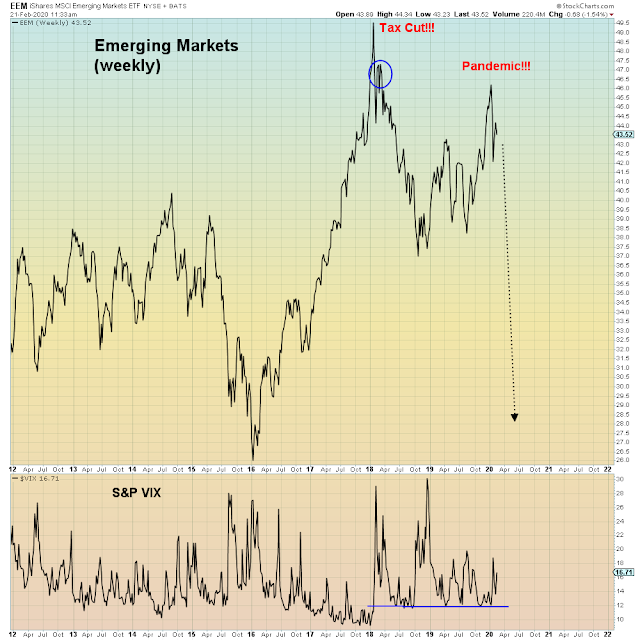

Only one generation has an excuse not to see this coming. The rest of today's cybernetic organisms have been programmed for self-destruct mode. Twenty years ago via the Dotcom bubble. Ten years ago via the housing bubble. Now, at the pinnacle of maximum "I should have seen it coming" Boomer retirement pain, it's the everything super bubble, compliments of Donald Trump. These people never miss an opportunity to self-implode. It's a tradition. For the past ten years, the stampeding crowd has been right en masse. Now, they will self-destruct en masse. Sadly, in a mindless Borg there is no strength in numbers.

The only asset class today is momentum of useful carbon from one bubble to the next.

This week in summary:

Any questions?

"The latest effort on this front came this past week when Morgan Stanley (ticker: MS) unveiled a $13 billion all-stock deal to buy E*Trade Financial"

The two year market top is ending the exact same way it started amid record stimulus-lubricated "FOMO" - fear of missing out. In every cycle, the usual bagholders come in at the end.

"At Charles Schwab, trading volumes, which Sundial measured through daily average revenue trades, are up 74%"

"Retail traders have become manic"

"The preliminary February results fell just short of a 101.4 reading two years ago that set the high watermark during the current economic expansion that began in the middle of 2009."

"Looking at data back to 1916, the researchers said that the index was a reliable recession indicator since it rose leading up to every prior recession"

In summary, it's a bullshit market everywhere you look.

What this pundit calls "good news", anyone with a brain would call "nowhere to hide":

"In the week just past, we witnessed record-high prices in risky assets—including U.S. stocks and corporate bonds, both investment- and speculative-grade. At the same time, havens from risk—gold and long-term Treasury bonds—also registered records."

"The prospect of a democratic socialist facing off against the incumbent U.S. president in November's election is viewed positively by Wall Street. The odds of President Trump's re-election are seen as better if he were opposed by Bernie Sanders"

What I say is don't count your money while you're still in Trump Casino. That has never worked out well for anyone.

"Trump economist Larry Kudlow says you can ignore record low long-term bond yields, but they're a leading indicator of a stock market crash"