge on Zerohedge yesterday decrying the stimulus bill's provisions to bolster pay for unemployed workers. He skipped past the parts about bailing out airlines and Boeing with public money, he skipped the part about Trump's $500 billion corporate slush fund full of public money, and he only questioned giving a modest increase in unemployment benefits to workers as being anti-capitalist. Moore invokes Ayn Randian pulp fiction to make his case:

“Government help to business is just as disastrous as government persecution... The only way a government can be of service to national prosperity is by keeping its hands off.”

- Ayn Rand

Moore then asserts that Ayn Rand's Atlas Shrugged is the second most influential book next to the bible. To which I say, in life we are offered the Christ and the Anti-Christ. Choose more carefully next life Mr. Moore.

Let's explore this Ayn Randian fantasy in which government doesn't bail out capitalism at this critical juncture. What if as Ayn Rand implored, we didn't help business, but instead let the chips fall where they may? I can tell you what would happen, there would be a smoking crater 90 days from now where this over-leveraged capitalist economy used to be. Which is where this gets interesting, because it appears that Stephen Moore is about to get his wish of a biblical hard landing.

Contrary to ubiquitous belief, there is NOTHING stimulating about this bailout bill. You can't pay people to stay at home and do nothing and count that as "GDP". ALL of this bailout money is anti-GDP - it's paying people to stay at home in order to suppress layoffs for the next 90 days.

When companies all reach for mass layoffs at the exact same time, you get the vertical collapse in GDP that the American model is now famous for - this "system" only seems to work because it's backstopped with insane amounts of public money. We are always told in the depth of crisis, that we must bailout the system to save the system. Apologists never tell us why a system that lauds personal accountability constantly needs to be saved with public money. Because they are intellectually and morally brain dead.

Be that as it may, GDP is now heading towards zero for the foreseeable future. And this last gun to head bailout of capitalism is merely papering over the damage taking place to the underlying economy. Consider that last week's jobless claims were equal to one third of the layoffs from the great recession. The Fed's own estimates this week predict 32% unemployment which is 47 million people. That figure is 5x the great recession.

These fools all think that the Coronavirus is the problem and therefore once that passes, the economy will "rebound" back to normal. They never stop to think that maybe laying off close to 50 million people is now the REAL problem.

Getting back to Trump Casino, having just witnessed Super Crash - the largest and most severe market crash in history, I am now calling this next phase Everything Crash. Because looking across myriad broken charts and sectors from one asset class to the next, it appears that everything is now pointed in the same direction - down. The Casino is seven months overbought and the first quarter just ended, so the algos no longer have to artificially prop up the market.

These mega bailouts have succeeded in conning morons:

"About 70% of institutional clients think that a 20% climb for stocks is more likely than another 20% tumble"

Overall, Only 4% of investors in the Gallup poll say now is a time to sell stocks to protect your value"

"Overbought"

The market is rolling over exactly where Amazon rolled over last month:

Semis back-tested the 50 day during the last bailout bounce, this time they back-tested the 200 day:

You ain't seen nothing yet

Bailout? What bailout?

Bailout? What bailout?

No surprise, the Energy industry is lining up for bailouts. Per this article below, there are many reasons why shale oil deserves to fail - overleverage and past subsidies among others. However, the author seems to omit the fact that it's an environmental disaster. He also omits the fact that the ESG movement left this sector bidless well before Coronavirus. So what he really wants is a bailout from responsible investing. Because if it's one thing these people can't stand it's responsibility for themselves. For everyone else, it's "the system".

Here we see that it was Trump's "energy independence" fantasy that imploded this sector from the outset:

In summary, Stephen Moore is about to get his wish for a hard landing sans bailout.

I predict he isn't going to like real capitalism as much as he thinks.

I also predict that Banana Republicans who have sent Trump's approval to a record high are not going to like real capitalism either. Especially when they are all expecting a bailout and instead are about to get financially obliterated.

By their own cadre of criminals