Predicting the future is always murky, however predicting future-based themes is where I am going with this post. Predicting a happy ending for Disney World with sheer over-confidence I leave to today's salesmen.

Start with the fact that this Coronavirus was truly a black swan event. It was wholly unpredictable and unprecedented. And yet, many prognosticators had been telling us all along that we should expect what just happened. Meaning that we were totally unprepared for something that should have been expected. Because that's how we roll baby.

My first major assertion is that Globalization is now officially over. It collapsed in 2008, but then it was bailed out with printed money for another decade. These last few years saw Brexit, Trump, trade wars, global nationalism, and now this pandemic.

I have to believe that in America's heyday, this virus would have been a speed bump along the way to prosperity. Consider that during World War II, America's civilian factories were wholly repurposed from consumer goods to war manufactures literally overnight. No big deal. Rationing was the order of the day. People made sacrifices.

Now however, this virus has exposed Globalization's latent fragilities. Laying bare all of the imbalances that go into making this Ponzi model appear to work. As I said two posts ago, the credit bubble is now on the verge of exploding. It can't take this level of demand collapse. These fiscal and monetary bailouts primarily for the rich, have done nothing to offset extreme deflation arising from millions of people losing their jobs per week. And today's record jobless claims figure doesn't account for gig workers now unemployed en masse, waitresses who get fractional unemployment benefits, sole proprietors who get nothing, and of course the undocumented workers, without whom the U.S. economy couldn't exist. All now income-less.

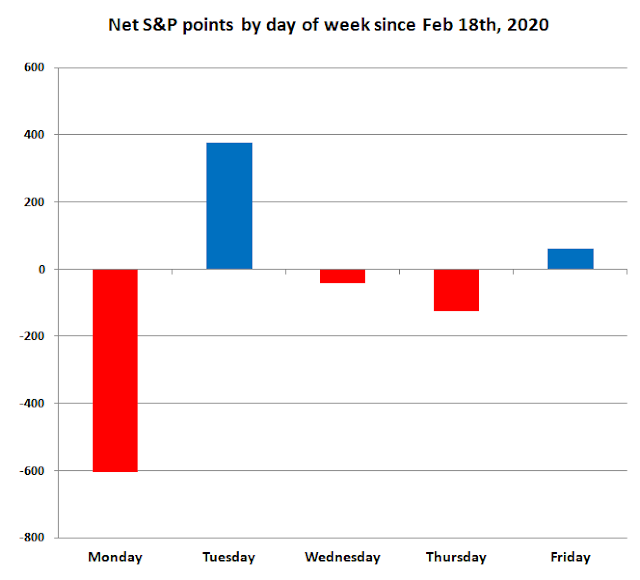

My next assertion is that the age of Trump is over. His entire platform which was based upon fooling people into believing this is the greatest economy and stock market ever, imploded overnight. It took three weeks to erase three years of Trump gains in the Dow.

I'm not blaming Trump for this virus - he handled it in his signature fashion, entirely incompetently. We had ZERO warning that the economy was shutting down. One day he was calling it a hoax, the next day he told mid-size Mormon families their dinners are now illegal. I said I wouldn't panic until they shut down the Waffle House, well now I'm panicking.

Over time Trump will just become more and more of a liability to the party that elected him. All of the above is ALREADY baked into the cake, and evident to anyone who is not a hardcore denialist. Which is why most people don't acknowledge it's already over.

Which gets us to the future, and the changes in social norms that will follow from this "event".

First off, consider how we "emerge" from this crisis. Trump has one timeline in mind, while every state governor has their own idea of when this will end. All have a different future date in mind. Meanwhile, young people will break the quarantine ahead of everyone else. I am referring to those in the 15-30 year old category. The invincible youth who don't know why we were hiding from the flu in the first place. Do you know how many ragers we missed on account of this bullshit? On the other hand, the immuno-compromised and elderly may not re-emerge until the vaccine arrives. Which means that best case scenario, this bifurcated economy lasts a full year or more:

"Currently, most medical and public health experts say we're at least 12 to 18 months away from having a usable vaccine against COVID-19."

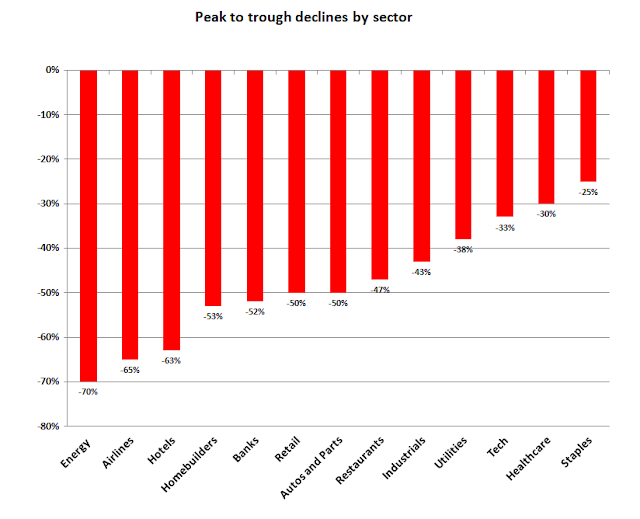

Which means that this reset will accelerate the demise of weak industries, in particular Mall Retail, Fossil Fuel Energy, and Tourism.

The unemployment rate a year from now will be "large" to say the least. And the funny money will be flowing like a river.

All of this turmoil will force lifestyle change, meaning deleveraging, downsizing, homemade solutions, DIY etc. People will learn how to cook again. Grow a garden. Sew a button, fix a lawnmower, use a lawnmower etc.

Branching into the more nebulous, I believe people will begin to self-educate. They will come to realize that the University higher education cartel is a colossal failure. Both economically and educationally. It's cheaper and easier to just read a book than to cram theoretical bullshit in between drunken frat parties. And then graduate bankrupt.

Which gets us to the defense budget. Part of acknowledging "this" is over, will be to recall troops from 145 countries and call it a day. Defund the military industrial complex and otherwise funnel the resources back into the domestic economy.

In summary, it's already over. Those who don't acknowledge these facts are going to learn the hard way when they find out that not all fairy tales are true. And the Dow is NOT in a new bull market.