I decided a long time ago that it's better to be a man before your time than a man after your time. Never more so than in an age of mass insanity. Sadly, in the company of fools, there is no strength in numbers. Today's masses are human call options on Donald Trump...

In an echo chamber of like-minded fools it's very easy to lose one's bearings. Those of us cassandras who've warned of history's largest Ponzi scheme were written off a long time ago. Fair enough. What remains of economic punditry are those who made the conscious decision to go ALL IN on Disney markets and otherwise ignore ALL risk.

Case in point, it seems a lifetime ago that Sunday night futures were tanking on the weekend news that Trump had killed the Iranian commander Soleimani. The (Jan. 6th) Monday morning gap open was the bottom for the week as WWIII got bought with both hands. Two days later, Iran counter-attacked the U.S. base and in the pre-market hours Trump signaled "all clear", at which point the rally accelerated. All of January has been a melt-up ignoring all risk.

The impeachment rally was accelerated by the Iran attack.

The hook is set.

They had a chance to get out, but they remained in the casino for the Keynesian bombing of foreigners

They stayed for the implosion of China.

And smash crash 2.0

They stayed for Y2K 2.0

And global growth collapse

2008 FinancialPlosion

And 1997 currency crisis

All at the same time.

People will want to know "how did this happen?". Why didn't anyone see this coming. The fact is that EVERYONE saw it coming. However, ignoring bad news and otherwise being a perma-optimist has become a major feature of this society.

Those of us who still recount risk, were long ago written off as permanent cassandras. Which is how risk has grown unchecked amid rampant complacency. In the age of central bank alchemy, we could not compete. Every fool knows that printed money is the secret to effortless wealth. Combined with an election year, it's no surprise that the truth didn't stand a chance.

World economic uncertainty hit a new record high in the fourth quarter of 2019 just as the RISK ON melt-up was accelerating. What can be more bullish than record uncertainty?

https://worlduncertaintyindex.com/

Today's gamblers are attracted to risk like moths to a flame, because to them it means more monetary dopium:

This manic reach for risk in the face of record uncertainty can only make sense in the context of moral hazard:

mor·al haz·ard

"lack of incentive to guard against risk where one is protected from its consequences"

Economists are well acquainted with this commonsense concept, nevertheless, it's just one more principle they've wholesale abandoned to their newfound belief in printed money. The extreme irony that central bank induced moral hazard eliminated all consideration for moral hazard, leaves a new definition:

"The incentive to forget moral hazard when one's own assets are being bid up by free money"

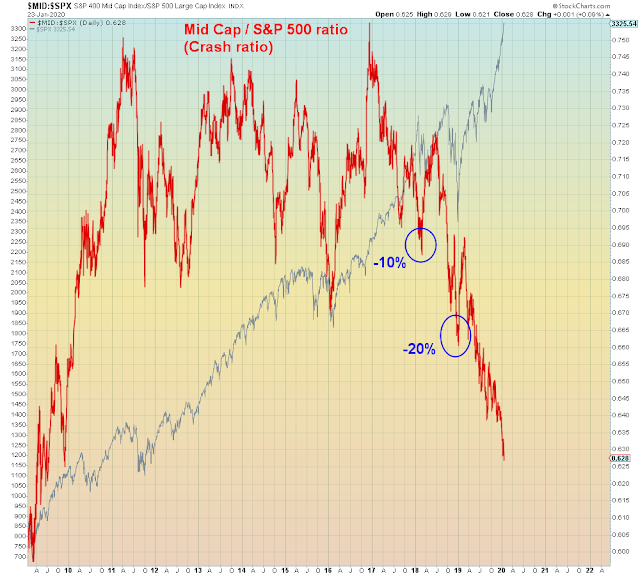

I don't know if this Coronavirus is going to spread worldwide and cause epidemic panic, all I know is that there is no way markets are priced for that risk.

China has been imploding off and on for several years now. This could very well be the final nail in the coffin for that country from an economic perspective. The fact that Trump has made an entire platform out of imploding the second largest economy is risk #1 for global investors. Not only thoroughly ignored, but actively embraced as an economic strategy. His success will be measured by global meltdown.

Make no mistake, we are living in an insane asylum run by total idiots. It's all just part of the scene to write off cassandras as permanent pessimists. Ignoring risk is just part of being "cool" nowadays. Nevertheless, the grasshoppers will soon learn that risks can be delayed temporarily, but not denied forever.

Based upon today's record complacency and leverage and record risk, you can fully expect this will be a lesson they will never forget.

I've said the exact same thing for over ten years now - This Ponzi scheme can only end extremely badly. I believe a decade was more than enough time for ANYONE to prepare for the inevitable.

From a Darwinian standpoint, clearly not everyone was meant to see this coming.

Freedom is entirely wasted on those who don't think for themselves. Which is why the freedom movement has never caught on politically. We live in a society that is brainwashed for conformity from birth. Unfortunately, when you live in a society of fools, conformity can be lethal.

In the end, no one will believe that they sleepwalked into this much risk. Just going with the flow of mass buffoonery.