"Circuit breakers were installed after the October 1987 crash, making a 20% decline "almost impossible"

Thursday, October 26, 2023

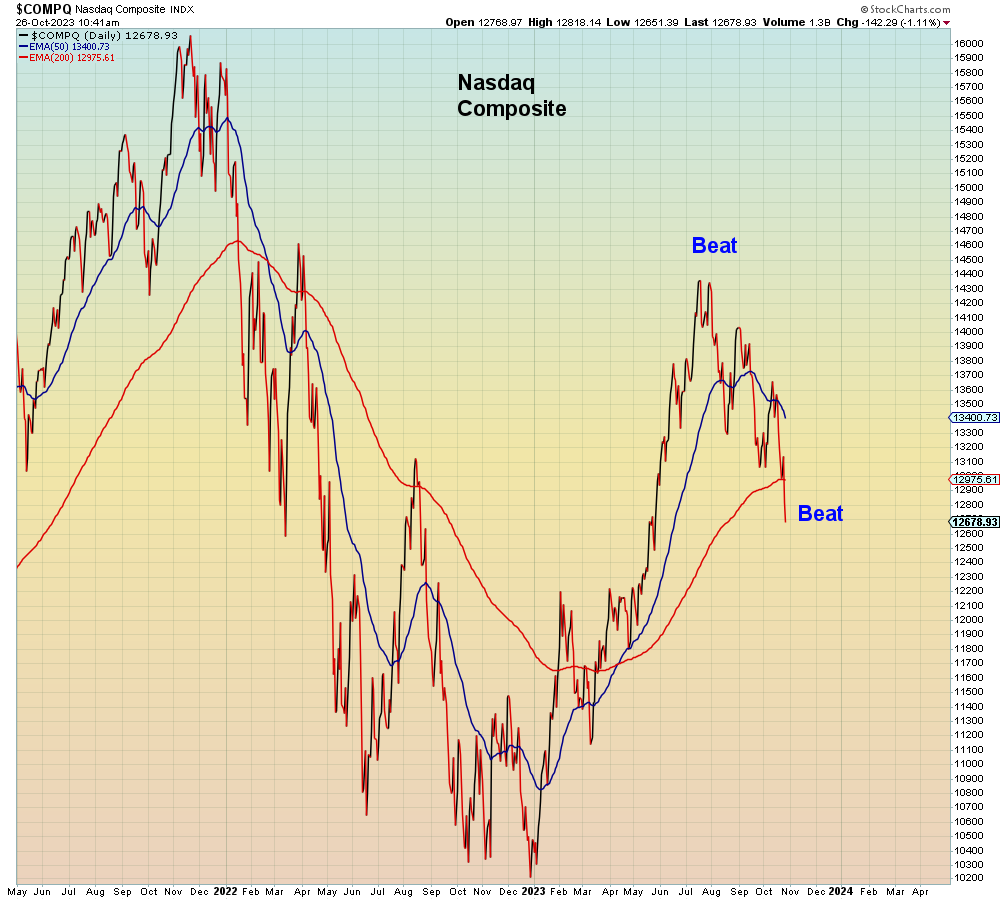

THIS IS CRASH

"Circuit breakers were installed after the October 1987 crash, making a 20% decline "almost impossible"

Thursday, October 19, 2023

HARD LANDING

Tuesday, October 10, 2023

CONDITIONED TO EXPLODE

“If you remember 2017, right before we got into Volmageddon in February 2018, the volatility environment smelled similar to right now”

Wednesday, October 4, 2023

GLOBAL MARGIN CALL

The month of crash has officially begun.

Since the Fed "pause" last week, global bond yields have sky-rocketed. Under this new paradigm, the Fed won't have to tighten again because the bond market is tightening for them.

No one seems to have any answers for why this is happening. Bulls are at a total loss to explain how a Fed pause caused long rates to explode. The most obvious explanation is that the global bond market is now going bidless due to relentless central bank tightening. Real yields are rising which is a sign of central bank policy error. However, central banks are now trapped between the threat of further inflation and the need to support asset markets during an incipient meltdown. Consider the stark difference below between March 2020 and this current situation.

Central bank policies are currently at the opposite end of the bailout spectrum relative to 2008 and 2020. But to hear bulls tell the story, CBs can just flip a switch and instantly bail out everyone. As I said on Twitter, this time there will be a long line for bailout. A long soup line.

Because by the time central banks get the bond market back under control, the stock market will be a smoking crater.

Over the past weekend, the government shutdown was temporarily avoided for six weeks, but it came at the expense of Speaker McCarthy's job. I had predicted a market meltdown if this happened, but instead of course the market rallied.

One more obvious risk to ignore.

It appears that gamblers have yet to consider the implications of a market meltdown with a non-functioning Congress. They seem to forget that in 2008 and 2020, Congress backstopped both the FDIC AND the corporate bond market. So it's only fitting that corporate bonds are currently breaking the lows of last year and soon banks will be at new lows as well.

Which begs the multi-trillion dollar unasked question - at what breaking point does inflation risk morph straight into default risk? And the answer is when the deflationary impulse returns which should be any minute now. Because the deflation paradigm will cause a massive re-allocation of capital from stocks back to T-bonds when everyone realizes that today's earnings estimates are off by a minus sign.

Consider that rotation scenario in the context of Utility stocks that are ALREADY imploding the fastest since 2008.

THESE are the stock market safe havens. Where will investors hide when the rout accelerates.

Netflix?

In summary, in the first week of crash month, it's only fitting that the average U.S. stock has now given back all 2023 gains and is now sitting at a loss for the year. Meanwhile, gamblers remain totally complacent.

Because in a groupthink Idiocracy, the realization that they own an epic clusterfuck will dawn on them at the exact same moment.

aka. Too late.